Chart of The Day Gold/XAUUSD

Gold/XAUUSD Potential Reversal Zone & Probable Price Path

Raised hopes over vaccines from Pfizer and BioNTech SE led the US stock market rally overnight, with the S&P 500 rallying 1.17% and VIX falling to 25.75 (as compared to the recent high of 40.74 on 29 October). Meanwhile, UST bonds bear-steepened on the back of the improvement in risk sentiments, with the 10-year bond yield up to 0.93% (intra-day high was 0.97% last seen in the March sell-off). The $54b 3-year bond auction was awarded at 0.25%, and the Treasury Department is selling US$41b of 10-year notes ahead of the Veterans Day holiday on Wednesday. The 3- month LIBOR eased to 0.205% while the USD rebounded as investors took profit on short-USD positions.

President-elect Biden warned of a “dark winter” amid the Covid spread. The Fed’s financial stability report also reiterated that the Covid pandemic remains a top risk to the US financial system and asset prices could take a hit if the economic impact of Covid worsens in the coming months.

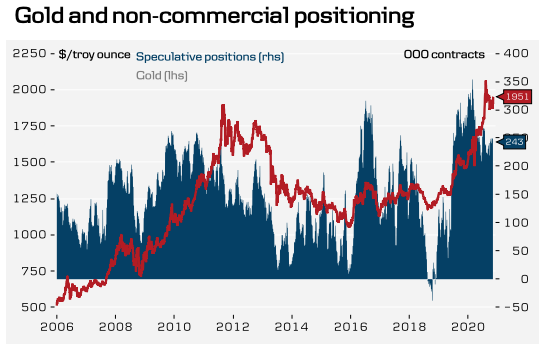

From a technical and trading perspective, Gold took a heavy beating yesterday, tumbling 4.5% to $1863.04/oz, after it had traded close to a two-month high of $1960.44/oz during early Asian hours yesterday. If the vaccine development continues to show progress, expectations of further monetary and fiscal stimulus will begin to ebb and that may pressure gold downwards. Note also that positioning remains stretched and elevated on the long side of the market according to IMM data.. As such bearish exposure is now warranted on a breach of yesterday's lows, targeting the downside equality objective versus the 1966 swing high at 1740, using a protective stop just above today's high to enhance the risk reward ratio of this potential opportunity

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!