US-Sino Mini Trade Deal Agreed

Benchmark indices continue to be driven by the dominant themes of Brexit and US-Sino trade negotiations. Indices had been broadly higher following Friday’s news that the US and China had agreed a “phase one” trade deal. The deal, which has yet to be signed by Trump and Xi, includes $50 billion worth of US agricultural purchases to be made by China in exchange for the US abandoning planned tariff increases. The US was set to raise the current 25% tariffs on $250 billion worth of Chinese goods to 30% this week.

Although the market has been mostly optimistic, there are some red flags. The week kicked off with reports noting that China was not yet prepared to sign the deal, wanting to work through some of the finer details of the agreement first. Talks broke down earlier in the year when Trump accused China of backpedalling on negotiations ahead of a deal and while the market is wary that the same is happening now, for now, traders are choosing to optimistic.

Brexit negotiations are also being closely watched by traders. Recent days have seen a more encouraging atmosphere with reports that the EU is considering making concessions around the Irish backstop issue in order to facilitate a deal. Following meetings last week, both the Irish Taoiseach and the Irish Foreign Minister have said that they believe a deal can be done. In the UK, there is also talk of a special parliamentary session which could be held on October 19th following the EU summit to decide next steps with Brexit in the event that the EU rejects the deal.

The Turkish invasion of Syria has so far been contained in terms of market impact. Despite reports of civilian casualties and ongoing clashes between Turkish troops and Syrian fighters, for now no other countries appear to be involved. Given the current backdrop of trade war and Brexit negotiations, the situation has taken a backseat in terms of market importance. However, any escalation in violence or involvement of other countries could start to impact risk appetite.

Technical & Trade Views

DAX (Bullish above 12667)

From a technical and trading perspective. It’s been a volatile fortnight for the DAX. Price has now reversed and is testing September highs. Longer-term VWAP has turned positive again suggesting potential for further upside. If we break above the monthly and yearly R1 at 12667 I will be watching for a retest to set longs. Caution here though as momentum studies flagging bearish divergence.

S&P500 (Bullish, targeting 3031)

S&P500 From a technical and trade perspective. Price is now challenging the monthly pivot, with longer-term VWAP supportive, further upside seen. Expect some initial resistance between the weekly R1 and year to date highs, but ultimately, view remains bullish looking for a renewed push higher towards the monthly R1 at 3031

FTSE (Neutral, Bullish above 7063, bearish below)

FTSE From a technical and trading perspective. Price continues to correct against the recent impulse move lower. Longer term VWAP has flipped negative suggesting we could see another step down. If we break back below the yearly pivot at 7063 I will be monitoring a retest for short opportunities. Risk to this is bullish divergence at recent lows which could see further upside.

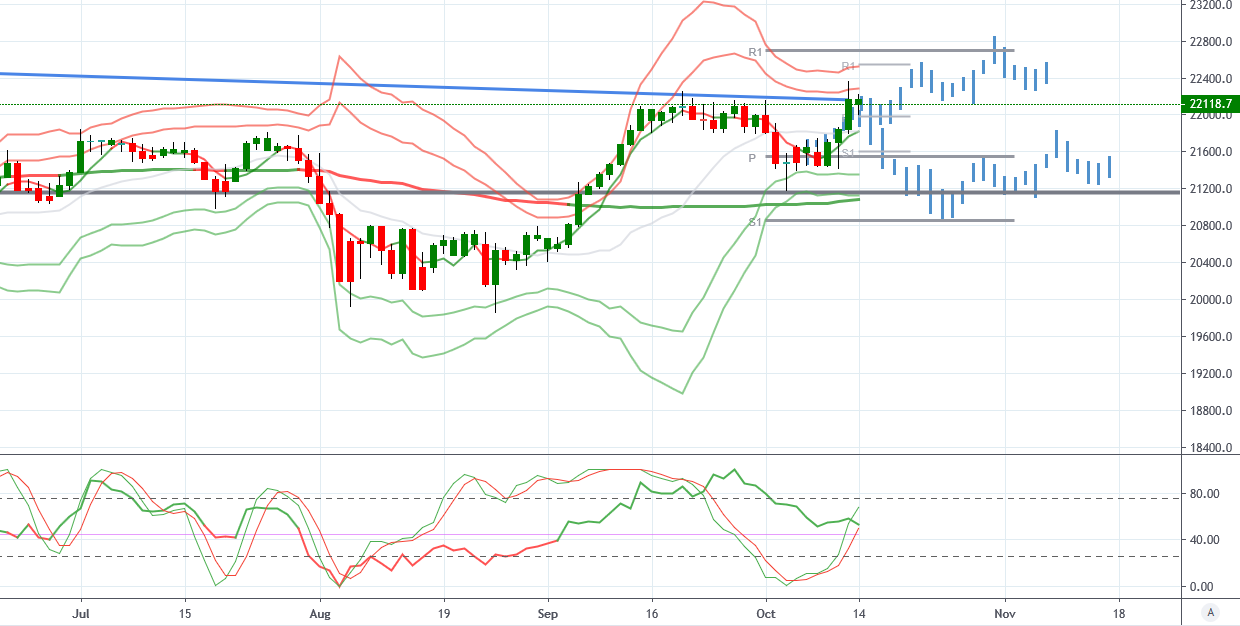

Nikkei (Bullish above 21600)

From a technical and trade perspective. Price now testing September highs. With momentum studies flagging divergence there is risk of a pullback though any move back towards VWAP should find support. With longer-term VWAP still bullish, I am anticipating further upside targeting the monthly R1 at 22691 initially.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!