Daily Market Outlook, July 8, 2022

Overnight Headlines

- Japan Ex-PM Rushed To Hospital After Apparent Shooting

- Johnson’s Plan To Drag Out His Departure Under Pressure

- New UK PM To Be Selected Early September After Recess

- UK Labour Demand Growth At Slowest Pace In 16 Months

- Fed Hawks Support 75Bps July Hike, Still See Soft Landing

- Biden To Meet With Advisers To Discuss China Tariffs Cuts

- Dems Aim To Close Tax Loophole On Pass-Through Firms

- Shanghai Outbreak Persists As Shandong Infections Jump

- Japan Household Spending Slips For Third Straight Month

- Germany See Energy Markets Intervention To Revive Coal

- Elon Musk’s $44Bln Deal To Buy Twitter In Peril Over Bots

- Rolls-Royce Playing Long Game On 787, Final Fix Delayed

The Day Ahead

- Asian equity markets are mostly up this morning, but gains are generally smaller than those seen in Europe and the US yesterday. Chinese indices are down slightly, despite speculation of more fiscal stimulus before year end, possibly due to further reports of more Covid cases. Japanese PM Abe has reportedly been shot while campaigning. Upper House elections are scheduled for Sunday. US President Biden will consult on lowering tariffs on some Chinese goods today as he is said to have not yet made up his mind. Meanwhile, the timetable to choose the next Conservative Party leader will reportedly be revealed early next week.

- Today’s US labour market report for June will be seen as important gauge of economic conditions. US Federal Reserve policymakers have repeatedly stressed that the tight labour market is reinforcing their concerns about inflation. This is the last labour market update before the Fed’s next monetary policy announcement on 27th July so it is likely to be watched particularly closely. Monthly reports so far this year have confirmed that the labour market remains buoyant as they have shown strong employment growth, a fall in the unemployment rate below its pre-Covid low and an acceleration in wage growth. There have been tentative signs in recent weekly unemployment benefit claims data that the market may now be turning. However, while weaker employment growth than in May, markets expect a sizeable rise and a further decline in the unemployment rate. Average earnings growth will also be watched closely to see if it confirms recent indications that wage growth may have peaked.

- Canada’s labour market for June will also by a key input into the Bank of Canada’s next policy decision. As in the US, the concern is that a tight labour market will add to inflationary pressures. The BoC’s latest update is due next Wednesday and it is widely expected to raise interest rates by another 50 basis points taking them to 2%. A hike next week seems almost certain whatever is in today’s report, but a strong outcome will probably lead to calls for the BoC to consider an even bigger rise.

- There are no major data releases elsewhere but there are some central bank speakers. Both European Central Bank President Lagarde and Bank of France head Villeroy are speaking at a conference in France. Neither seems likely to offer anything new on the immediate interest rate outlook for the Eurozone but they may touch on some of the risks. Meanwhile in the US, comments from Fed policymaker Williams, a pivotal figure on the rate-setting committee, may provide further insight int the size of the interest rate increase that can be expected this month.

FX Options Expiring 10am New York Cut

- USD/JPY: 133.50 (355M), 134.00 (559M), 135.00 (1.2BLN)

- GBP/USD: 1.1930 (203M) EUR/GBP 0.8585 (328M), 0.8600 (498M)

- USD/CHF: 0.9500 (250M), 0.9650 (205M), 0.9670 (330M)

- AUD/USD: 0.6800-10 (591M), 0.6850 (305M), 0.6900-05 (455M)

- 0.7100 (2.18BLN)

- USD/CAD: 1.2800 (771M), 1.3000-05 (535M)

