BTC Bouncing on Back of Heavy Selling

Bitcoin prices are seeing better demand across early European trading on Monday. However, on the back of the heavy decline suffered last week, it will be hard for bulls to feel optimistic here. The futures market plunged by more than 12% from the weekly high, now down more than 25% from the record highs printed in early October. The selling echoes the widespread losses we’ve seen across the crypto space in recent weeks, driven by a shift in traders’ Fed outlook and the broader risk-off tone to trading recently. Total crypto market cap has dropped sharply since October, now sitting around $3.3 trillion from the roughly $4.5 trillion peak.

Institutional Outflows

The decline from recent highs has been fuelled by heavy outflows from BTC ETFs. Following their approval at the start of the year, inflows to BTC ETFs have been a big driver of any price upside we’ve seen this year. The caveat is that periods of repatriation from the ETFs has amplified price declines in BTC. In recent weeks more than $1 billion has been pulled from the BTC ETF space reflecting the shift in market sentiment as well as profit taking on the bumper rally we saw into the Q3 peak.

US Data & Fed Expectations

Looking ahead, BTC looks likely to remain weak unless we see a bullish catalyst develop. With an influx of US data to come over the next few weeks as postponed shutdown-period data gets released, there is the potential for BTC and broader risk-appetite to recover if we see weak data fuelling a sharp uptick in dovish Fed expectations. Soft jobs and inflation data should revive December easing forecasts, putting pressure on USD and allowing BTC to climb. However, unless we see a sharp dovish shift in the Fed outlook as a result of decisively weak data, BTC is at risk of a drifting lower. Indeed, any upside data surprises should weigh furtehr on Fed easing expectations, amplifying BTC selling.

Technical Views

BTC

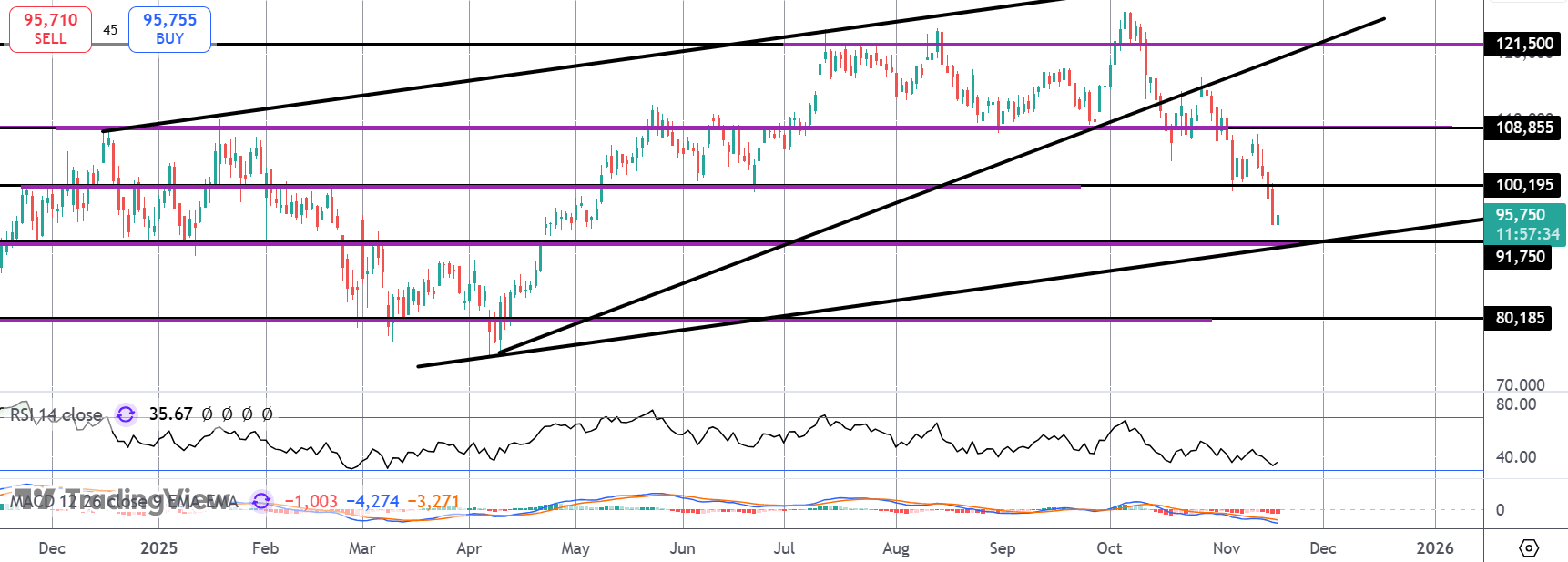

The correction lower has seen BTC moving back down to the bottom the bull channel. While the channel lows and 91,750 support hold, focus is on a rotation higher. 100,195 will be the first hurdle for bulls to overtake, putting the big 108,855 level back in view. If we break below 91,750 however, the picture turns much bleaker for bulls with 80,185 the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.