Daily Market Outlook, March 28, 2024

Munnelly’s Macro Minute…

“Markets Await Holiday US PCE Data & Powell Speech”

Asian stock markets are experiencing a mix of trading on Thursday, as they respond to the generally positive trends in global markets from the previous day. Some traders are taking profits following the recent market strength, while also waiting cautiously for key US inflation data and Fed Chair Jerome Powell's speech, as the markets will be closed on Good Friday. At the same time, there is an optimistic atmosphere as several central banks are expected to begin cutting rates in the second half of the year. The Asian equity gauge saw minimal changes as gains in Hong Kong and mainland Chinese equities balanced out losses in Japan.

The UK's Q4 GDP growth data, which was released earlier today, remained unchanged, confirming a 0.3% quarter-on-quarter contraction. This decline represents the second consecutive quarterly decrease following a 0.1% drop in Q3, officially indicating a technical recession. However, recent business surveys present a more positive outlook, suggesting that the economy may already be showing signs of improvement. Bank of England Monetary Policy Committee (MPC) member Haskel, who is one of the two remaining policymakers advocating for interest rate hikes but has recently shifted to the no-change camp, cautioned that wage growth still appears to be too elevated. He expressed a preference for a gradual rather than swift approach to any potential rate cuts. Haskel's remarks stand in contrast to Governor Bailey's recent indication that all MPC meetings are "in play," suggesting openness to potential changes in interest rates.

In the Eurozone, today's releases of the M3 money supply and German jobless claims figures are expected to garner relatively little attention. However, market focus will likely be on speeches by ECB policy makers Panetta and Villeroy, as they lay the groundwork for potential interest rate cuts, anticipated to occur in June. Eyes will then turn to Friday's release of the latest March CPI inflation figures from France and Italy, which will be closely monitored ahead of next week's estimates for Germany and the Eurozone as a whole. The early timing of Easter this year may introduce some volatility, but markets will be seeking evidence to support recent comments by ECB President Lagarde, who suggested that the decline in inflation is likely to persist.

Later today, the US is set to release its latest update for Q4 GDP, with expectations that it will remain unrevised at 3.2% (annualized). However, the spotlight will be on Friday's release of the personal consumption expenditure (PCE) deflator, which serves as the Federal Reserve's preferred inflation gauge. Following recent unexpected increases in inflation, markets will closely monitor the core deflator, excluding energy and food prices. In February, the seasonally adjusted month-on-month change for the core deflator is anticipated to hover between 0.3% and 0.4%, look for a 0.4% increase compared to the consensus median forecast of 0.3%. The year-on-year rates for both headline and core PCE inflation are expected to slightly rise to 2.5% and 2.9%, respectively. Despite these modest inflation surprises, the Federal Reserve appears undeterred, maintaining its trajectory towards potential interest rate cuts, possibly by mid-year. Federal Reserve Chair Powell is slated to speak tomorrow, offering further insights into the central bank's stance.

Overnight Newswire Updates of Note

Fed’s Waller Says No Rush To Cut Interest Rates

BoJ Policy Shift Not Yet A Turning Point For Japan's Economy

BoJ Policymakers Saw Need To Go Slow In Future Rate Hikes

BoE Rate-Setter Warns Against Rushing To Cut Interest Rates

China’s Property Crisis Is Rippling Through Its Biggest Banks

Australian Retailers Shake Off Malaise With A Little Help From Taylor Swift

Australia Job Vacancies Fall 6.1% In Feb Quarter As Demand Cools

Dollar Firm After Fed Comments; Yen Under Close Watch

Japan’s Bonds Saw Most Outflow In 14 Months In Historic BoJ Week

Oil Prices Advance As Investors Reassess US Inventories Data

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 150.50 ($2.85b), 150.00 ($1.5b), 152.15 ($1.24b)

EUR/USD: 1.0840 (EU1.53b), 1.0825 (EU1.46b), 1.0700 (EU1.2b)

USD/BRL: 4.9000 ($2.48b), 4.9500 ($2.02b), 4.8500 ($1.56b)

USD/CNY: 7.2500 ($1.15b), 7.3700 ($971.4m), 7.1800 ($619.7m)

USD/CAD: 1.3600 ($1.31b), 1.3435 ($851m), 1.3625 ($744.2m)