- USD/ZAR: 16.3100 (300M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.05

- Retains offered tone trading towards 1.01

- EUR/USD weighed further by EURJPY flows driven by Abe shooting news

- ECB/FED policy divergence remains in focus, NFP’s next catalyst

- Soaring energy costs, inflation and recession concerns pile on the pressure

- Bids eyed at 1.0070 offers sitting above 1.02

- Bears eyeing a parity test; offers seen at 1.0340/60

- 20 Day VWAP is bearish, 5 Day bearish

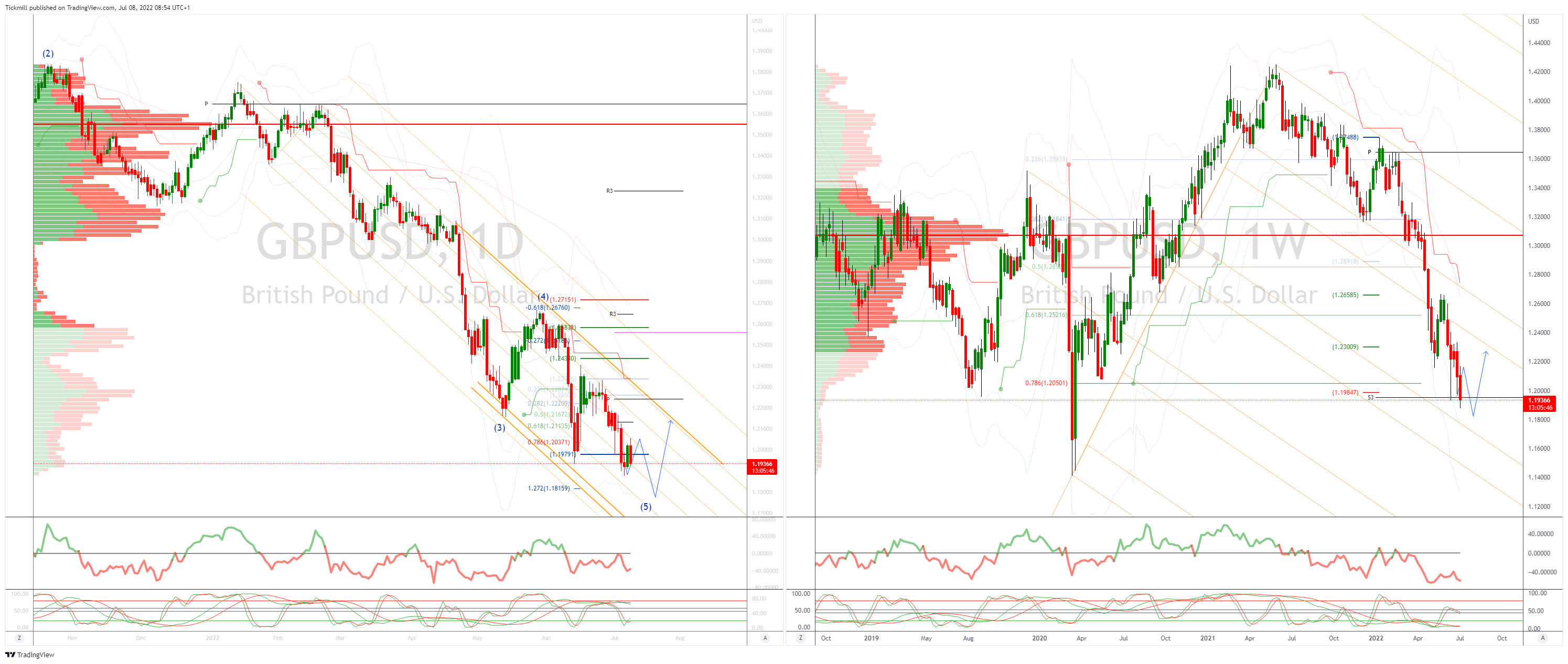

GBPUSD Bias: Bearish below 1.2150

- GBP pop on UK PM resignation is short lived back below 1.20 now

- Political power void likely to constrain BoE action in August

- GBP languishing at 2yr lows

