Daily Market Outlook, March 12, 2024

Munnelly’s Macro Minute…

“Markets Firmly On US Inflation Watch”

This morning, most Asian equity markets are on the rise, although Japan and one key index in China are experiencing declines. Bank of Japan Governor Ueda, testifying to parliament, refrained from indicating whether the BoJ will raise interest rates next week, stating that "more data will come this week." Meanwhile, the New York Federal Reserve's gauge of consumer inflation expectations saw a slight uptick in median and longer-term measures.

In the UK, recently released labor market data showed a modest slowdown in annual pay growth for the three months to January. Overall pay growth eased to 5.6% annually from 5.8%, while regular pay growth slipped to 6.1% from 6.2%. Unexpectedly, employment declined while the unemployment rate edged up to 3.9% from 3.8%. These figures, slightly weaker than forecast, support the message from yesterday’s unofficial KPMG/REC survey indicating that the labor market is loosening. While these outcomes may fuel hopes for a UK interest rate cut, most Bank of England policymakers are likely to proceed cautiously.

Today's primary focus will be on the February US Consumer Price Index (CPI) data, which may indicate a slowdown in the downward trajectory of inflation. Markets anticipate both headline and 'core' inflation to have increased by 0.321-4% month-on-month. Factors such as higher gasoline prices may influence the headline rate, while persistent issues with seasonal adjustment and relatively stable services inflation are expected. The annual headline inflation rate is forecasted to remain unchanged from January at 3.1%, with some upside risks, while the core inflation rate is predicted to have slightly eased to 3.8% from 3.9%. US Federal Reserve Chair Powell suggested the likelihood of a US interest rate cut by mid-year unless the inflation outlook deteriorates, and today’s data will likely not disrupt that plan. However, they may reinforce caution among Fed policymakers regarding further rate cuts.

Overnight Newswire Updates of Note

Doves Hope Slowing US Inflation Will Convince Fed To Cut Sooner

Biden's $7.3Tln Budget Is Campaign Pitch For Spending, Tax Goals

Dimon Says Economy Booming, But Recession ‘Not Off The Table’

President Biden May Condition Aid For Israel After Rafah Invasion

BoJ’s Ueda Reiterates Economy Recovering Gradually Before Meet

Japan FinMin Suzuki: Still Haven’t Completely Overcome Deflation

RBA’s Hunter Says Households Are ‘Clearly Struggling’ At Moment

ECB Officials Are Leaning Toward Keeping Minimum Reserve At 1%

BoE's Mann: Long Way For Inflation To Be Consistent With Target

Oracle Jumps After Posting Strong Sales, Cloud Growth Stabilises

FAA Audit Of Boeing 737 Max Production Found Dozens Of Issues

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 151.50 ($2.16b), 148.25 ($1.86b), 149.00 ($630.3m)

EUR/USD: 1.1030 (EU605.6m), 1.1010 (EU503.2m), 1.0785 (EU426m)

USD/CAD: 1.3705 ($671.3m), 1.3475 ($486.2m)

AUD/USD: 0.6530 (AUD805.3m)

USD/CNY: 7.4500 ($401.4m), 7.5000 ($385.9m), 7.2100 ($366.2m)

GBP/USD: 1.2850 (GBP418.7m), 1.2535 (GBP316m)

NZD/USD: 0.6145 (NZD465.5m), 0.6175 (NZD351.2m)

USD/BRL: 5.0100 ($349.3m)

EUR/GBP: 0.8580 (EU681.8m)

Monday’s FX trading was calm ahead of the U.S. CPI release, with the dollar slightly supported by position squaring. The upcoming CPI release could significantly impact the Federal Reserve rate outlook, potentially leading to a market reaction similar to last month. Risks are balanced, with the potential for an equal move in either direction. A higher-than-expected CPI could result in EUR/USD and NZD/USD moving lower, while a lower-than-expected CPI would weaken the dollar across the board.

