Daily Market Outlook, September 28, 2022

Overnight Headlines

- Moody's Warns UK Unfunded Tax Cuts Are 'Credit Negative'

- IMF Tells UK To Re-Evaluate Tax Cut As Global Criticism Mounts

- UK Price Inflation In Shops Hits Record High As Pound Tumbles

- Treasury 10-Year Yields Rise Above 4% In First Time Since 2010

- Poll: Fed To Take Rates Even Higher With Further Pain Ahead

- Fed’s Kashkari Says Rate-Hike Pace Appropriate To Cool Prices

- White House’s Deese Doesn’t See Another Plaza Accord Ahead

- White House Mulling Potential Yellen Departure After Midterms

- Senate Advances US Funding After Manchin Drops Energy Bid

- BoJ Board Agreed On Need For Vigilance On Sharp Yen Moves

- Putin Raises Gas Pressure As Moves To Annex Ukraine Regions

- EU Warns Against Attacks On 'Active Infrastructure' After Leaks

- Apple Ditches iPhone Production Increase After Demand Falters

- China's Offshore Yuan Hits Record Low Against Strengthening Dollar

- Oil Tumbles As Dollar Hits Record In Fresh Blow To Commodities

- US Futures Fall After S&P 500 Hits New Low For The Year

The Day Ahead

- Asian equity markets came under renewed pressure and the US dollar strengthened against other major currencies. Treasury yields climbed further after hawkish Fed comments and some strong US data including a rise in consumer confidence. The White House also reportedly played down prospects of a 1985 Plaza-type agreement to weaken the dollar. Regarding the UK, the IMF said fiscal policy should not “work at cross purposes to monetary policy”. Data from the British Retail Consortium showed another record rise in shop prices in September.

- In the absence of significant economic data releases, especially in Europe and the UK, the focus will remain on several central bank speakers today. In the UK, yesterday saw comments from BoE MPC member and Chief Economist Huw Pill who said there will be a “significant monetary policy response” to recent developments. Fellow rate-setters Deputy Governor Jon Cunliffe and new external MPC member Swati Dhingra are due to speak today.

- The BoE’s Cunliffe will speak on payment systems rather than the economic or monetary policy outlook. This evening, Dhingra will chair a panel with Chicago Fed President Charles Evans on inflation and monetary policy. Dhingra dissented at her first policy vote last week in favour of a smaller 25bp hike, rather than the majority 50bp, putting her at the most dovish end of the spectrum.

- There are also several scheduled ECB and US Fed speakers today as well, as the two central banks prepare to increase interest rates further in response to high inflation. Ahead of this Friday’s Eurozone flash CPI inflation figures, which are expected to show a rise to a record high, ECB President Lagarde will participate in a ‘keynote fireside chat’ this morning. Fed Chair Powell will also give welcome remarks at an event today.

- US advance trade data and pending home sales will draw some attention in the afternoon session. The goods deficit is forecast to narrow slightly, while pending home sales are expected to fall as rising interest rates dampen housing activity.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9650 (302M), 0.9725-30 (444M)

- USD/JPY: 143.40-50 ( (431M), 143.94-00 (263M), 145.00 (554M)

- EUR/JPY: 138.00 (401M). USD/CHF: 0.9890-00 (830M)

- AUD/USD: 0.6285 (200M, 0.6495-05 (594M)

- USD/CAD: 1.3760-65 (1.28BLN)