- Energy price inflation, recession fears and political unknowns weigh on GBP

- Bears breach YTD lows en-route to a test of 1.18

- Offers seen at 1.20 Bids 1.1770

- 20 Day VWAP is bearish, 5 Day bearish

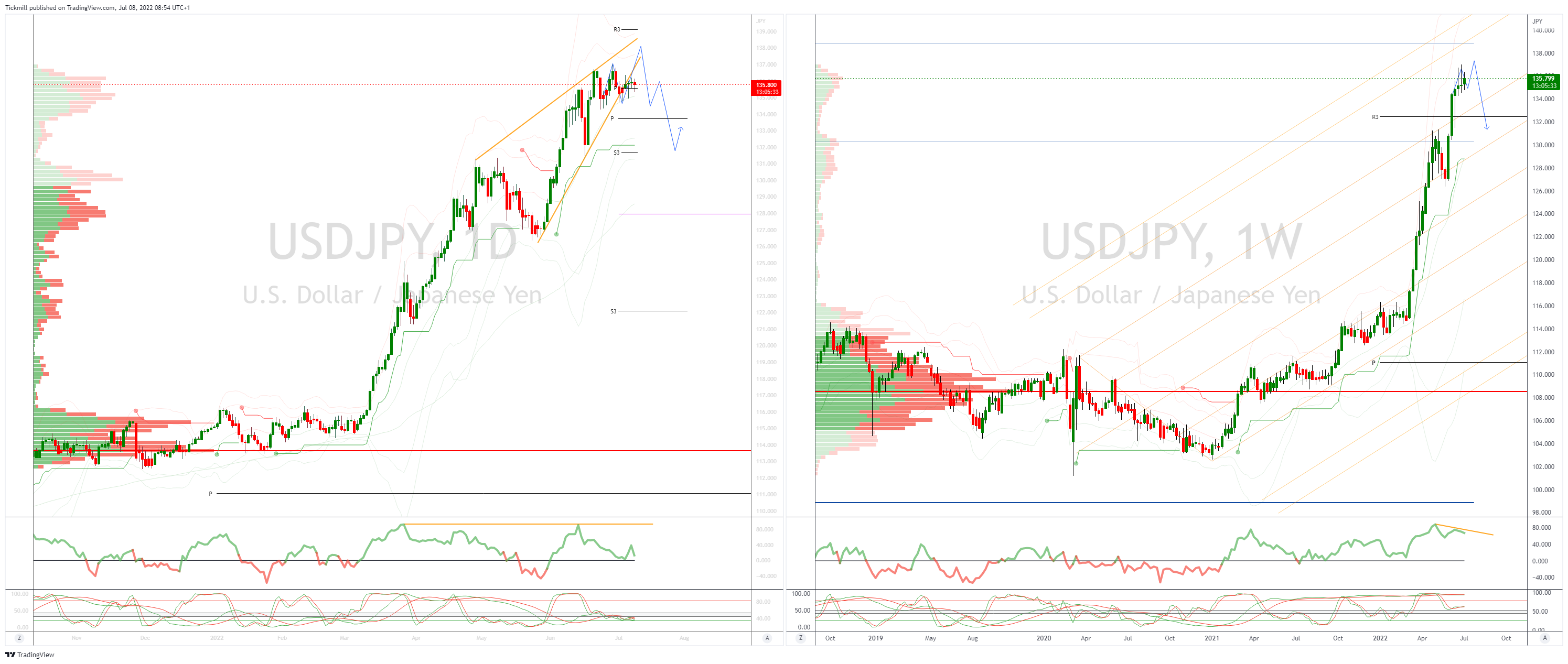

USDJPY Bias: Bullish above 134

- JPY buy backs driven by shock shooting of former PM Abe

- Japanese importer bids seen at 135

- Traders betting on 134/137 range trade

- US10Y 2.94 giving back over 1% overnight supporting JPY bid

- Initial offers seen at 136.55/65 stops above to see a retest of 137

- Option barriers KO’s quoted at 137 remain intact

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bearish below .7050

- AUD weighed by JPY cross flows

