Daily Market Outlook, June 14, 2022

Daily Market Outlook, June 14, 2022

Overnight Headlines

- Fed Door Open To 0.75Bps Hike After Inflation, Market Moves

- JPMorgan Economists Now See Fed Hiking 75Bps This Week

- Lawmakers Make New Aim To Block US Investments In China

- White House Plans Saudi Arabia Trip But Says Not Around Oil

- US House Passes Ocean Shipping Bill To Allay Export Backlog

- China Data To Show May Contraction In Few Recovery Signs

- Beijing Cases In Three-Week High As Virus Czar Urges Action

- ECB Set To Face Down Bond Stresses Without Divulging Plan

- UK PM Johnson In Fresh Fight To Pass Brexit Law-Break Plan

- UK Business Confidence Tumbles To Year Low Over Inflation

- Wall Street Favourite Recession Signal Back As Curves Invert

- Bitcoin Slumps Over 10% In Deepening Crypto Sector Selloff

The Day Ahead

- Risk-off sentiment prevailed during the Asian trading session on concerns that US monetary policy will have to tighten aggressively to tackle inflation. Rising Covid case numbers in Beijing have also weighed on market sentiment. European and US equity futures, however, point to a rebound. The Fed announces policy on Wednesday and is expected to raise interest rates by 50bp, but rate-setters may be considering a bigger move. US Treasury yields reached new multi-year highs, while the S&P closed more than 20% below its peak.

- Ahead of Thursday’s Bank of England policy update, latest UK labour market data released this morning showed an unexpected rise in the unemployment rate from 3.7% to 3.8% in the three months to April. The consensus forecast was for a decline to 3.6%. Both employment and unemployment rose, while the economic inactivity rate fell. Headline annual earnings growth edged down to 6.8% from 7.0%, while underlying wage growth (excluding bonuses) was steady at 4.2%. The number of unfilled vacancies reached a new high of 1.3 million in the three months to May, although the pace of increase continued to slow.

- In the Eurozone, the German ZEW investor survey will be released this morning. Both the current situation and the expectations indices are expected to have improved from last month but to remain negative. Look for the current situation index to have moved up to -32 from -36.5 and the expectations index at -28 from -34.3.

- ECB Executive Board member Schnabel speaks this evening. Her speech on ‘euro area bond market fragmentation’ could be interesting in the context of market disappointment that new measures to counter widening intra-euro yield spreads were not provided after last week’s ECB policy update.

- In the US, the NFIB small business optimism index will probably be slightly lower than April’s 93.2. Indications of production pipeline inflationary pressures will come from producer price inflation which is expected to remain elevated at 10.7%y/y in May. That comes after last week’s CPI inflation data which surprised on the upside and prompted speculation of more aggressive Fed policy tightening.

- Early Wednesday, markets will be watching for signs that the Chinese economy has partially recovered from April’s lows. The year-on-year contractions for both retail sales and industrial production in May are forecast to be less negative than in April.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0385-90 (460M), 1.0415-20 (1.22BLN)

- 1.0425-30 (880M), 1.0435-40 (366M)

- GBP/USD: 1.2200-05 (407M). EUR/GBP: 0.8535 (255M)

- USD/CHF: 0.9755 (355M)

- AUD/USD: 0.7100 (262M), 0.7140 (331M), 0.7300 (472M)

- NZD/USD: 0.6250 (381M)

