Dollar Pauses For Now

The US Dollar is trading with a softer tone through the early European session on Tuesday, on the back of the rally seen last week. A stronger-than-forecast set of US labour market readings has seen expectations for a deeper .5% cut in November put to bed, for now at least. The NFP print was seen spiking higher to 254k from 159k prior, above the 147k the market was looking for. The unemployment rate was seen improving to 4.1% from 4.2% prior and expected while wage rose at 0.4%, above the expected 0.3% reading forecast on Wall Street. The greenback was seen firmly higher into the close on Friday with traders now forecasting a .25% cut along with a roughly 10% chance of a hold.

FOMC Minutes & CPI Due

Looking ahead this week, focus will now be on the FOMC minutes due tomorrow followed by CPI on Thursday. Traders will be carefully scrutinising the minutes for clues as to how the Fed is likely to act next month. For CPI, given the shift in expectations on the back of the NFP, any upside surprise in Thursday’s data should see the current USD rally find further support. However, if we see a downside surprise, this could reignite expectations for a deeper cut in November, leading USD lower near-term. Finally, on Friday traders will look to further inflation data with the latest PPI readings also due.

Technical Views

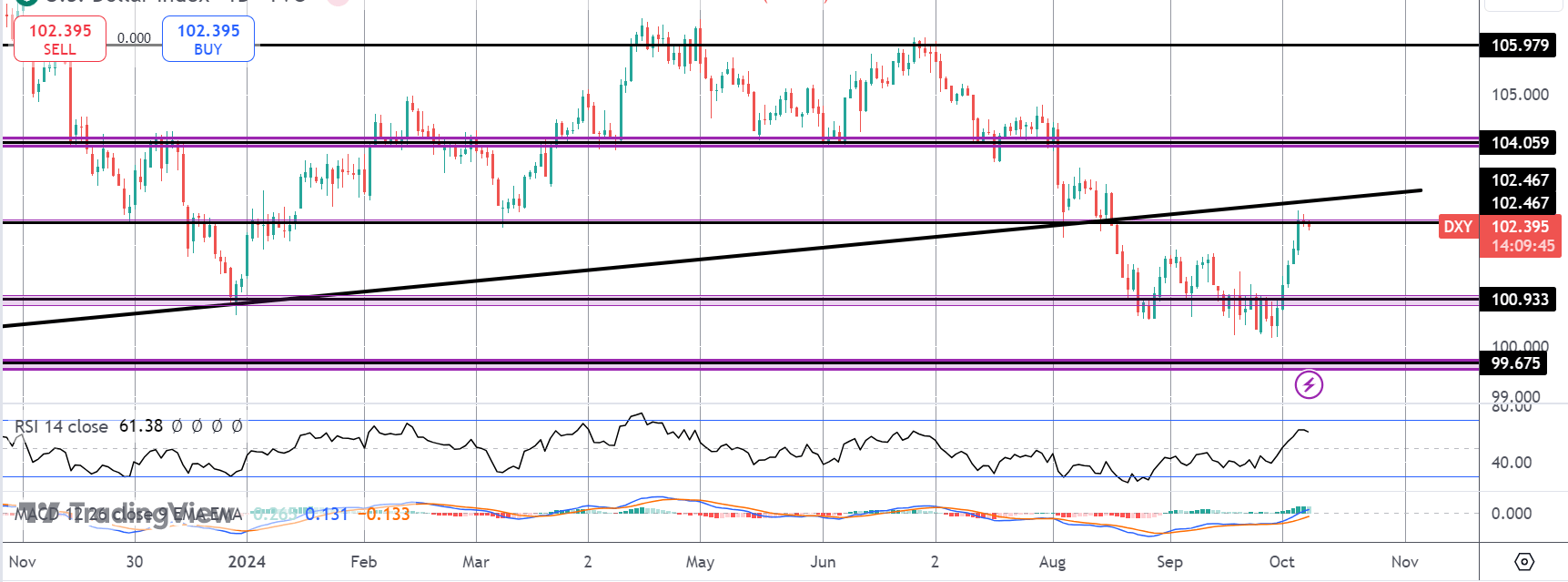

DXY

The rally in the DXY has stalled for now into a test of the 102.46 level and the underside of the broken bull trend line. This is a key pivot for the market which, if broken opens the way for a move up to 102.05 next. To the downside, 100.93 remains the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.