DXY Testing Key Resistance Area

USD Grinds Higher

The US Dollar is continuing to rise as we move through the middle of the week, despite the ongoing US government shutdown. Political developments in Japan and France are fuelling a weakening of JPY and EUR this week, feeding into better demand for USD.

Shifting BOJ View

In Japan, news of Sanae Takaichi taking over as leader of the LDP has sparked fears of a return to fiscal expansion in Japan. If the LDP wins in the upcoming elections and Takaichi leads as PM, the BOJ is expected to adopt a more dovish approach in line with Takaichi’s economic agenda, which has been dubbed Abenomics 2.0. This marks a sharp shift from the hawkish BOJ outlook held by traders over the summer and is fuelling a rally in Japanese stocks while JGBs and JPY are dumped.

French Political Turmoil

In Europe, all focus is on France at the moment following the resignation of PM Lecornu just half a day after appointing his cabinet. Macro has asked the outgoing PM to try and form a government in his departure that can handle urgent budgetary issues. If talks fail by tonight’s deadline, snap elections look likely to be called. If elections are called EUR is likely to weaken furtehr near-term as French budgetary management is thrown into uncertainty. Indeed, even if snap elections are avoided, French political instability will remain a downside threat to EUR near-term. Against this backdrop, USD should stay bid near-term though tonight’s FOMC minutes could cause some pullback in the Dollar if Fed members are seen to be more dovish than expected.

Technical Views

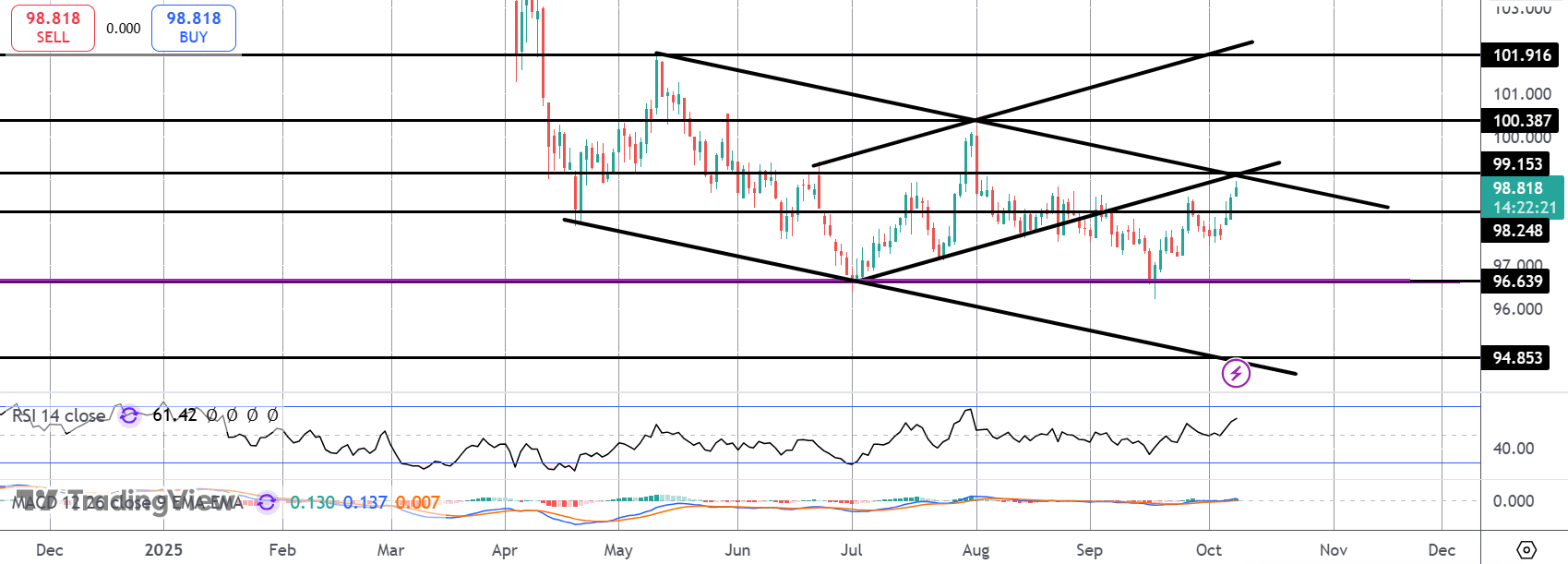

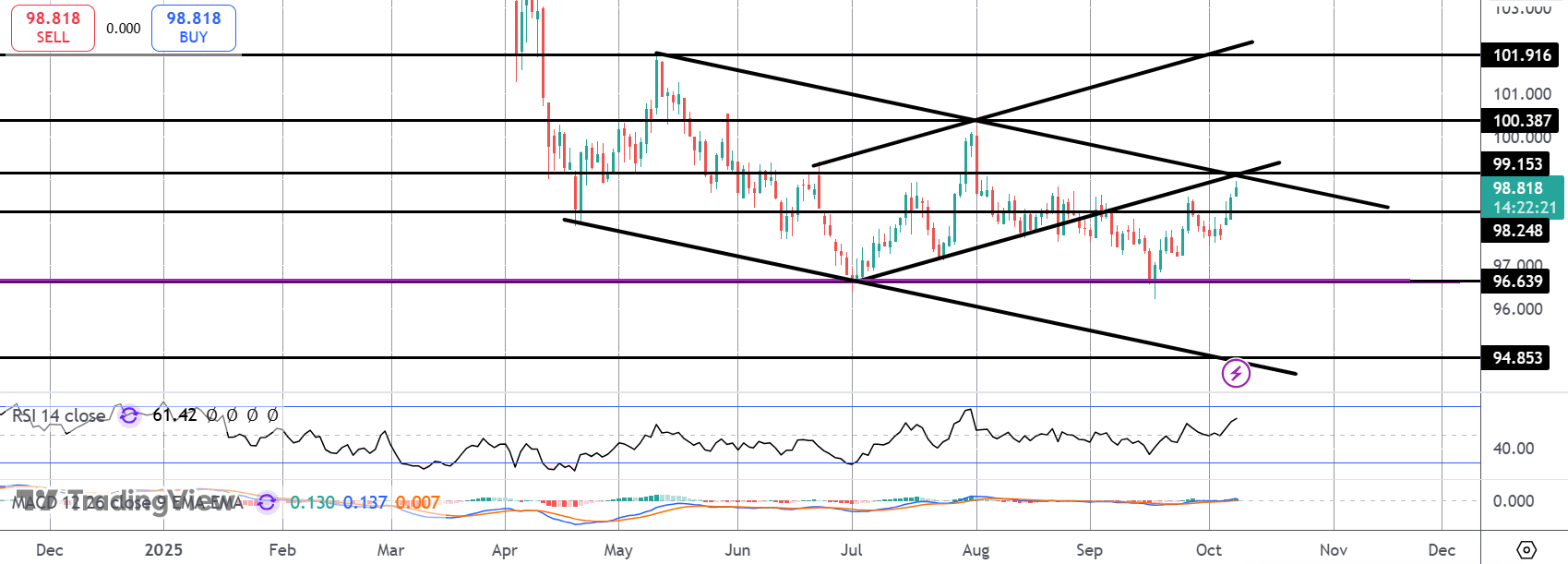

DXY

The rally in DXY has seen the index breaking above the 98.24 level with price now testing the 99.15 level. We also have confluence here between the broken bull channel lows and the bear channel highs. As such, this is a key resistance level to watch which, if broken, turns focus to the 100 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.