Technical & Trade Views

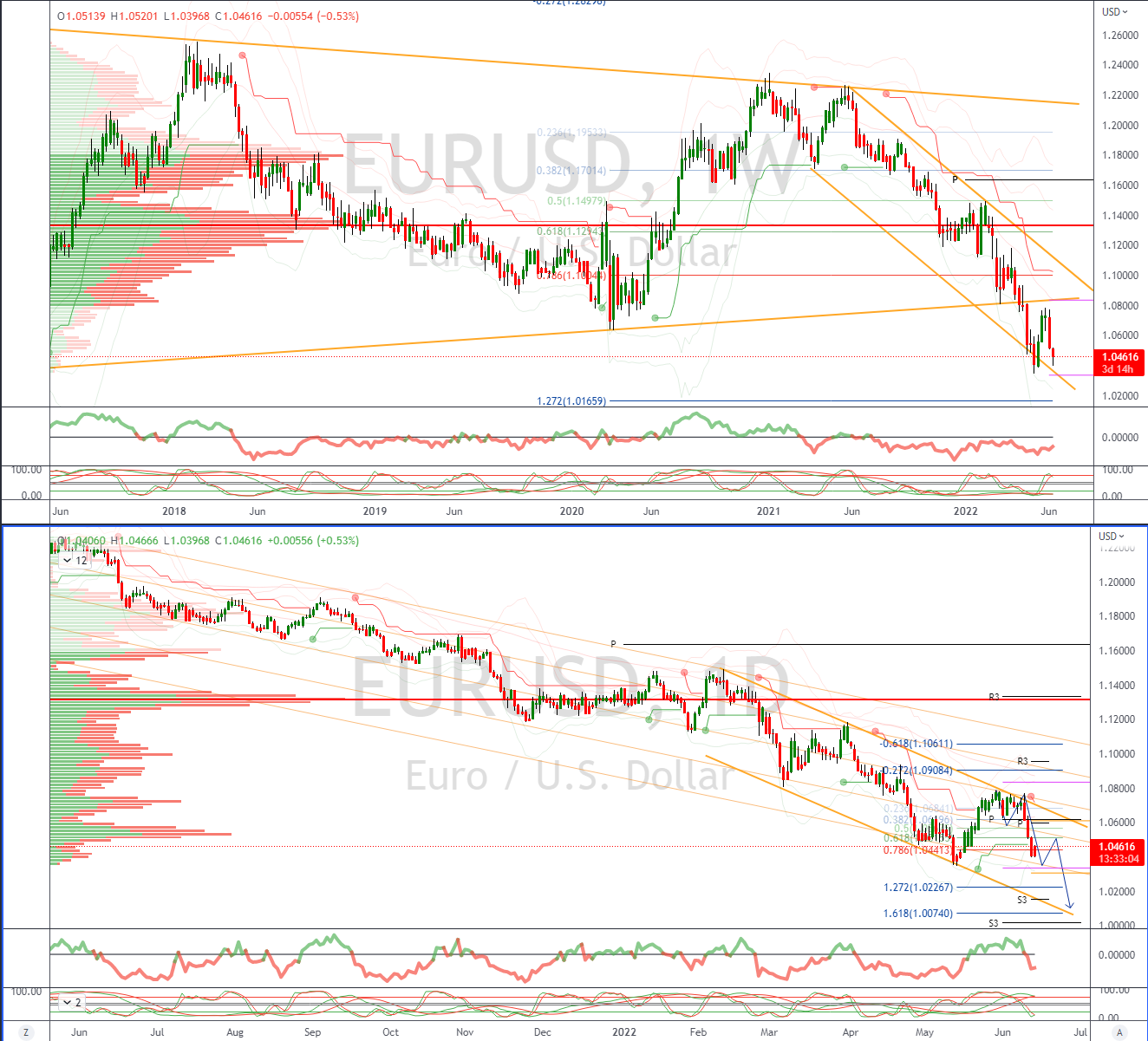

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD opened -1.0% at 1.0405 as markets priced in a 75 BP Fed hike Wednesday