Technical & Trade Views

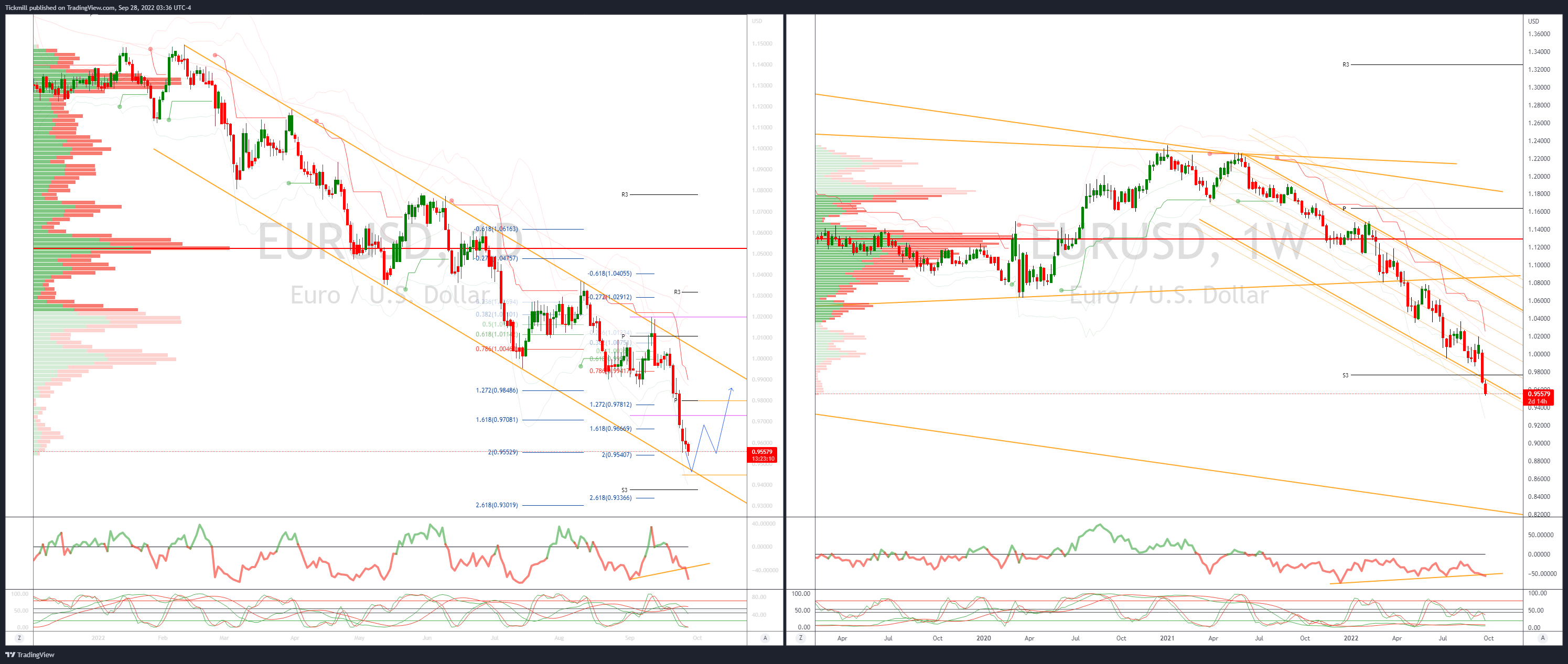

EURUSD Bias: Bearish below 1.00

- Under pressure as USD buying picks up steam in Asia

- EUR/USD down 0.45% as USD bid across the board - led by GBP/USD

- Equities pressured as negative feedback loop between USD and equities bites

- US 10-year yield testing yesterday's 3.9930% high and underpinning USD

- E-minis down 0.45% while AXJ equity index down over 1.5%