- Commodities rolling over again Nickel falling as much as 3%

- Offers seen towards .6900

- Support seen at the 50% retracement of the 0.5510/0.8007 move at 0.6758

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

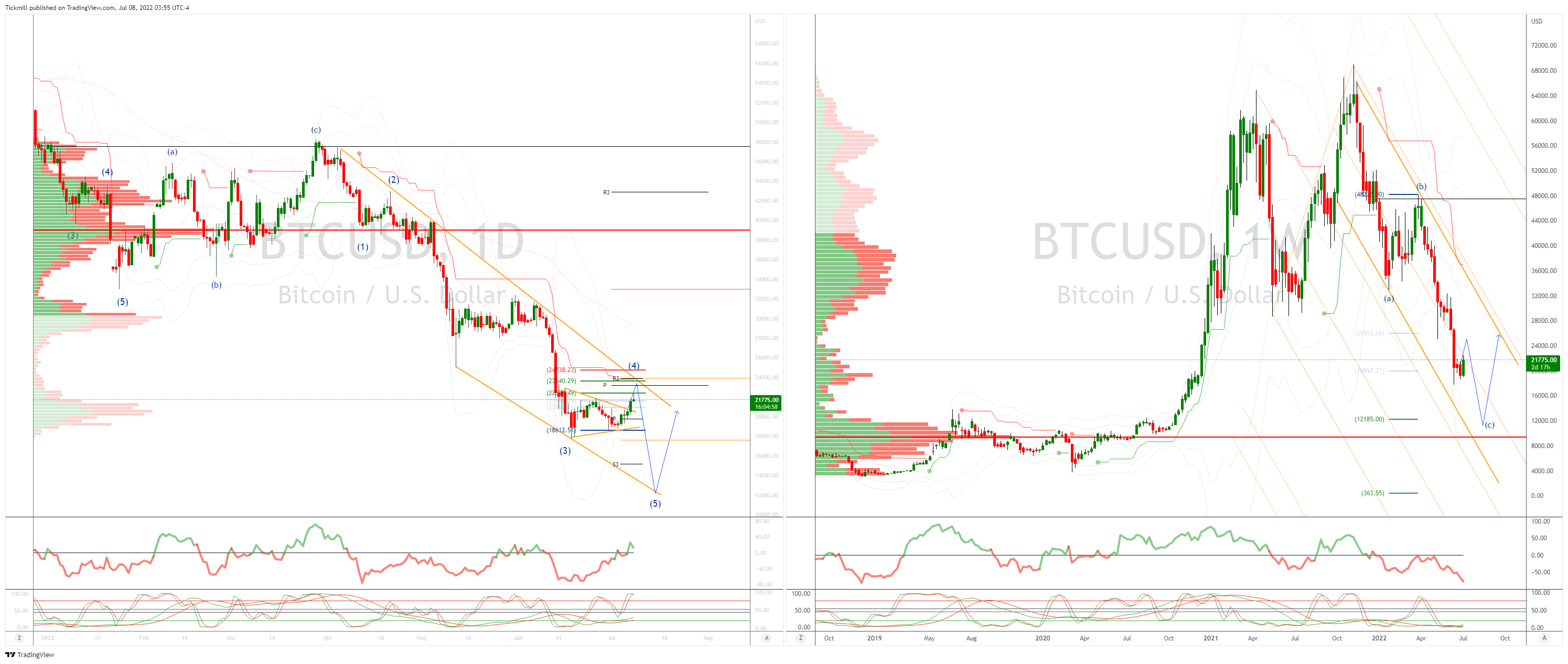

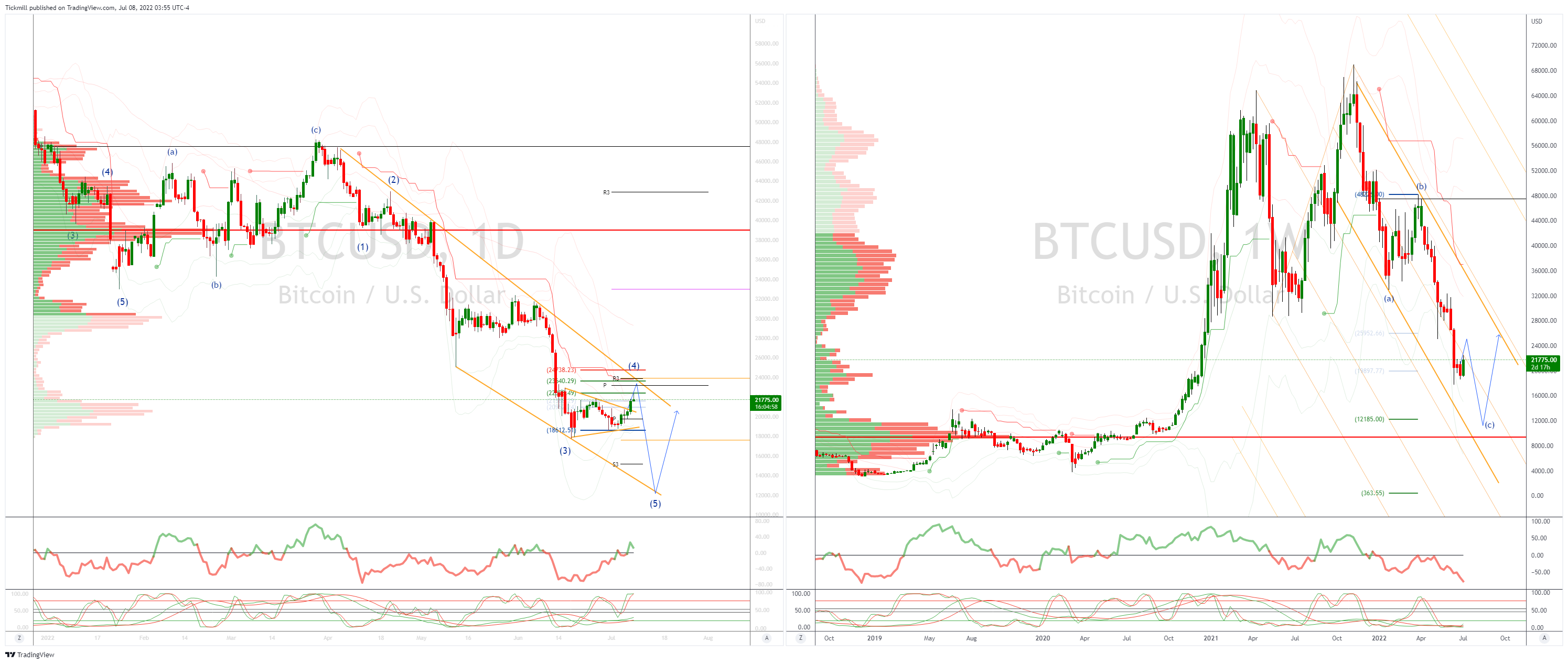

BTCUSD Bias: Bearish below 22k

- BTC briefly tests 22k but quickly rejected

- FTX CEO says the exchange has more than USD 2bln to backstop the crypto industry if needed; the worst appears to be over for the liquidity crunch in the industry

- 20 VWAP band contracting ready for next directional drive

- Trend remains down as within broader bearish channel beckons

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!