Daily Market Outlook, June 16, 2022

Daily Market Outlook, June 16, 2022

Overnight Headlines

- Fed Sets Biggest Hike Since 1994, Flags Slowing Economy

- Wall Street Sound Louder Recession Call After Fed Rate Hike

- BoE Set To Increase Rates Again As Inflation Heads For 10%

- Biden Attacks Refiners For Record Profits On Pain At Pumps

- President Biden Keeping Mind Open On Easing China Tariffs

- China Home Prices Falls In Ninth Month, Demand Still Weak

- China Eyes Central Iron Buyer To Counter Australian Control

- Australia May Employment Rises As Labour Market Tightens

- ECB’s Lagarde: Will Not Be Dictated By Fiscal Considerations

- ECB Bond-Buying Policy Set To Add Some Loose Conditions

- SNB Set To Lay Groundwork For Rate Hikes, July Move See

- Musk To Reiterate Desire To Own Twitter In Meeting Thursday

The Day Ahead

- Initial market reaction to the US Federal Reserve’s decision late yesterday to raise interest rates by 75bp – the largest since 1994 – was volatile. The rate increase was larger than the 50bp signalled last month, but stronger CPI inflation data and rising inflation expectations compelled policymakers towards a bolder move. Chair Powell signalled that another 75bp rise next month is on the table, which would take the upper bound of the fed funds rate to 2.5%. Bonds and equities moved modestly higher after the announcement, while the US dollar declined slightly. Asian equity markets started trading on the front foot but gains were pared overnight.

- The Bank of England will announce its decision on interest rates at midday. With UK CPI inflation running at 9.0%, Bank Rate is anticipated to rise for a fifth consecutive meeting, with expectations for a 25bp increase today to 1.25%. That outcome is fully discounted by financial markets which are currently pricing in about a 40% probability of a larger 50bp increase. It is probable that there will be a vote split, highlighting Monetary Policy Committee members’ differing views on the balance of inflation and growth risks.

- The government’s recent fiscal package to support households adds to the case for further tightening. It will be interesting to see members’ reaction to this and whether it impacts on their ‘forward guidance’ about the likelihood of further rate moves. Some on the MPC may vote for a 50bp rise today. However, the labour market data released earlier this week showing, among other things, a rise in the unemployment rate may tilt the odds towards a 25bp rise. Markets currently anticipate interest rates will rise to at least 2.75% by the year-end, which is 100bp above the consensus forecast of economists.

- Attention will also be on ECB speakers today. That follows an impromptu meeting of the Governing Council yesterday in response to intra-euro government bond yield spreads widening sharply in anticipation of the end of QE and higher policy interest rates. The ECB pledged apply ‘flexibility’ in reinvesting redemptions from its asset purchases under PEPP (Pandemic Emergency Purchase Programme). As that may not be sufficient to counter widening spreads, the ECB also said it will accelerate the completion of a new ‘anti-fragmentation instrument’.

- In the US, data releases include housing starts and building permits, as well as weekly jobless claims and the regional Philadelphia Fed manufacturing survey. Overnight, the Bank of Japan is expected to leave its interest rates unchanged, but it will be interesting to see to what extent it will continue to resist policy tightening seen in other major central banks.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0500 (325M)

- USD/CAD: 1.2700-10 (490M)

- Expiries for Friday June 17

- EUR/USD: 1.0425 (292M), 1.0500 (904M), 1.0600 (315M)

- USD/JPY: 132.00 (365M)

- GBP/USD: 1.2110 (406M), 1.2175 (214M), 1.2200 (328M)

- EUR/CHF: 1.0350 (274M)

- AUD/USD: 0.6970 (200M), 0.7000-05 (380M), 0.7145-50 (900M)

- 0.7250 (695M)

- USD/CAD: 1.2840 (236M), 1.2850 (313M)