CFTC Data As Of 8/03/24

Bitcoin net short position is -1,352 contracts

Euro net long position is 66,311 contracts

Japanese Yen net short position is -118,843 contracts

Swiss Franc posts net short position of -17,551 contracts

British Pound net long position is 58,385 contracts

Equity fund managers cut S&P 500 CME net long position by 24,150 contracts to 917,973

Equity fund speculators trim S&P 500 CME net short position by 31,617 contracts to 402,895

Technical & Trade Views

SP500 Bullish Above Bearish Below 5150

Daily VWAP bearish

Weekly VWAP bullish

Below 5100 opens 5080

Primary support 5050

Primary objective is 5240

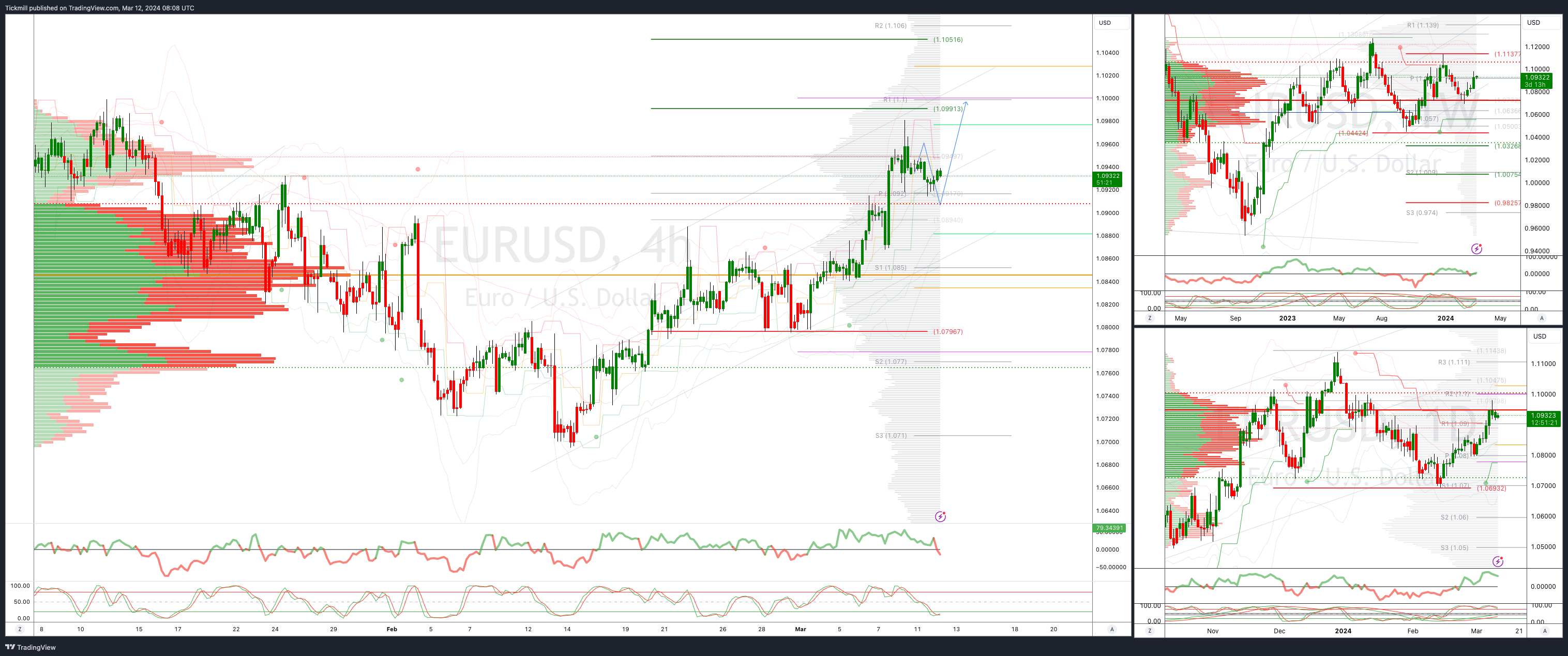

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0990

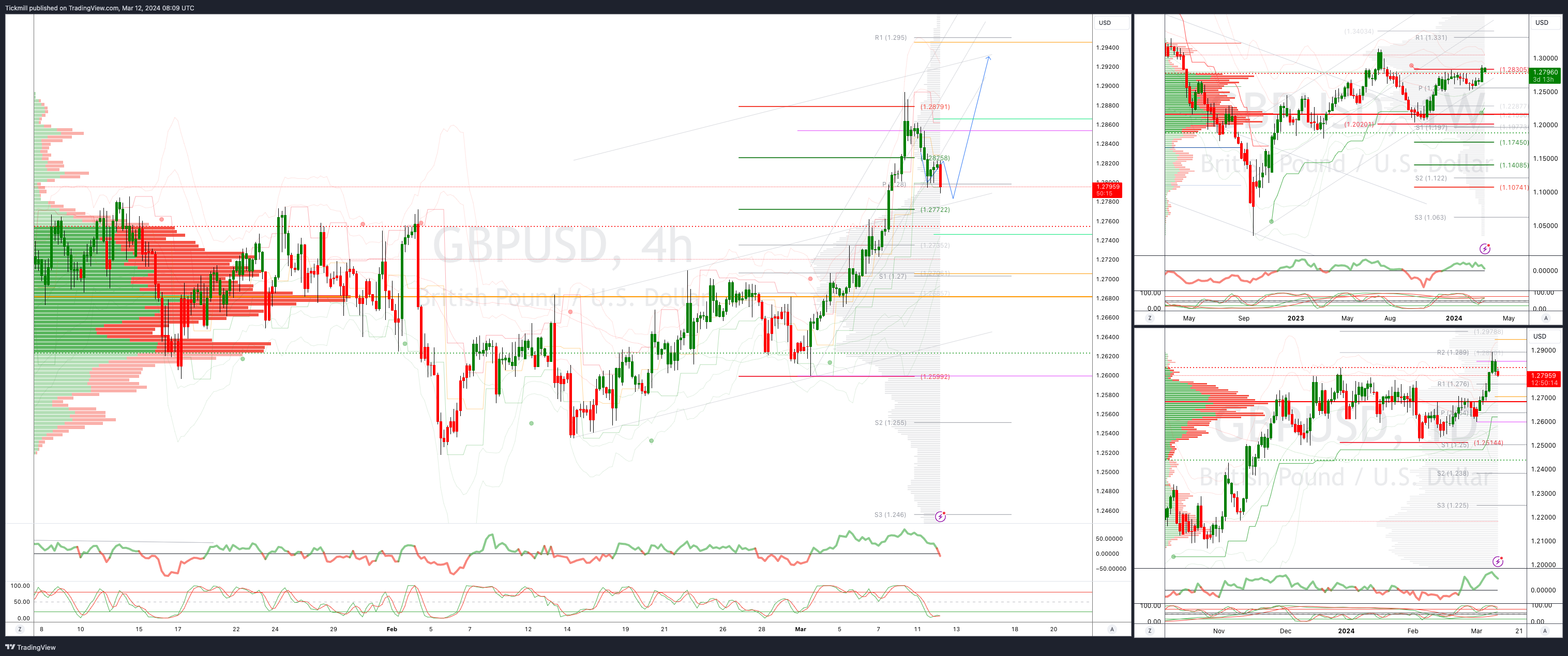