- EUR/USD below Tuesday's 0.9570 low with support at Monday's 0.9528 low

- Bids are tipped ahead of 0.9500 with talk of stops below

- 20 Day VWAP bearish, 5 Day bearish

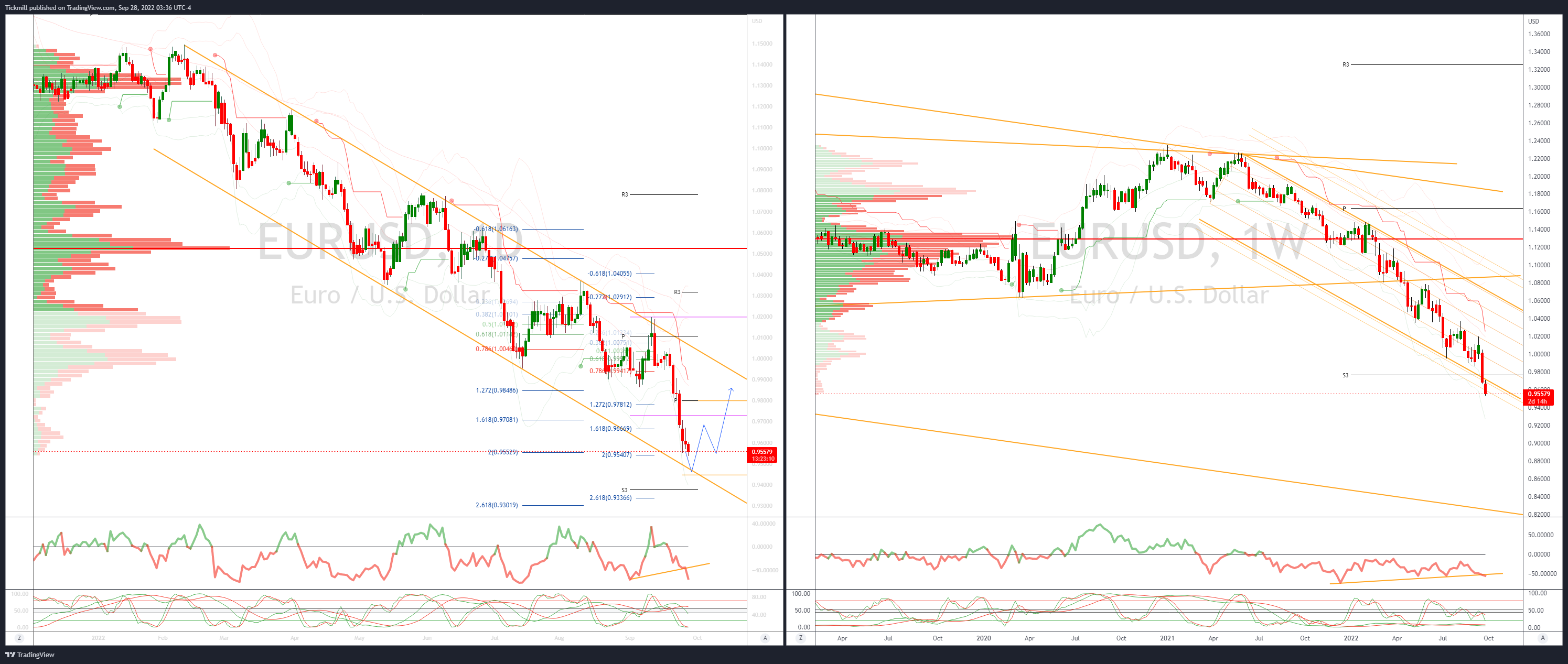

GBPUSD Bias: Bearish below 1.10

- Heavy, scepticism on UK pro growth policies resurfaces

- Off 0.5% as sterling sellers return, with EUR/GBP up 0.2%

- White House's Deese - UK economic plans need 'fiscal prudence'

- Moody's warns UK unfunded tax cuts are 'credit negative'