Technical & Trade Views

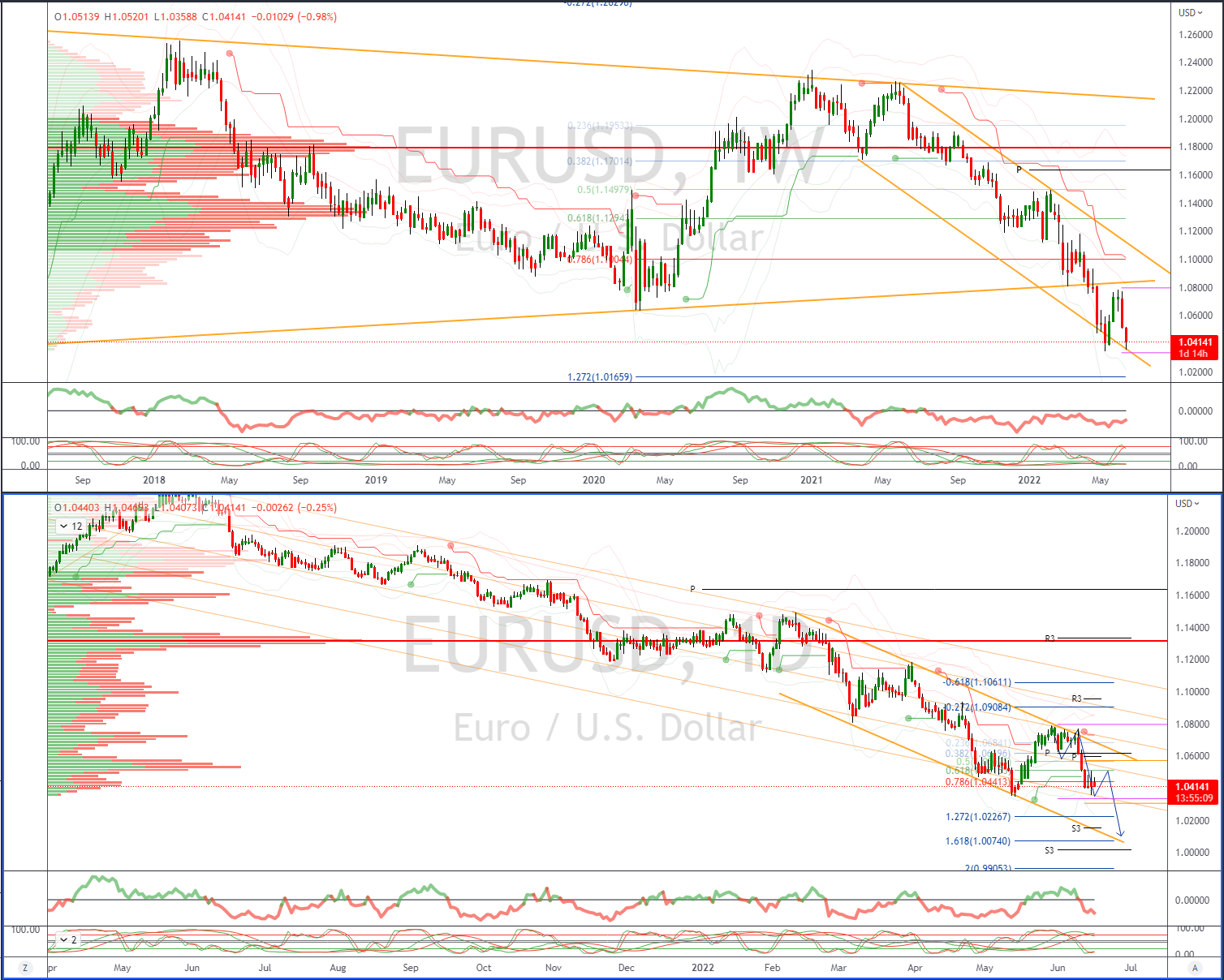

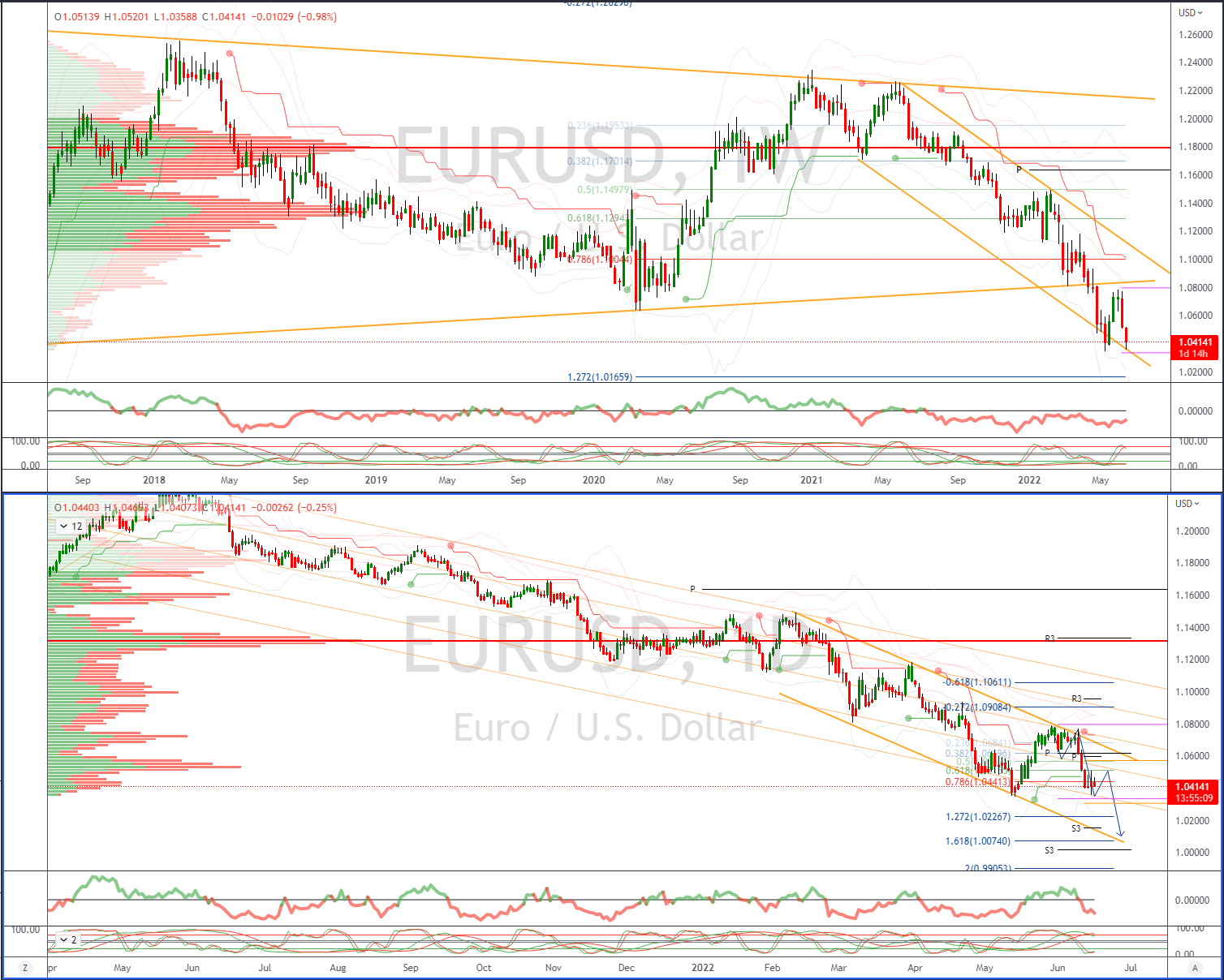

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD offered after ECB fails to excite Euro bulls