GBPUSD Bullish Above Bearish Below 1.2770

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2750 opens 1.2700

Primary support is 1.2740

Primary objective 1.29

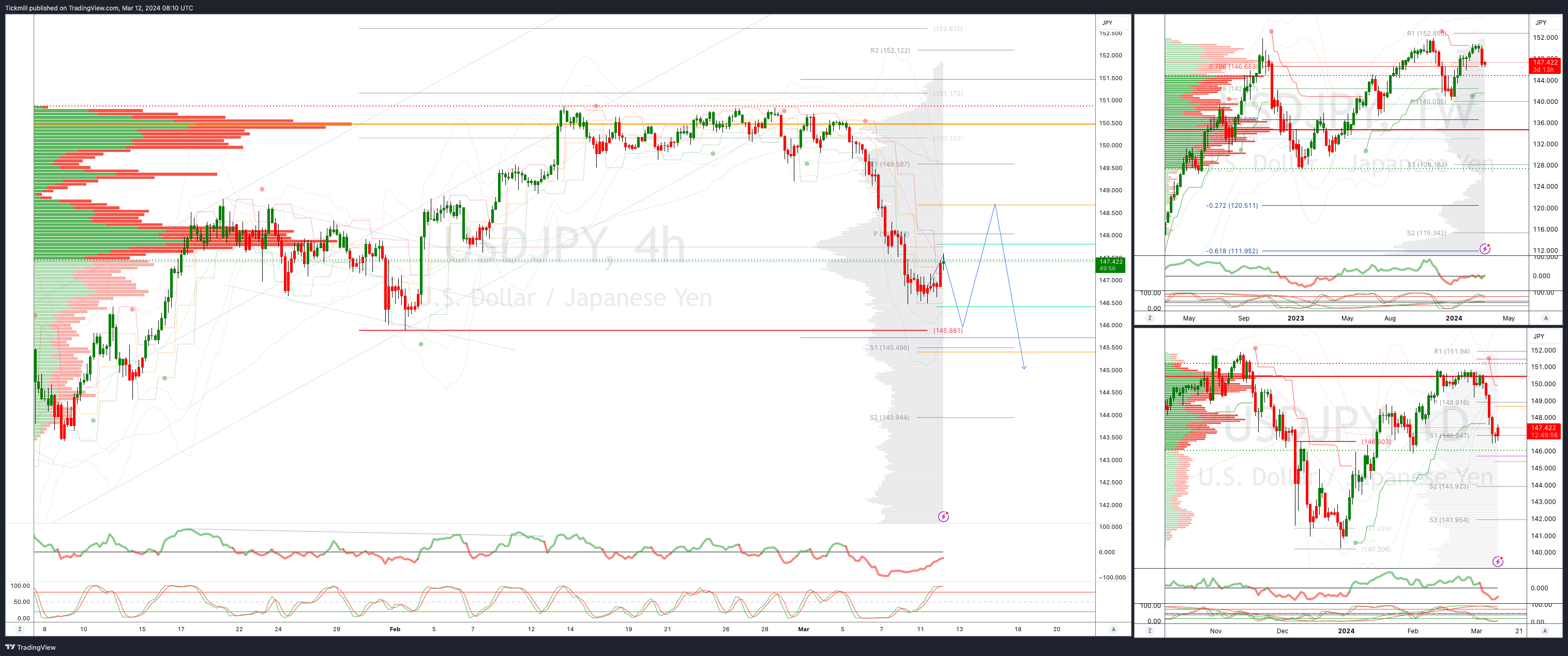

USDJPY Bullish Above Bearish Below 147.50

Daily VWAP bearish

Weekly VWAP bearish

Below 147.50 opens 145.88

Primary support 145.85

Primary objective is 152

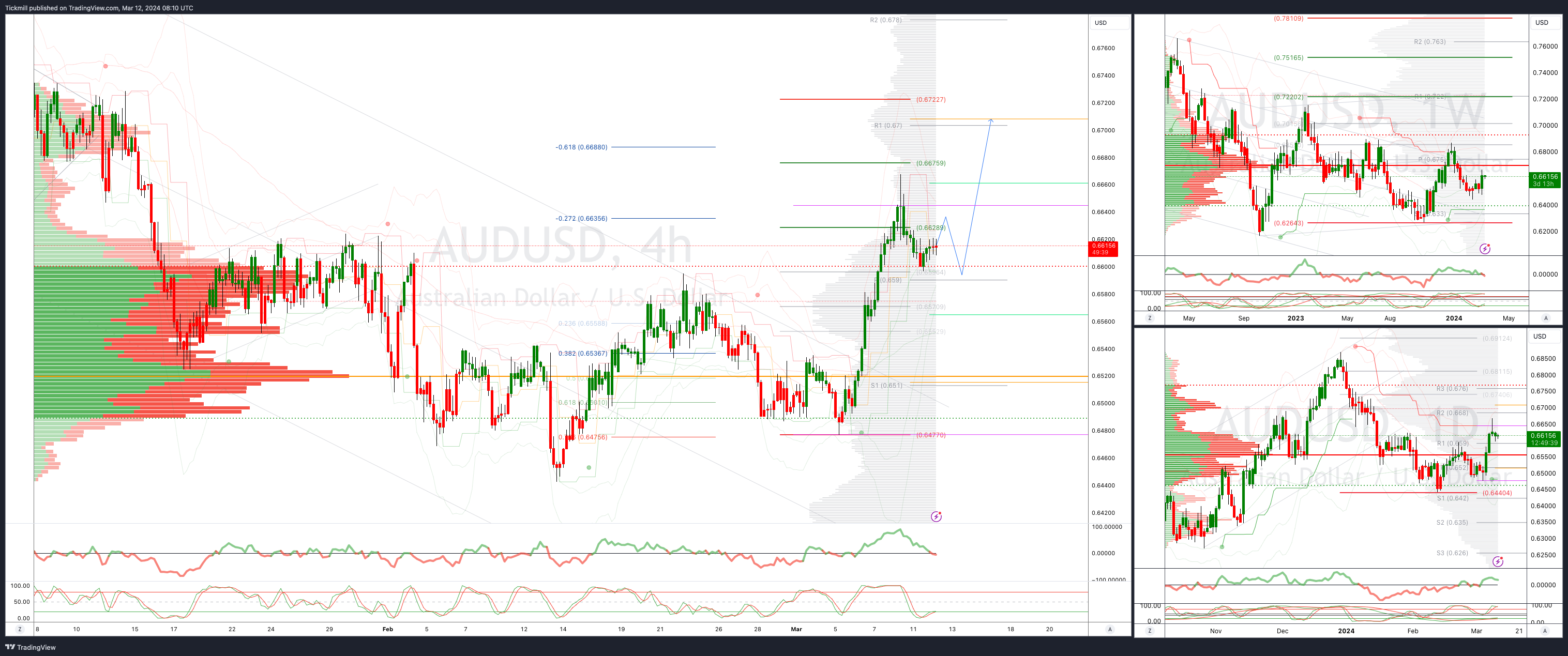