- After dipping to 1.0397, it found support and slowly drifted higher

- A 0.75% rise in E-minis encouraged some USD selling more broadly

- Near term offers seen towards 1.0465

- EUR/USD trending lower with VWAP bearish alignment

- Only a break above 1.0619 would suggest a bottom is forming

- Support is at the 2022 low at 1.0349 and the 2017 trend low at 1.0340

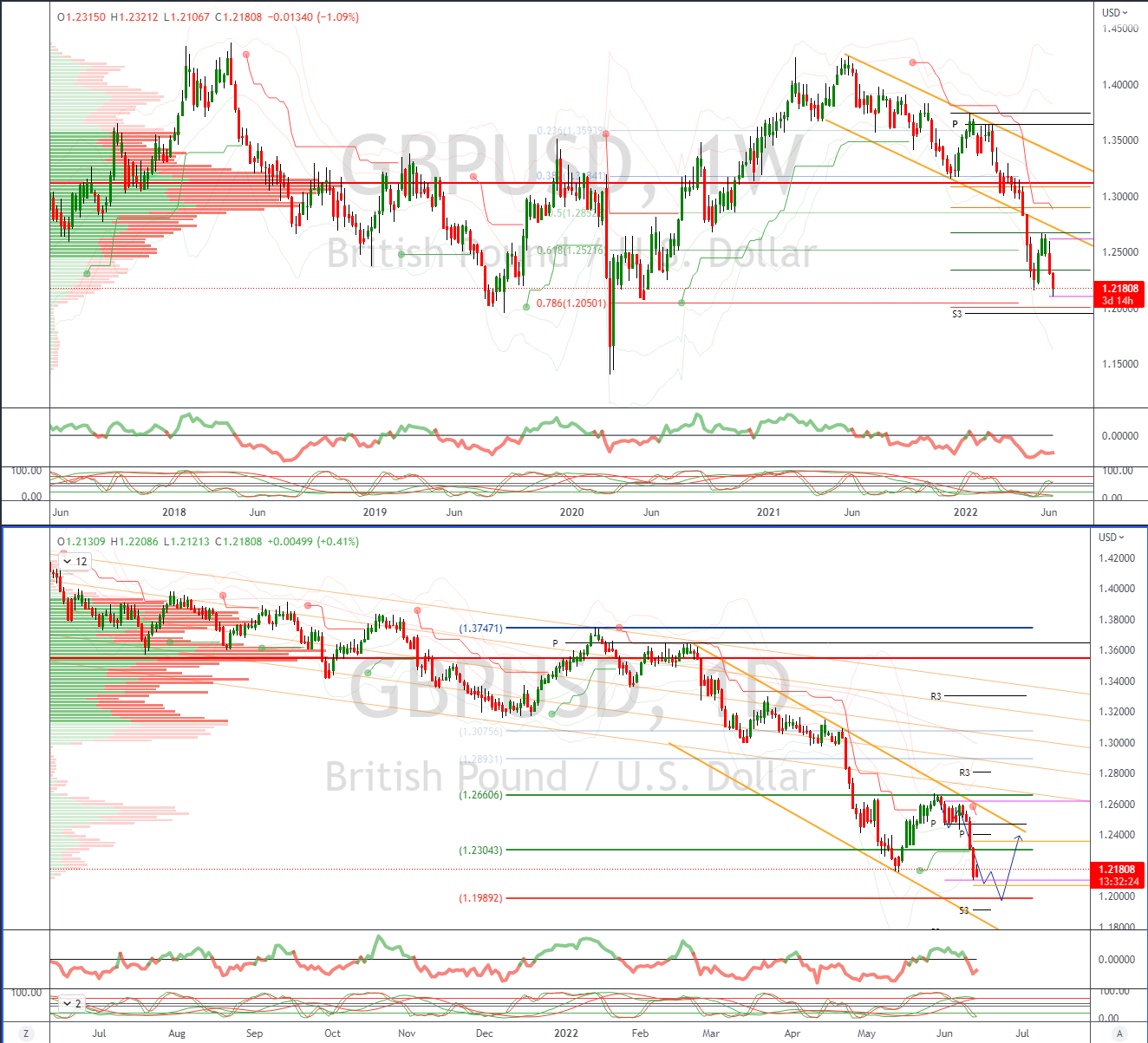

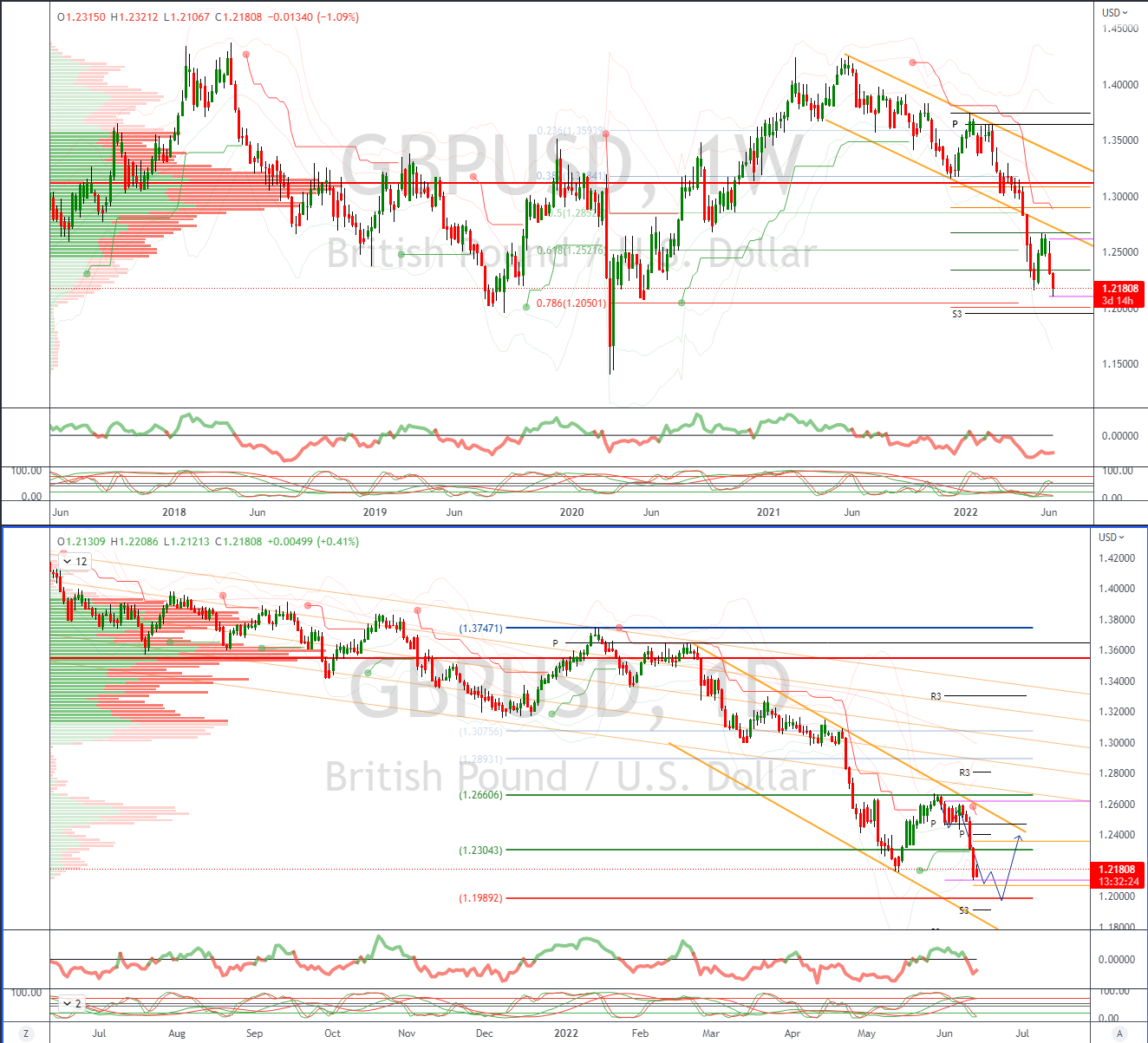

GBPUSD Bias: Bearish below 1.26 Bullish above.

