Copper Stabilises Following Record Crash

Copper

Copper prices remain steady today, though skewed lower with the futures market in the red as prices remain subdued on the back of last week’s record plunge. Copper prices crashed more than 20% in a single day as traders reacted to news of fresh Trump’s tariffs last week. Traders had been widely expecting Trump to action a 50% levy on copper imports, as signalled weeks prior. However, as news of the tariffs broke, raw copper imports were seemingly exempt from the raft of new tariffs with restrictions only applied to electronic conductors and pipes, having minimal impact on total US copper imports.

Market Recalibration

The plunge lower in copper, its largest single-day move since covid, has seen the futures market trading back to levels last seen in April. Given that US inventories had been run up to record highs ahead of the anticipated tariffs, the near-term outlook for copper remains weak as the market will now need to recalibrate in the wake of this development, though prices look to have bottomed out, for now, at least. Looking ahead, price action is likely to be driven by underlying supply factors. News of a tunnel collapse at a Chilean copper mine this week, forcing the closure of the mine and the loss of around a month’s worth of copper ore, should help underpin prices somewhat. However, trade news will remain the key focus with prices vulnerable to further downside on any fresh trade tariff news.

Technical Views

Copper

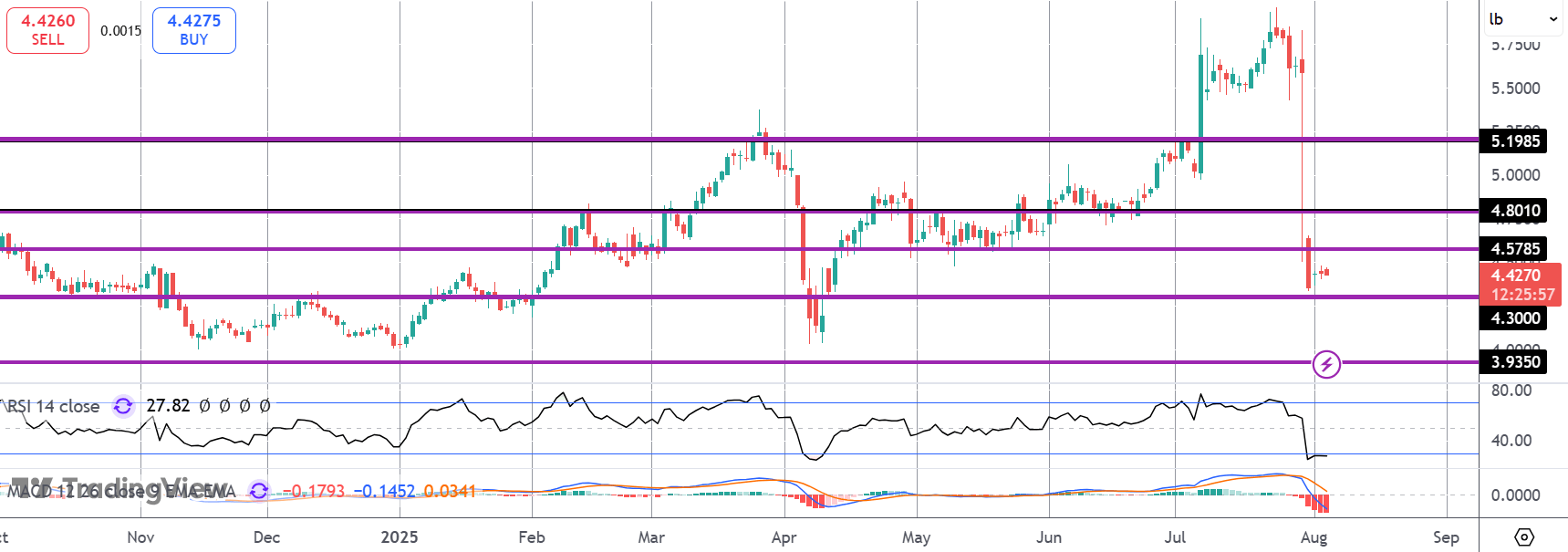

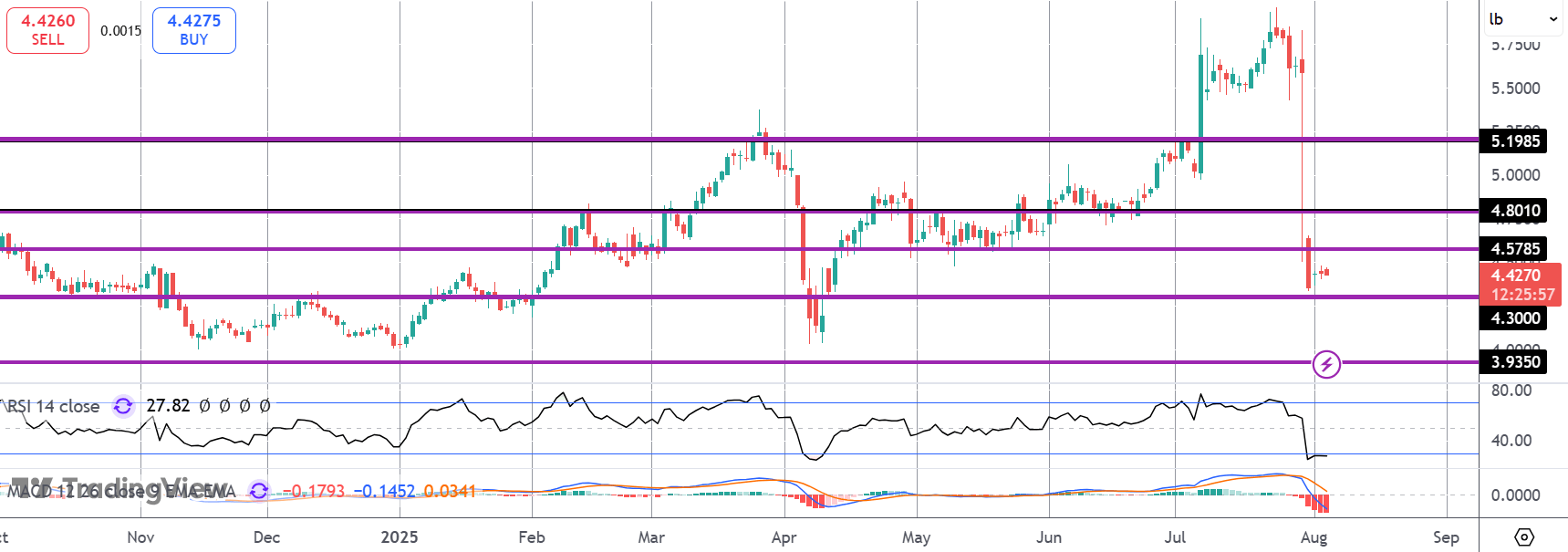

The collapse in copper has seen the market breaking down to test support at the 4.3000, which is holding for now. Momentum studies remain weak, however, keeping focus on the potential for further downside unless bulls can get price back above the 4.8010 level near-term. If we do break lower, 3.9350 will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.