Crude Ending Week Lower

Oil prices are attempting to stabilise today following a fresh drop lower yesterday as the US Dollar rebounded in response to some better-than-forecast data. Despite the rebound, crude futures are on course to end the week lower as global supply concerns weigh on sentiment. There has been chatter this week over a potential outsized production hike from OPEC+. Media sources have been reporting a furtehr 500k bpd increase to take effect form next month. While OPEC+ has downplayed the reports the market is still expecting a fresh output hike from the group, given the string of consecutive increases this year, which should keep prices pressured near-term.

Crude Stores Rise

Crude prices have also come under pressure this week from a larger-than-forecast rise in US stockpiles. The EIA reported midweek that crude stores rose by almost 2 million barrels last week, above the 1.5 million barrels the market was looking for. This marks a sharp shift from the drawdown seen a week earlier and suggests that demand is slowing down. With the US government now in shutdown, crude demand is likely to tank furtehr near-term given the massive number of staff furloughed from work and the huge number of federal buildings and services closed. The longer the shutdown persists the greater the downside impact on demand and the deeper crude prices are likely to drift.

Technical Views

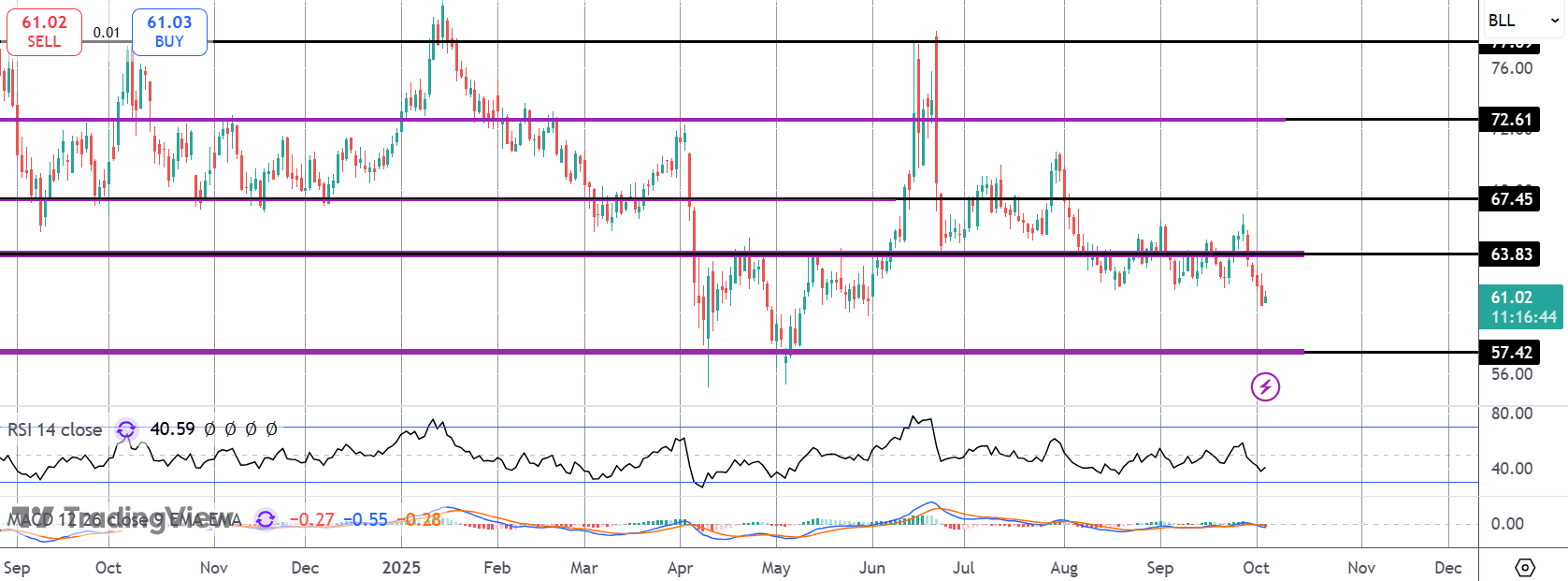

Crude

The sell off in crude has seen the market slipping back under the 63.83 level. With momentum studies weakening, focus is on a continuation down towards the 57.42 level next and the YTD lows. The bearish outlook holds while price remains below 67.45 near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.