- Headlines underline markets scepticism with UK's pro growth mini budget

- Tuesday's 1.0650 low and early Asian 1.0737 top initial support, resistance

- 20 Day VWAP is bearish, 5 Day bearish

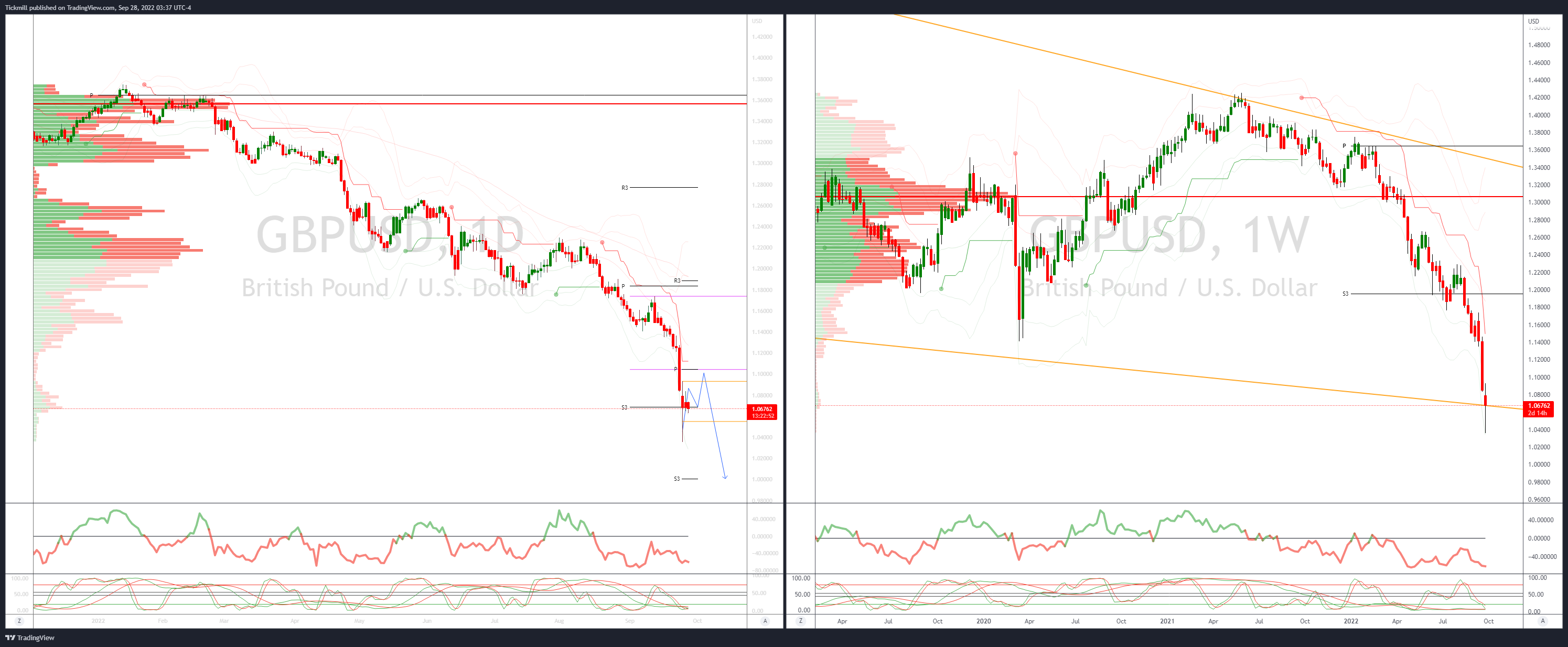

USDJPY Bias: Bullish above 140

- Yen shows broad strength, as risk appetite sours

- Risk off in Asia, in response to surging yields on Tuesday in EZ and U.S.