GBP/USD: 1.2600 (GBP1.15b), 1.1800 (GBP1.14b), 1.2700 (GBP484.7m)

AUD/USD: 0.7025 (AUD455.9m), 0.7200 (AUD354.2m), 0.6375 (AUD340m)

USD/MXN: 18.00 ($678.3m)

EUR/GBP: 0.8600 (EU301.2m)

NZD/USD: 0.6125 (NZD395.1m), 0.6098 (NZD300.1m)

Credit Agricole Month End Model: Our FX month-end rebalancing model suggests potential mild USD selling across various currencies, with the strongest sell signal observed against the SEK. Additionally, our corporate flow model indicates EUR selling at the end of the month. Consequently, we are employing a combined strategy, utilizing the signals from the month-end rebalancing model.

CFTC Data As Of 22/03/24

Bitcoin net short position is -2,096 contracts

Euro net long position is 48,342 contracts

Japanese Yen net short position is -116,012 contracts

Swiss Franc posts net short position of -20,500 contracts

British Pound net long position is 53,200 contracts

Equity fund speculators trim S&P 500 CME net short position by 57,268 contracts to 416,777

Equity fund managers raise S&P 500 CME net long position by 35.431 contracts to 949,421

Technical & Trade Views

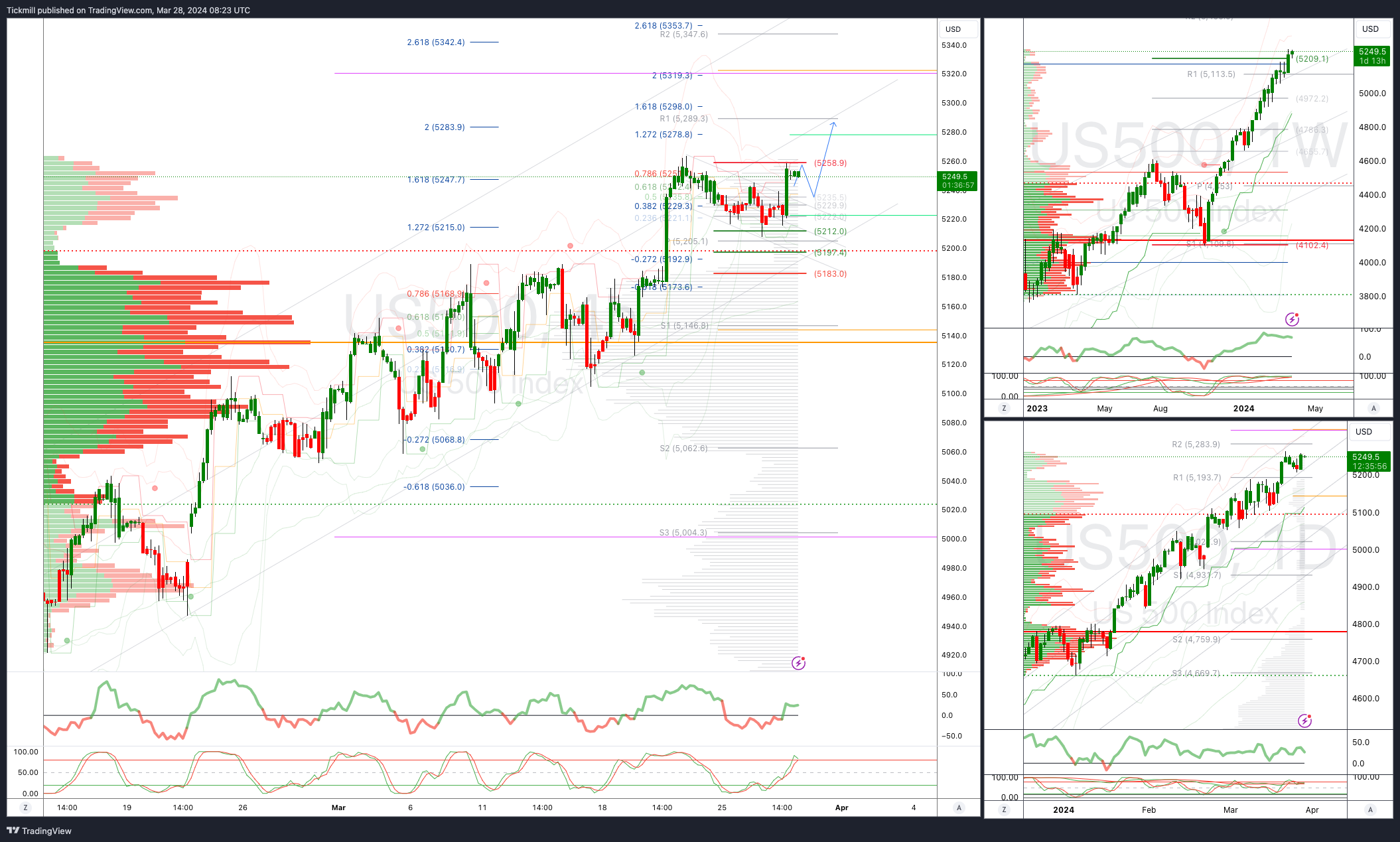

SP500 Bullish Above Bearish Below 5200

Daily VWAP bullish

Weekly VWAP bullish

Below 5190 opens 5160

Primary support 5160

Primary objective is 5300

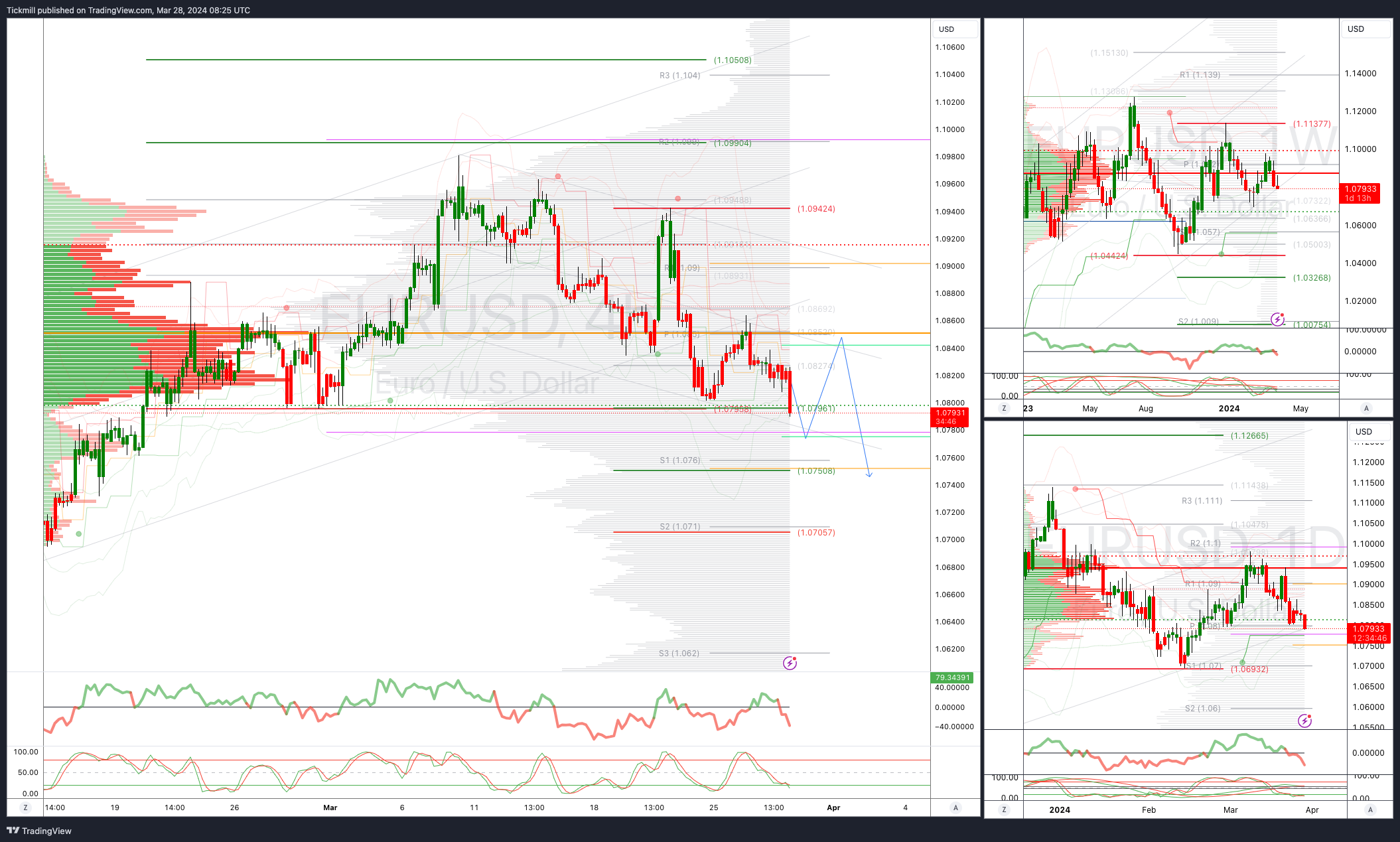

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bearish

Below 1.08 opens 1.0750

Primary support 1.08

Primary objective is 1.10 (Potential Objective Change Developing)

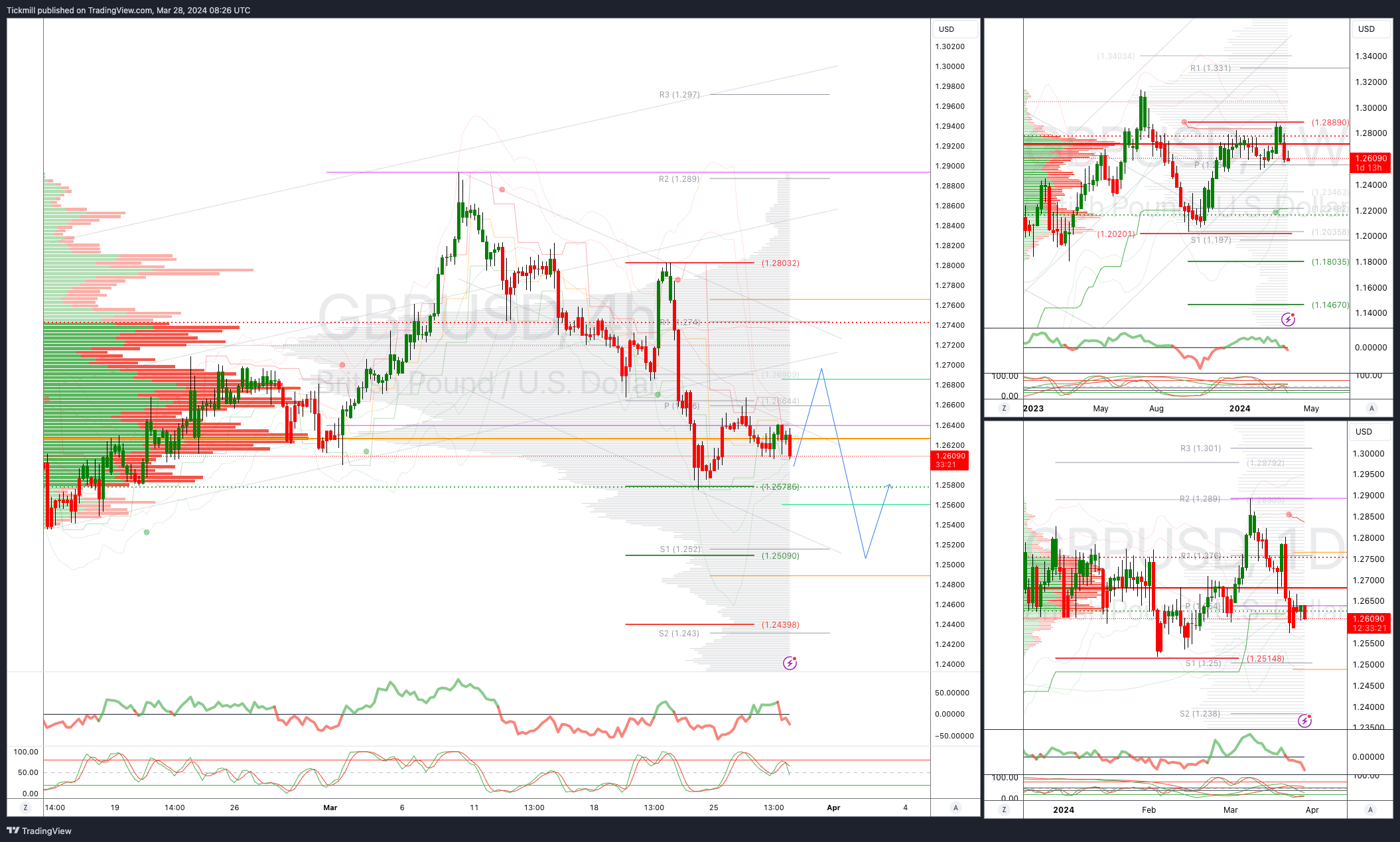

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2514

Primary objective 1.29 (Potential Objective Change Developing)

