Crude Rallying Ahead of EIA Data

Crude Higher on Bullish Demand Outlook

Crude prices continue to climb as we move through the back of the week with crude futures on course for the best run since March. Expectations of a lift in demand due to the holiday travel season in the US and Europe are helping underpin bullish sentiment here. Indeed, despite a firmer US Dollar and weak data out of China, prices have remained buoyant this week.

EIA On Watch

Looking ahead today, focus will be on the latest set of EIA crude inventories figures. Bulls will be hoping for fresh signs of firm demand with the market expecting an almost 3-million-barrel drawdown in crude stores. Earlier in the week, the API reported a roughly 2.5-million-barrel draw in crude stores, bolstering expectations for a similar figure today.

Rising Geopolitical Uncertainty

Another key driver of the upside we’ve seen in crude prices this week is the rising geopolitical uncertainty linked to violence between Russia and Ukraine and in the Middle East. A drone strike at a Russian port saw a fuel tank set ablaze, causing further disruption to Russian oil supply. Meanwhile, in the Middle East the world is watching tentatively ahead of a decision by Israel regarding ‘all out war’ on Hezbollah. Fears of a fresh escalation in violence look set to keep oil prices supported near-term.

Technical Views

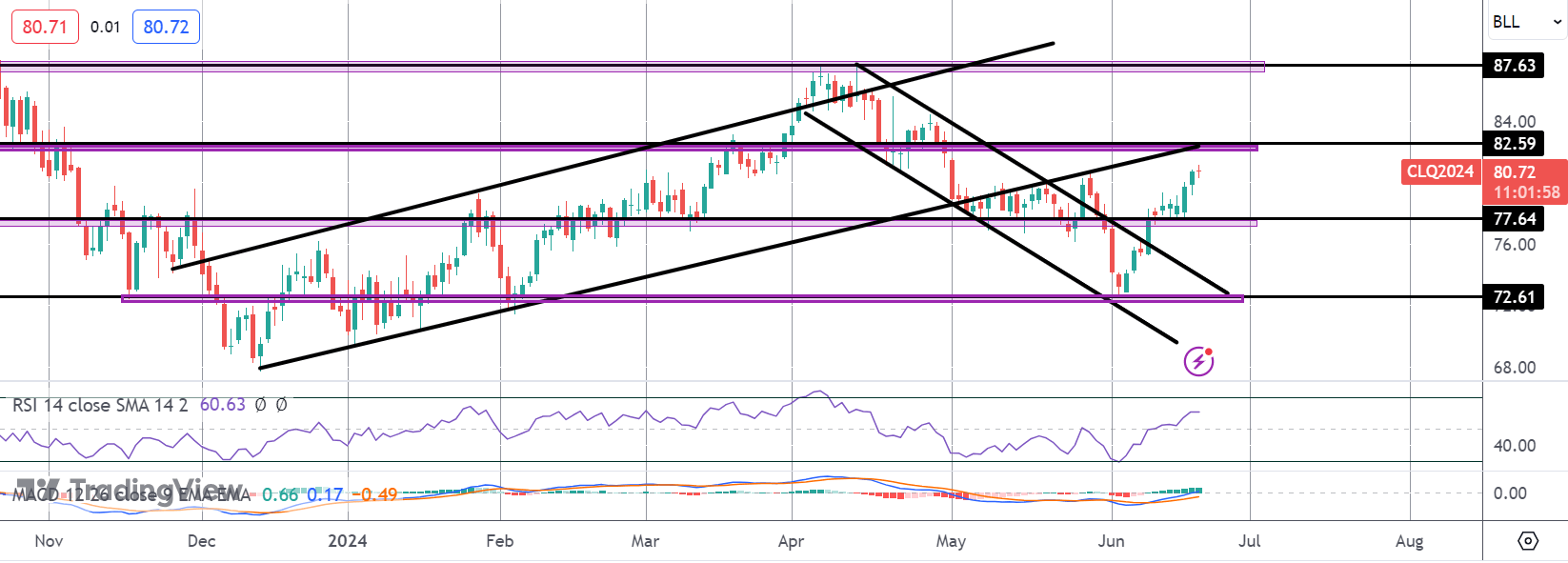

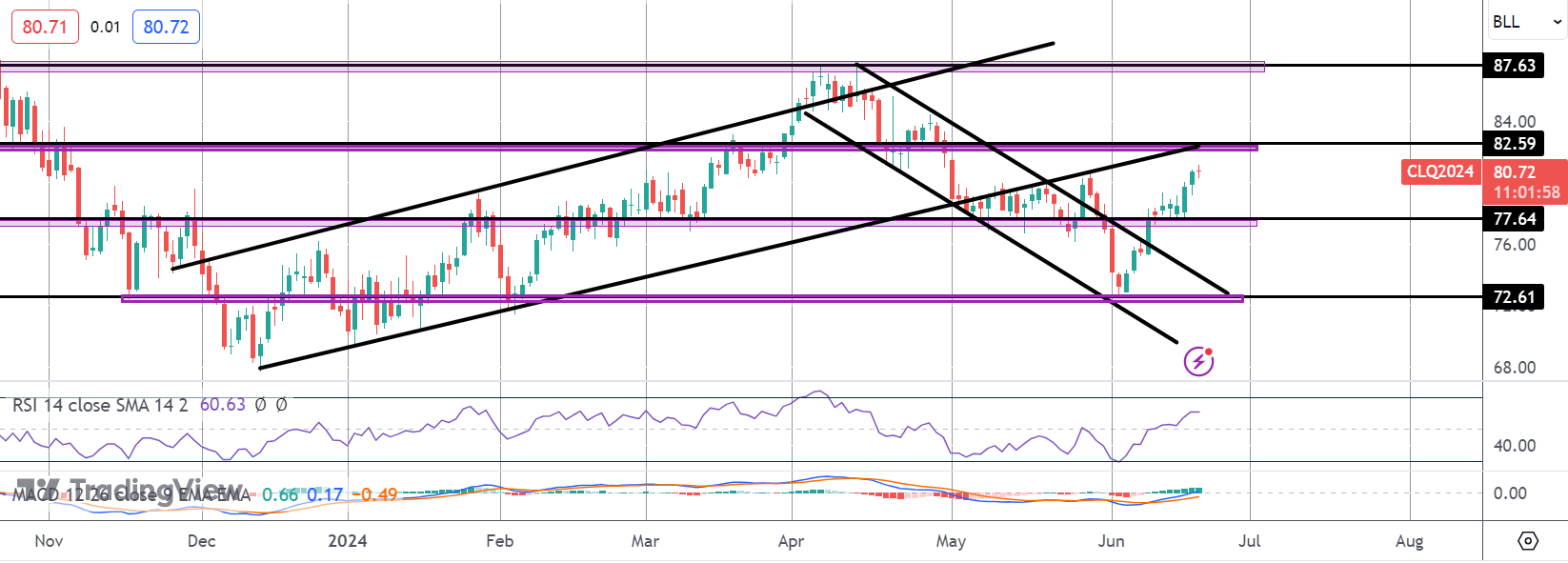

Crude

The rally in crude off the 72.61 lows has seen the market breaking back above 77.61 level. With momentum studies turned bullish the focus is on a continuation higher with a test of the 82.59 level the next objective for bulls. Beyond there, 87.63 sits as the broader target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.