- Nikkei -1.85%, AsiaxJP stocks -1.4% and E-mini S&P futures -0.55%

- Yen shows broad strength, as Japanese investors repatriate

- USD/JPY -0.1%, EUR/JPY -0.5%, GBP/JPY -0.75% and AUD/JPY -0.8%

- Pivotal 141.03 now major support

- Psychological 145.00 first resistance, then pre intervention 145.90 high

- London 144.06 low, then 143.10 initial supports

- 20 Day VWAP is bullish, 5 Day bullish

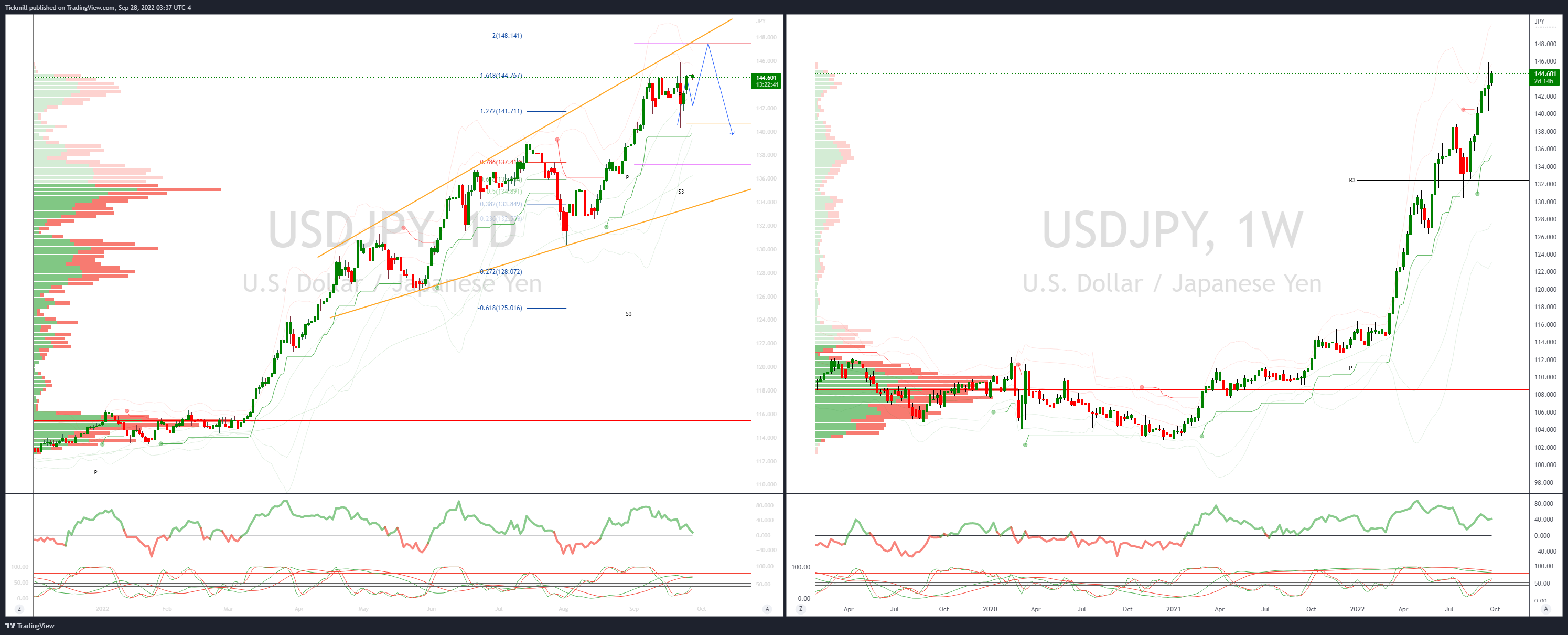

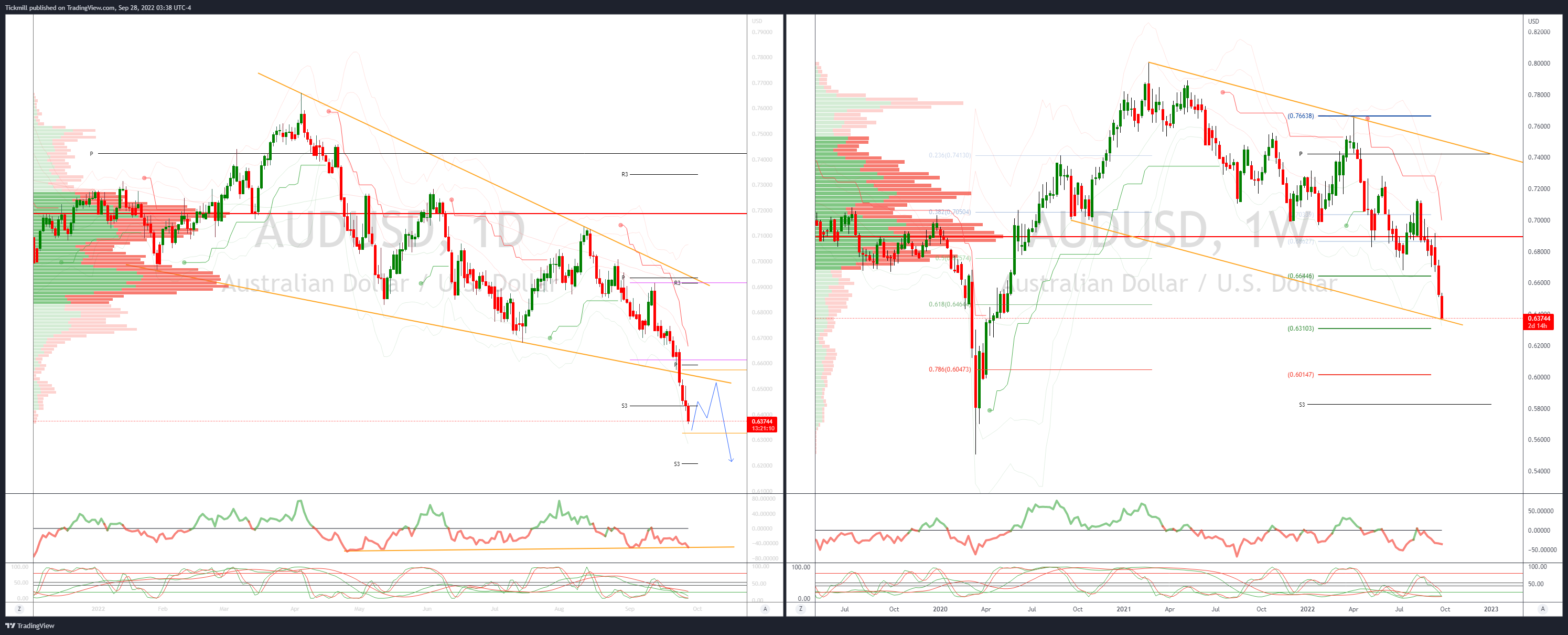

AUDUSD Bias: Bearish below .6750

- New low as USD firms – muted reaction to better Aus data

- AUD/USD eased to 0.6411 before Aus retail sales better than expected

- It is the lowest traded since May 2020 - as yesterday's low was 0.6413