- Euro post FOMC pop faded as US Treasury yields gained in Asia trade

- Short-term US yields traded 3.26% from 3.19%

- EUR/USD faded to 1.0430’s into the London session

- Decent offers tipped around 1.0510/15

- Below 1.0560’s sees sellers in control

- Support is seen at current cycle lows 1.0349 with better bids seen 1.0350’s

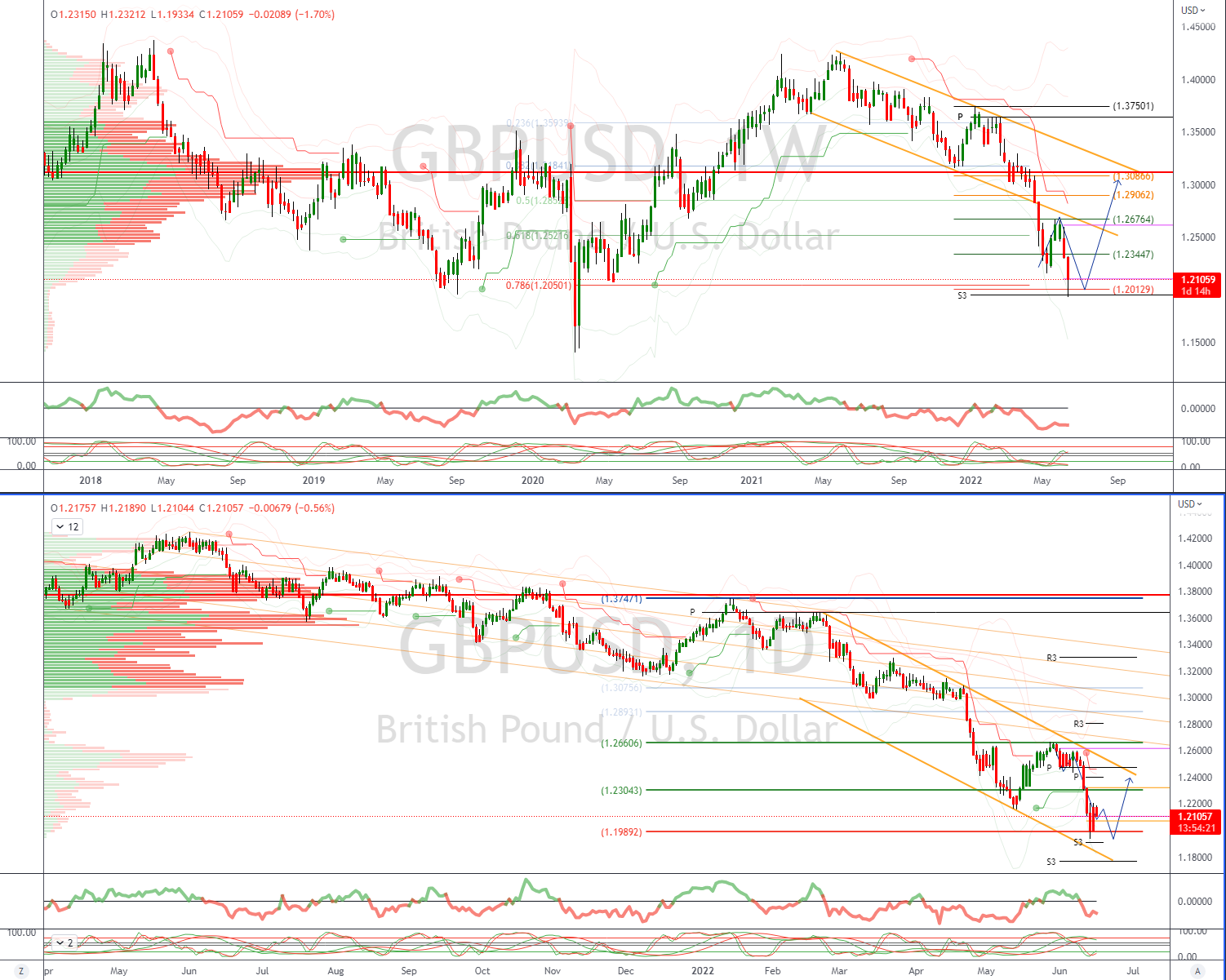

GBPUSD Bias: Bearish below 1.26 Bullish above.