- +0.25% on cable bargain hunting and broad based yen cross demand in Tokyo

- Trades at the top of a 1.2131-1.2182 range with plenty of interest on D3

- UK sets out legislation to override parts of post-Brexit N. Ireland protocol

- Move opens the door to EU-UK trade barriers at some point

- 52 of 90 in Northern Ireland assembly are against the UK's protocol changes

- VWAP is bearish

- Targets a test of 1.20, 78.6% of the 2020 - 2021 rise

- Friday's 1.2302 low then Monday's 1.2325 top initial resistance

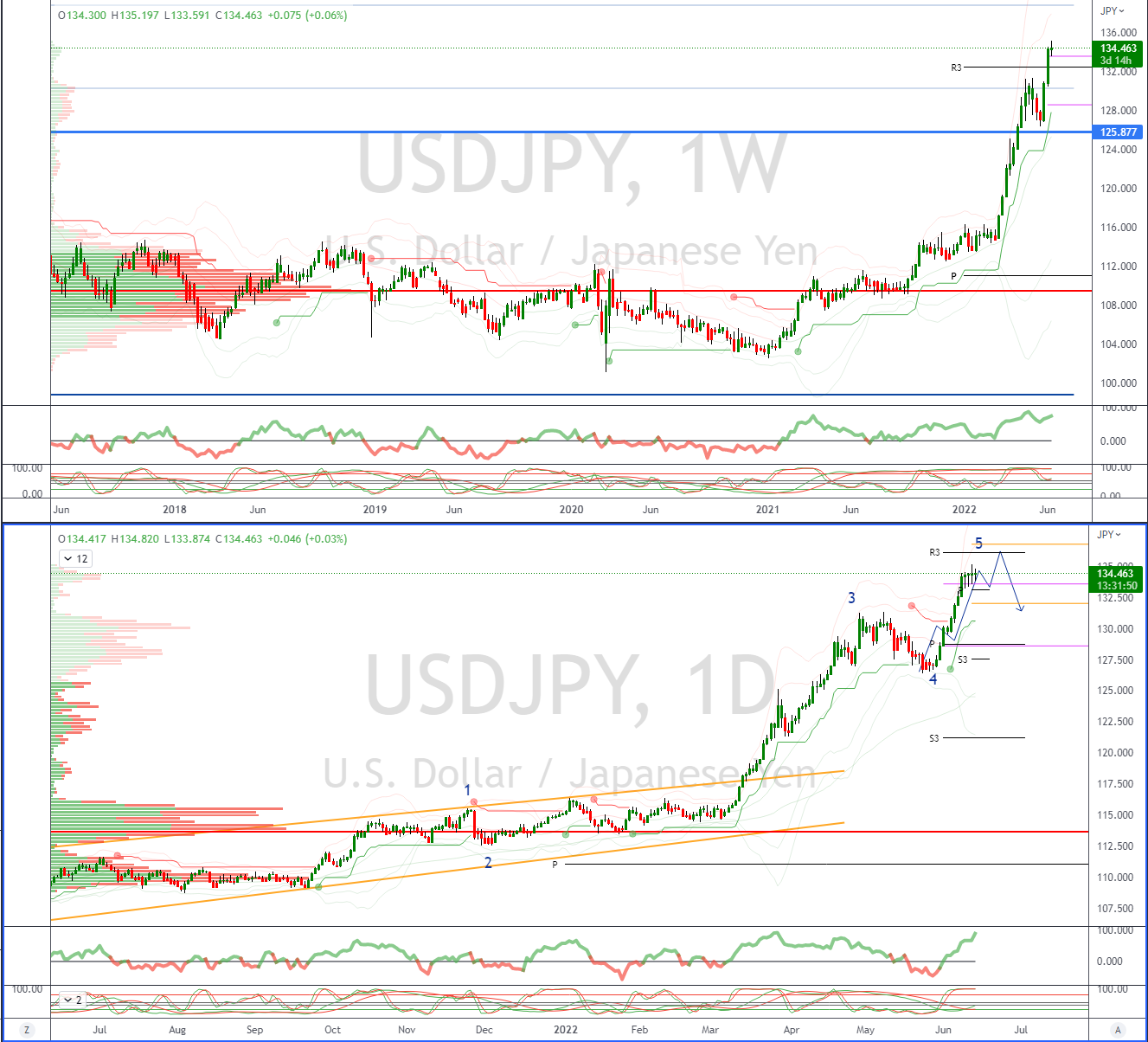

USDJPY Bias: Bullish above 127 Bearish below

- Market chatter regarding FX intervention keeping a near term cap on the upside

- Option barriers at 135.25, 135.50

- Downside likely limited however given Japanese importer, other demand

