Conflicting Middle East Signals

On the back of a strong few sessions at the start of the week, oil prices have since given up their gains and reversed back on themselves. Crude futures are still positive on the week though price has retraced around half the gains seen initially. Uncertainty around risks in the Middle East continue to drive price action as the market ricochets between headlines. On the one hand, news that US and Israeli negotiators are set to resume ceasefire talks this week are exerting a clear downward effect on price. However, Israel’s continued assault n Lebanon and retaliation against Iran, both keep risks of further violence elevated.

Weak Factory Data

Away from the Middle East, focus continues to be on the broader supply/demand environment. A slew of weak factory data out of the US, UK and eurozone this week has kept demand expectations muted. All three economies saw further negative manufacturing PMI readings this week. Along with ongoing weakness in China, the data does little to suggest that demand will increase near-term.

Large EIA Surplus Seen

These demand concerns were underscored by the latest EIA inventories data on Wednesday. US crude stores were seen surging higher to 5.5 million barrels, well above the 1-million-barrel surplus the market was looking for. On the back of the prior week’s 2.2-million-barrel increase, demand levels look to have trailed off heavily recently. While this continues, crude prices look vulnerable to further downside near-term.

Technical Views

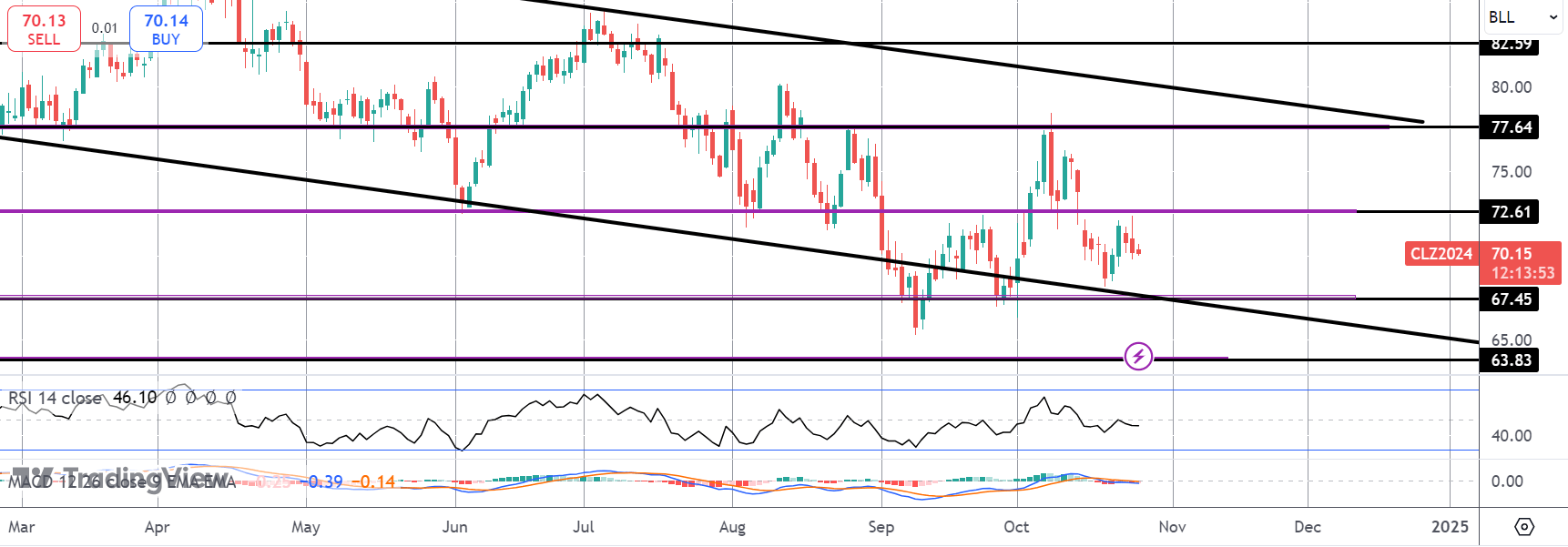

Crude

The sell off in crude has stalled for now into the 67.45 level and the bear channel lows. However, bulls have been unbale to get back above 72.61 and while this level holds as resistance, risk remain skewed towards further downside with 63.83 the next bear target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.