- BoE rate decision due today, with double-digit inflation weighing on the economy

- IGD believes UK food inflation is set to reach 15% this summer

- Rising rates, soaring inflation, and negative GDP suggest a long hot summer

- Decent bids are seen on the first test below pivotal 1.20

- Momentum & Daily VWAP remain negatively oriented

- Offers and stops towards 1.2215

- Bids are seen back to 1.21/1.2090 stops below

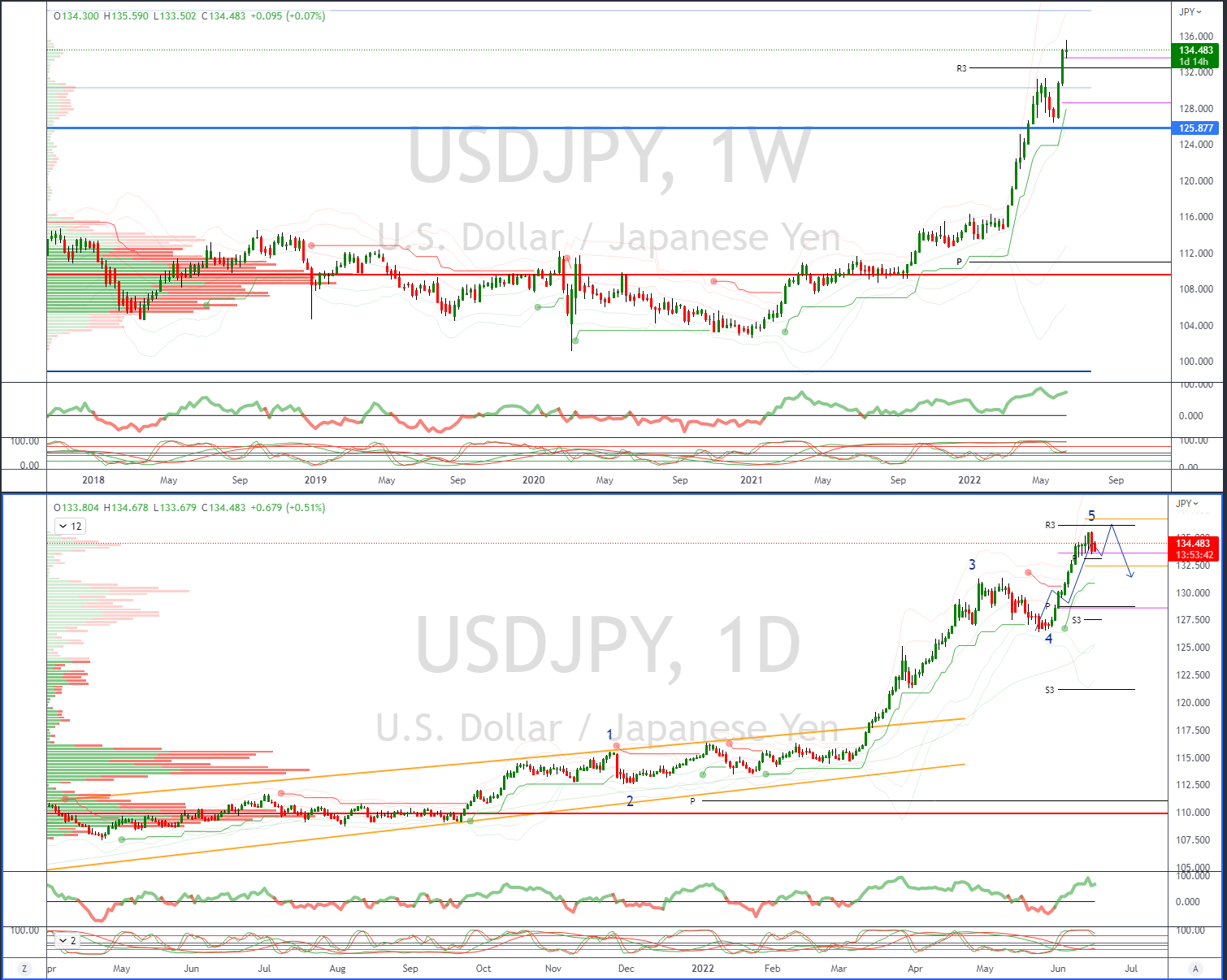

USDJPY Bias: Bullish above 127 Bearish below

- USD/JPY 133.50 bids into early Asia trading back above 134.50’s

- Japanese importers noted buyers from the open

- Bounce in US yields supported the push higher

