Daily Market Outlook, October 5, 2020

Market risk sentiment has started the week in positive fashion, buoyed by the improved assessment given by health officials on US President Trump’s condition. Reports suggesting Mr Trump could leave hospital as soon as today have seen most equity markets trade higher in Asia, while US futures point to a positive start for the S&P later today. Meanwhile, following last week’s ninth round of Brexit talks, a video conference over the weekend UK PM Johnson and European Commission President von der Leyen ended with both tasking their negotiators to work intensively to see if a trade agreement can be reached by the end of the month.

Against a background of rising Covid-19 cases, it seems likely that there will be an acute focus on infection statistics in the week ahead. The concern for many is that restrictions, in not only the UK but elsewhere too, will need to be tightened further in the coming weeks unless new cases stop accelerating.

Over the weekend, PM Johnson justified the recent ‘Eat Out to Help Out’ subsidised dining scheme but also acknowledged that it may have also contributed to the recent spike in new cases. With new localised lockdown measures taking effect over the past few days, news around their efficacy and the rate of new infections may receive more attention than the coming week’s economic data calendar, particularly as the releases will be for the period prior to the recent rise in cases.

Today’s domestic data calendar is limited to the final estimate of the September UK services PMI. The ‘flash’ estimate showed a robust outturn of 55.1 but down from the 58.8 outturn recorded in August, pointing to a slowdown in the rate of growth in September. Expect the final reading to remain consistent with solid growth across the sector. However, a probable modest downward revision to 54.8 on the basis that later returns will reflect the impact of the latest round of lockdown restrictions that were announced after the cut-off date for the ‘flash’ report.

In the US, look for a slight fall in the September ISM to 56.5 from 56.9, still consistent with decent growth. In the Eurozone, the ‘final’ reading of the September services PMI is expected to confirm the decline below the 50- mark, as registered by the flash estimate. At 47.6, the data is a reminder of the potential for post-lockdown rebounds to lose steam in the absence of a solid recovery in confidence. Elsewhere, Fed policymakers Evans (15:45 BST) and Bostic (20:15 BST) are due to speak at separate events.

The snapshot of FX sentiment and positioning contained in this week’s CFTC Commitment of Traders Report shows USD bearish sentiment is receding only very gradually. The aggregate USD short position implied by net exposures in the major currencies we cover in this report declined by USD3.5bn in the week through Tuesday but the overall short remains substantial and a little over USD30bn. Speculative accounts moved to reduce net longs in the EUR, JPY and CHF this week, accounting for about a third of the overall reduction in net USD short positioning. Net EUR longs remain significant, however, at USD27.6bn. This equates to around 188k contracts, down just a little more than 10% only from the peak (record) EUR bull position at the end of August. GBP sentiment deteriorated relatively sharply over the period covered in this report, however, likely reflecting concerns over how UK/EU trade talks are progressing (they are not). Net GBP shorts rose USD1.3bn, representing a little less than another third of the overall reduction in the aggregate USD short position

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1700 (870M), 1.1730 (761M), 1.1745 (231M), 1.1800 (455M) 1.1815 (257M), 1.1830 (480M)

- USDJPY: 104.50 (450M), 104.70-75 (360M), 105.00 (1.25BLN), 105.50 (314M) 105.80 (600M), 105.90-106.00 (530M)

- GBPUSD: 1.2825 (200M)

- AUDUSD: 0.7100 (326M), 0.7160-65 (900M), 0.7230 (628M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1750 Bullish above

EURUSD From a technical and trading perspective,test of 1.1750 trendline attracted fresh bids, as 1.18 now acts as interim support look for a test of offers and stops above 1.1950 UPDATE as 1.1700/50 acts as support expect continued rotation in 1.17/1.19 range, a breach of 1.17 would suggest a deeper correction underway to challenge bids at 1.16. UPDATE as 1.1750 now acts as resistance look a challenge of bids and stops below 1.16

Flow reports suggest downside bids limited through the 1.1620 area opening the downside through to the 1.1480-1.1500 level in the short, Topside offers likely to be limited now through the 1.1760 level but increasing in resistance into the 1.1780-1.1800 area with weak stops likely on a push through the 1.1820-30 area for a quick stab towards the 1.1850 area

GBPUSD Bias: Bearish below 1.2850 Bullish above

GBPUSD From a technical and trading perspective, test of the pivotal primary trendline support at 1.2830/50 stalls downside for now, however as 1.3000 acts as resistance look for renewed downside to target 1.2650 next UPDATE as 1.2850 acts as resistance look for a test of bids to 1.26/1.2570 UPDATE as 1.28 now acts as support lok for a test of 1.30, a breach of 1.2750 would suggest a false upside break and resumption of downtrend