- US yields supportive, Tsy 2s/10s highest since '07/'11, @3.40%/3.358%

- BoJ continues to defend a bidless domestic bond market with massive liquidity

- Tokyo risk-off after another Wall St plunge, Nikkei -1.8% @26,491

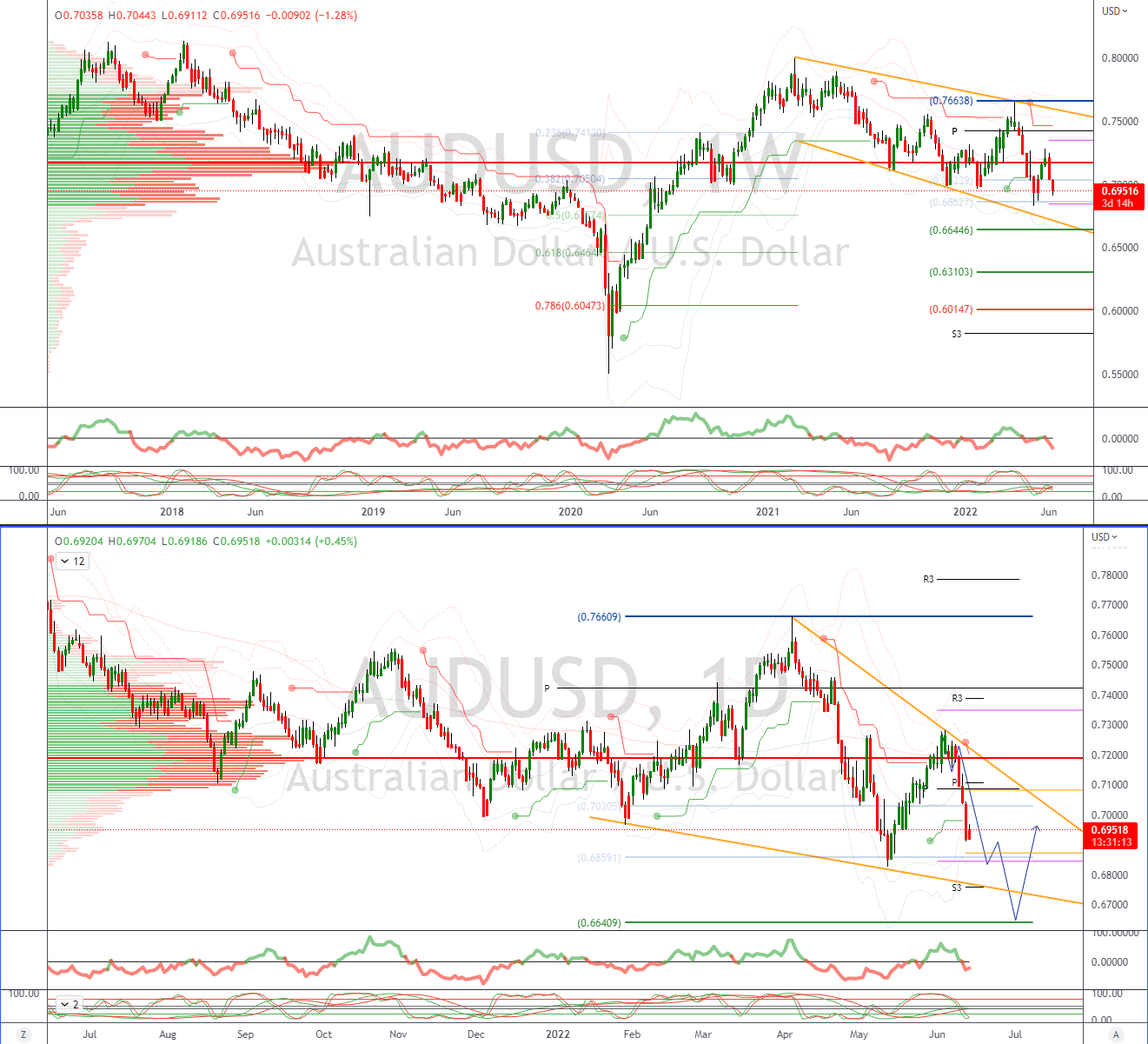

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD opened -1.68% after US yields surged and risk assets clobbered

- After opening at 0.6926 it dipped to 0.6921 before moving higher

- AUD/USD was severely over-sold on the RSA and slow stochastic readings

- Sellers are tipped at former resistance around 0.7000

- Resistance is at the 38.l2 of the 0.7282/0.6911 move at 09.7052

- Support is at the 2022 low at 0.6829, which is the likely objective of move

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!