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bullish

Weekly VWAP bullish

Above .6640 opens .6700

Primary support .6477

Primary objective is .6700

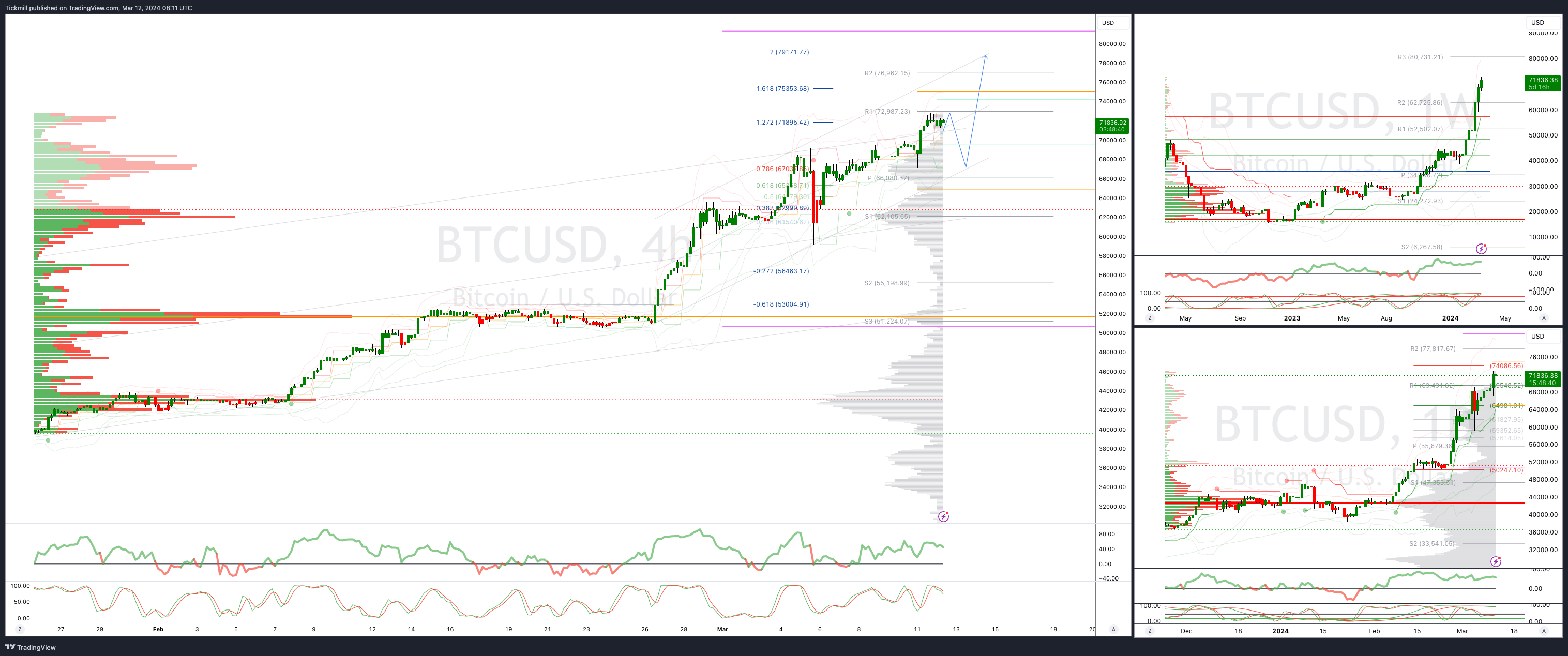

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bullish

Weekly VWAP bullish

Below 62000 opens 58000

Primary support is 52800

Primary objective is 75000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!