- Muted reaction to the better retail sales as USD broadly firmer in Asia

- AUD/USD looks vulnerable after clearly breaking important fib at 0.6463

- There isn't much in the way of support until weekly lows at 0.6235/50

- 20 Day VWAP is bearish, 5 Day bearish

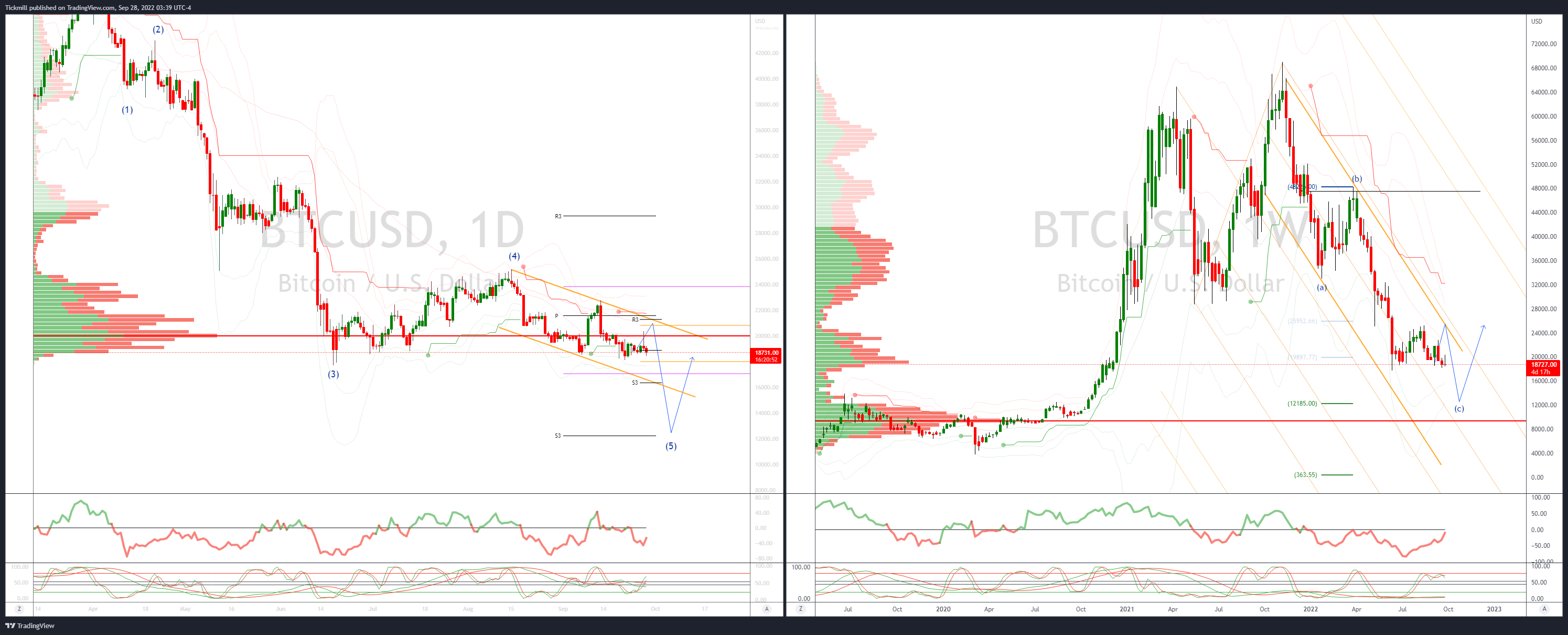

BTCUSD Bias: Bearish below 25.3K

- BTC gave up a +5% gain to close negative and sub 19k on the day

- BTC is still down ~58.5% so far this year

- CFTC - BTC specs +451 contracts, long rises to 577 contracts; BTC -6.23% in period

- Crypto Exchange FTX President Brett Harrison Stepping Down

- Crypto billionaire Bankman – Fried eyeing bid for Celsius assets - BBG

- First resistance sited at 21k support now see at 18k

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!