Flow reports suggest topside offers light through to the 1.2900 level with offers congested through to the 1.2930 area before lighter offers begin to appear into the sentimental 1.2950 area stronger offers are then likely on any approach to the 1.3000 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2800 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

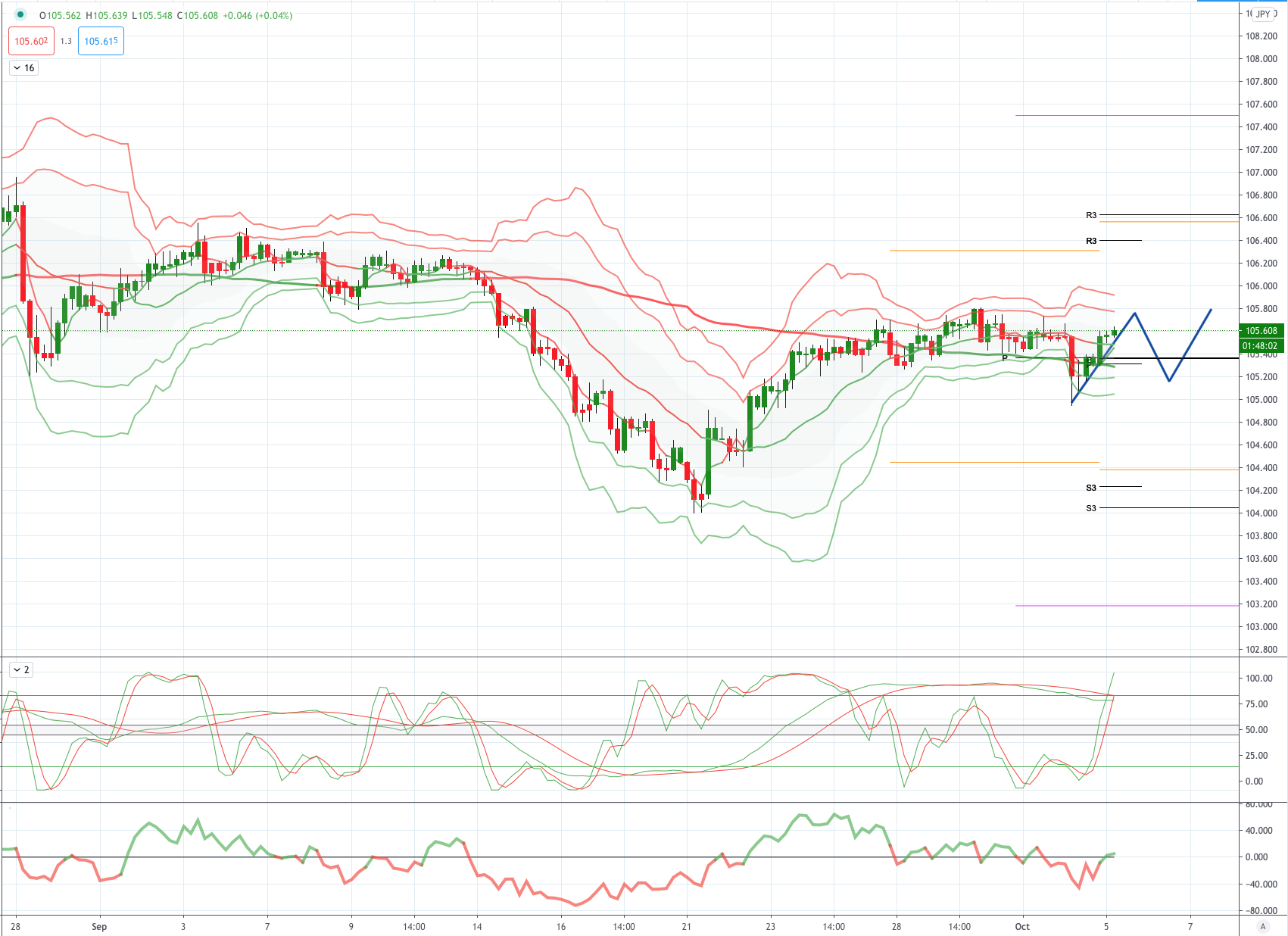

USDJPY Bias: Bearish below 105.50 Bullish above

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. UPDATE as 105.50 now acts as resistance look for a test of bids towards 103.80 as the next downside objective. UPDATE continued rotation around 105.50, as 105.10 supports look for a test of 106.00