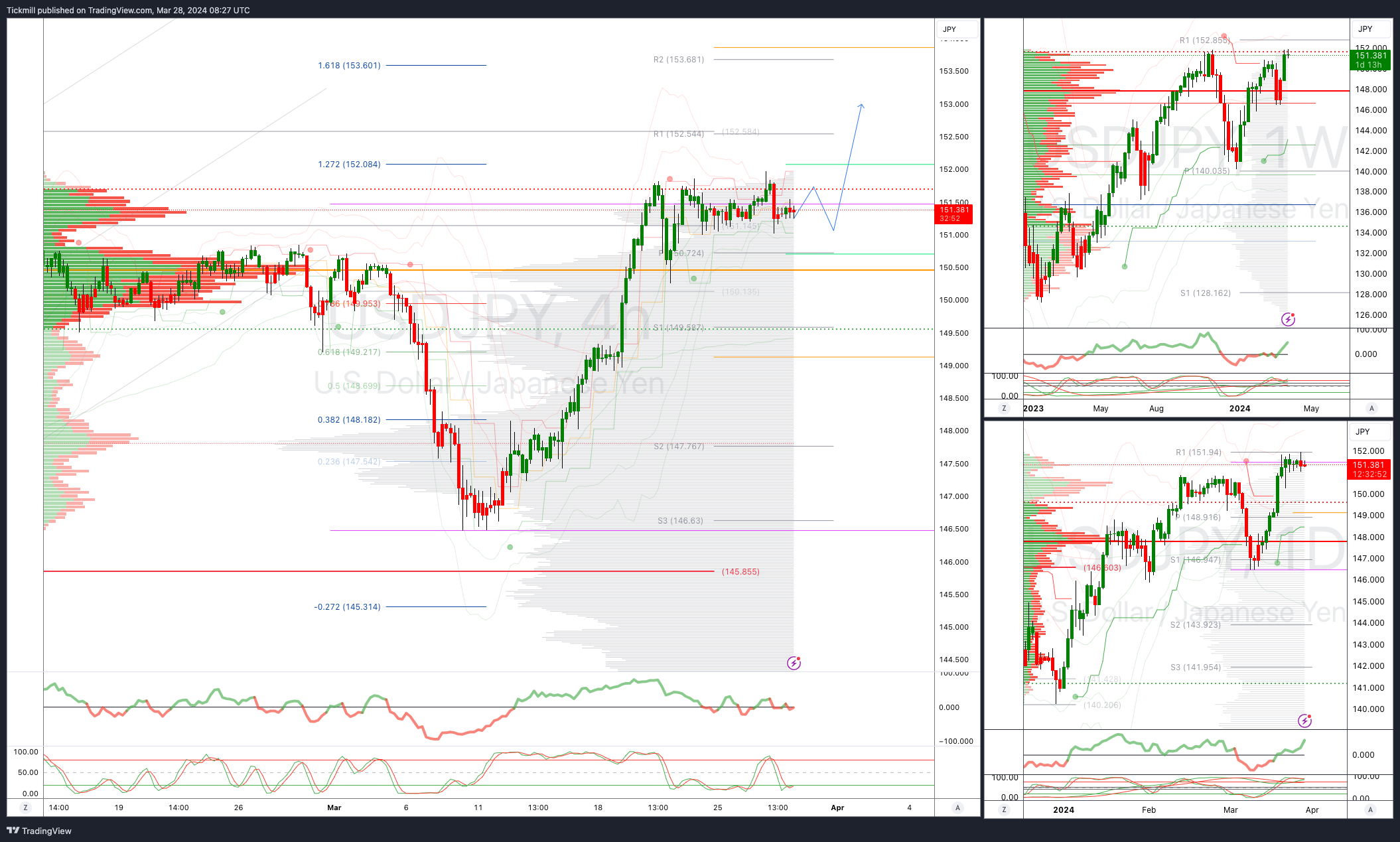

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

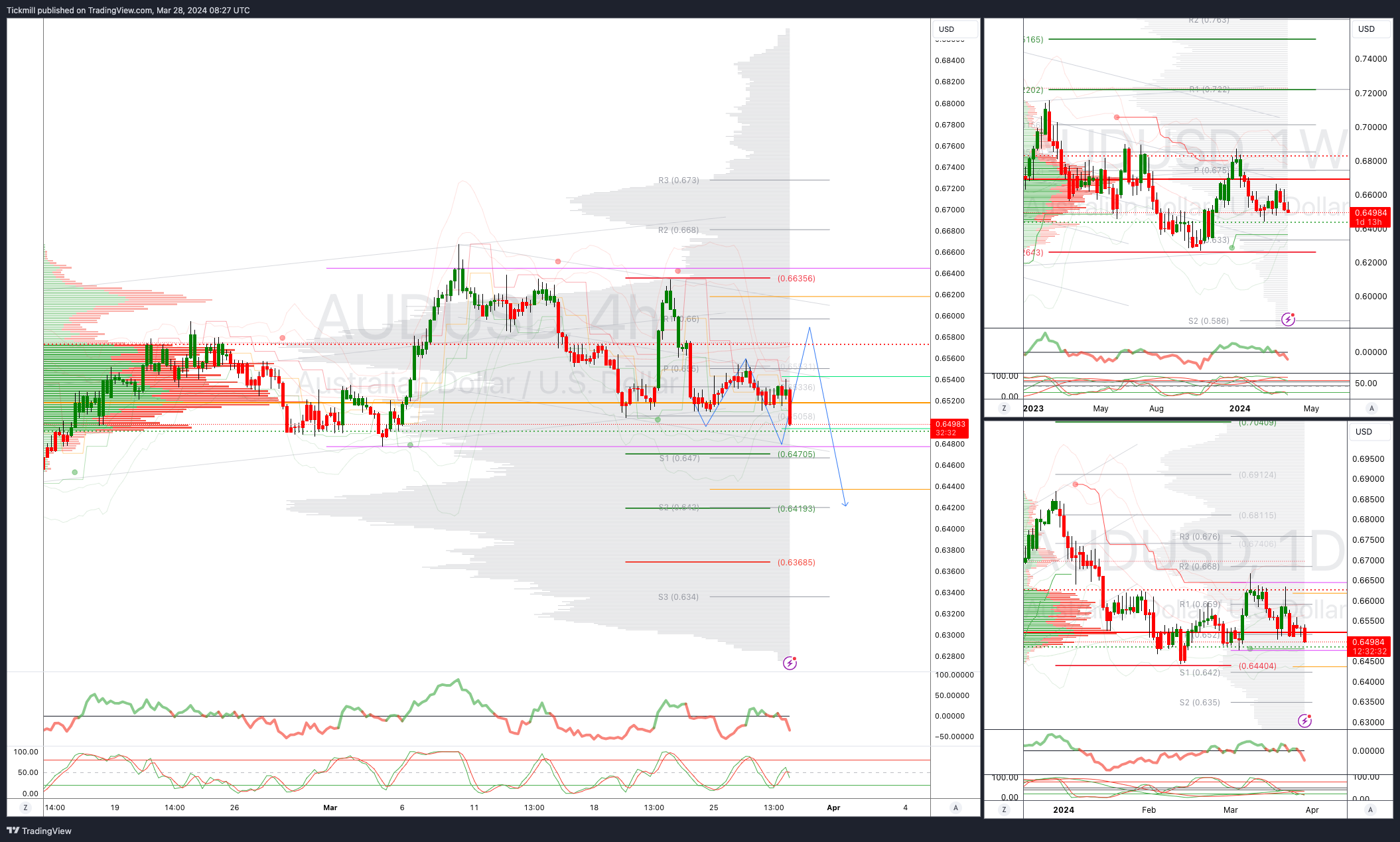

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6470

Primary support .6477

Primary objective is .6700 (Potential Objective Change Developing)

BTCUSD Bullish Above Bearish below 68300

Daily VWAP bullish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!