- US yields cooled as does USD/JPY from post-Tokyo fix high

- Offers are seen towards 135, with bids 133.30’s stops building below

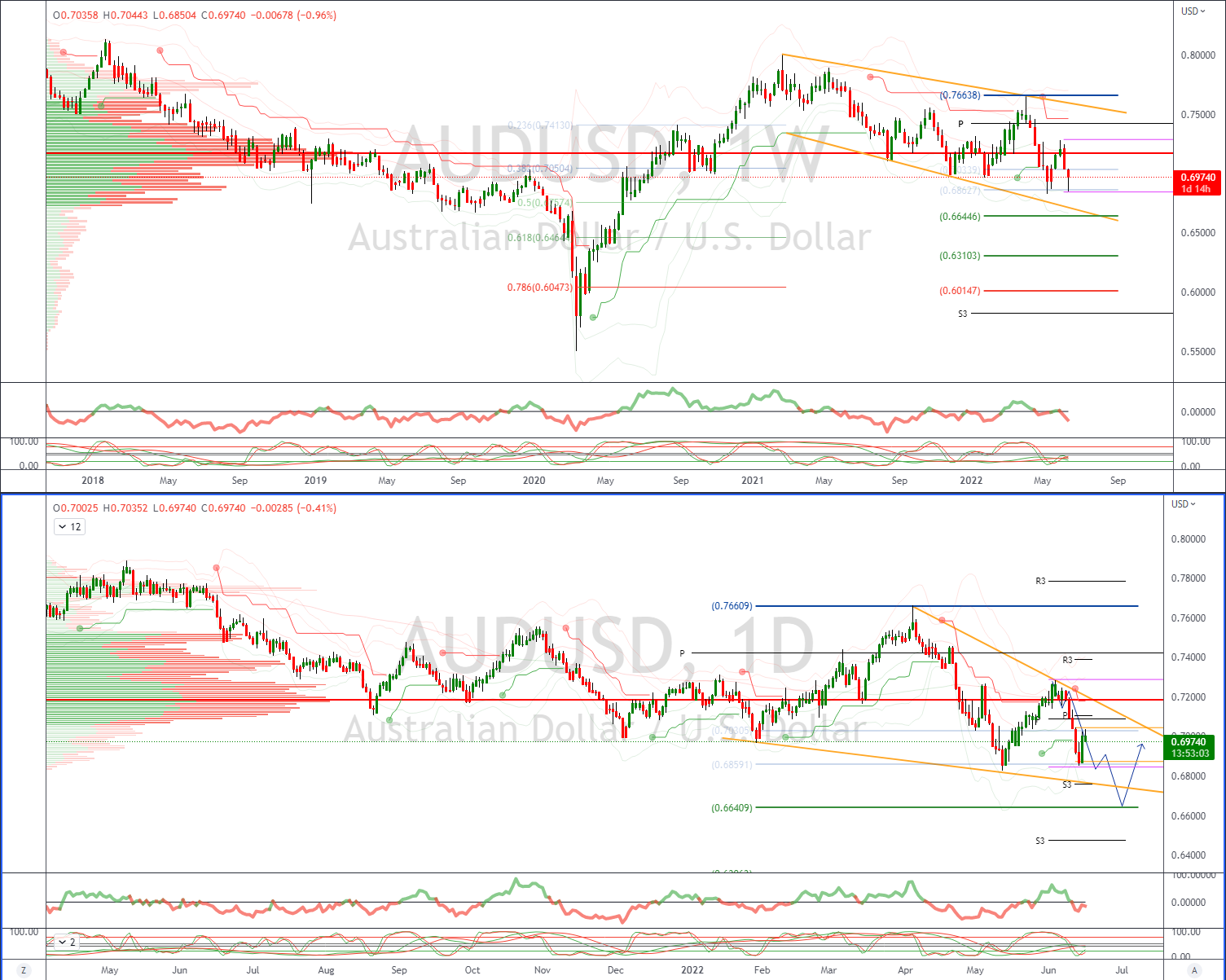

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD sell the rumor buy the fact relief rally post FOMC

- AUD/JPY bids helped the AUD/USD test weekly projected range resistance .7030’s

- AUD/USD traded back towards 0.70 post better than expected jobs data

- AUD/USD rally post-FOMC sees bears back on the offer

- Offers seen towards.7100, support sited towards 0.6850 and current cycle low at 0.6829

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!