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

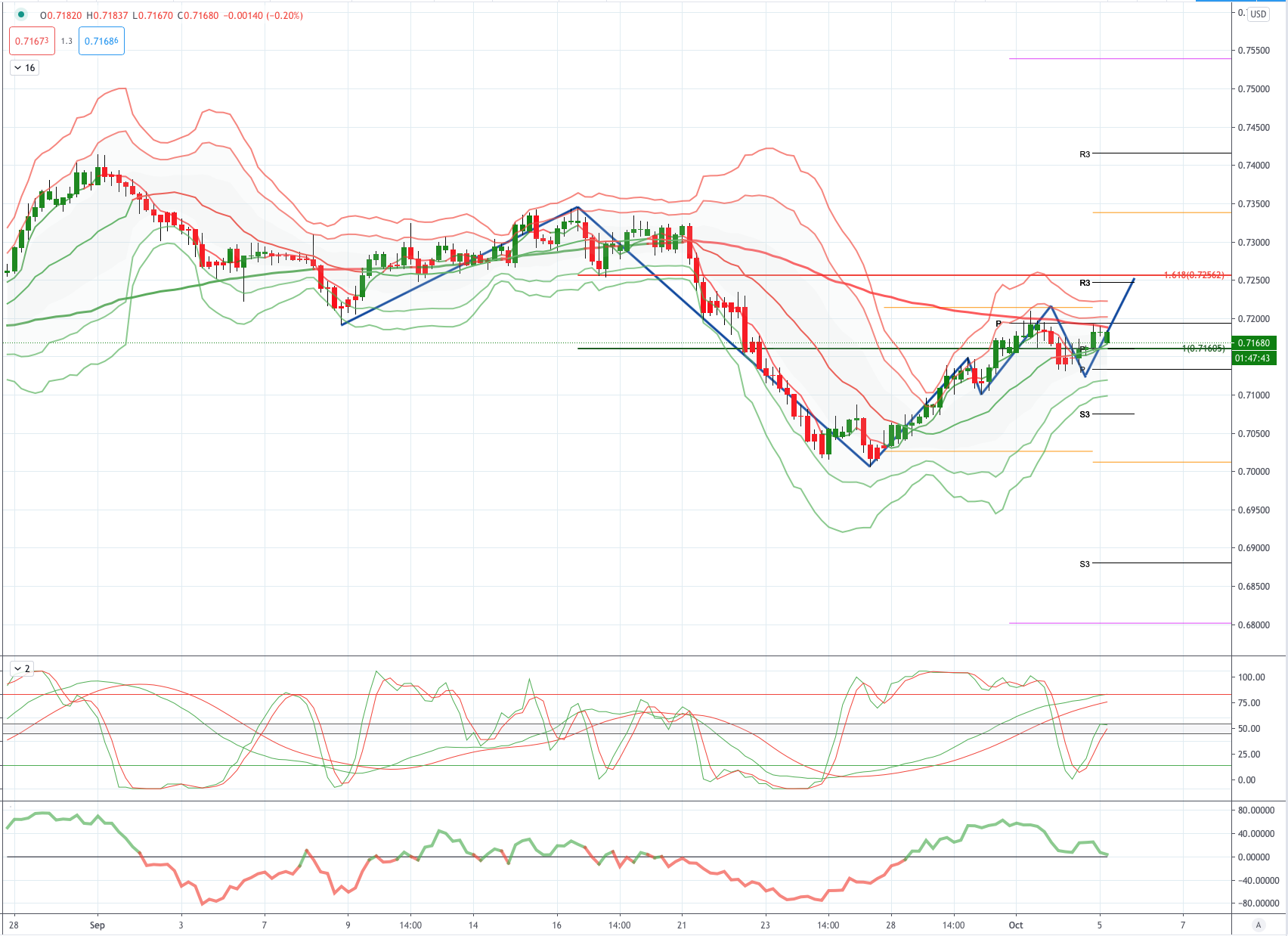

AUDUSD Bias: Bullish above .7150 Bearish below

AUDUSD From a technical and trading perspective, as .7220 now acts as support, look for a test of psychological .7500. Only a daily closing breach of .7220 would concern the bullish thesis opening a retest of .7100. UPDATE as .7220 now acts as resistance look for a test of bids to .7050 UPDATE as .7150 acts as resistance look for a test of bids and stops below .7000 UPDATE breach of .7150 opens a retest of .7220 from below

Flow reports suggest downside light bids through to the 0.7020 area with stronger bids starting to make an appearance and possible option related bids coming into play, a push through the 0.6980 level should see weak stops appearing and the market running into congestion on any push to the sentimental 0.6950 area and likely to continue through to 69 cents area, Topside offers light through to the 0.7160 level before sufficient offers appear to slow any further rise however, strong offers through to the 72 cents level are likely to stymie any further movement however, weak stops through the 0.7220 level could help it run a little higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!