Dollar Heavily Sold

The US Dollar is trading heavily lower on Thursday as the fallout from president Trump’s tariff announcement yesterday continues to pressure the greenback. The Dollar Index is now approaching six month lows as US recession fears take centre stage again on the back of the announcement. There had been some speculation that Trump might opt for lighter measures, which might have spare the Dollar the worst of the impact. Indeed, expectations of USD upside, linked to safe-haven inflows and inflation fears, have also fallen flat with traders seemingly more focused on dwindling US growth prospects in light of the new tariffs.

Bearish Risks

The tariffs, which included a baseline rate for all countries and higher rates for key trading partners, have been taken as a negative for USD. Looking ahead, the Dollar is now at risk of a deeper push lower if tomorrow’s US labour reports highlight further weakness.

Fed & US Data

Near-term Fed easing expectations have risen recently, in line with softening US data. Last month’s softer NFP print was a key bearish catalyst for USD. If we see a further downside surprise this month, USD is at risk of accelerated selling as Fed easing expectations rise again. A softer JOLTS number earlier in the week was followed up by a stronger-than-forecast ADP print, keeping expectations mixed ahead of the release tomorrow, forecast at 137k down from 155k prior.

Technical Views

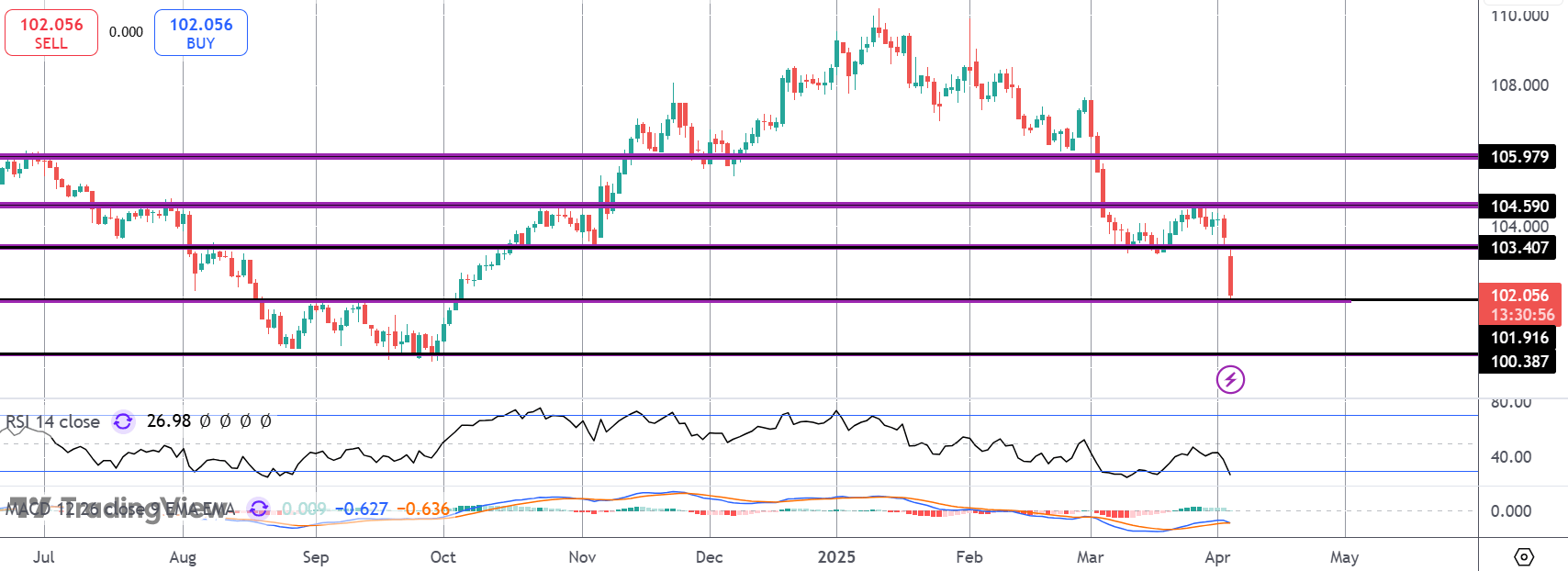

DXY

The sell off in the index has seen the market breaking down below the 103.40 level. Price is now testing support at 101.91 and with momentum studies dipping, risks of a further push towards 100.38 are seen. The bear outlook remains while below the 103.40 level near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.