Fed's June Rate Hike Gains Credibility as NFP Report Highlights Inflation Risks

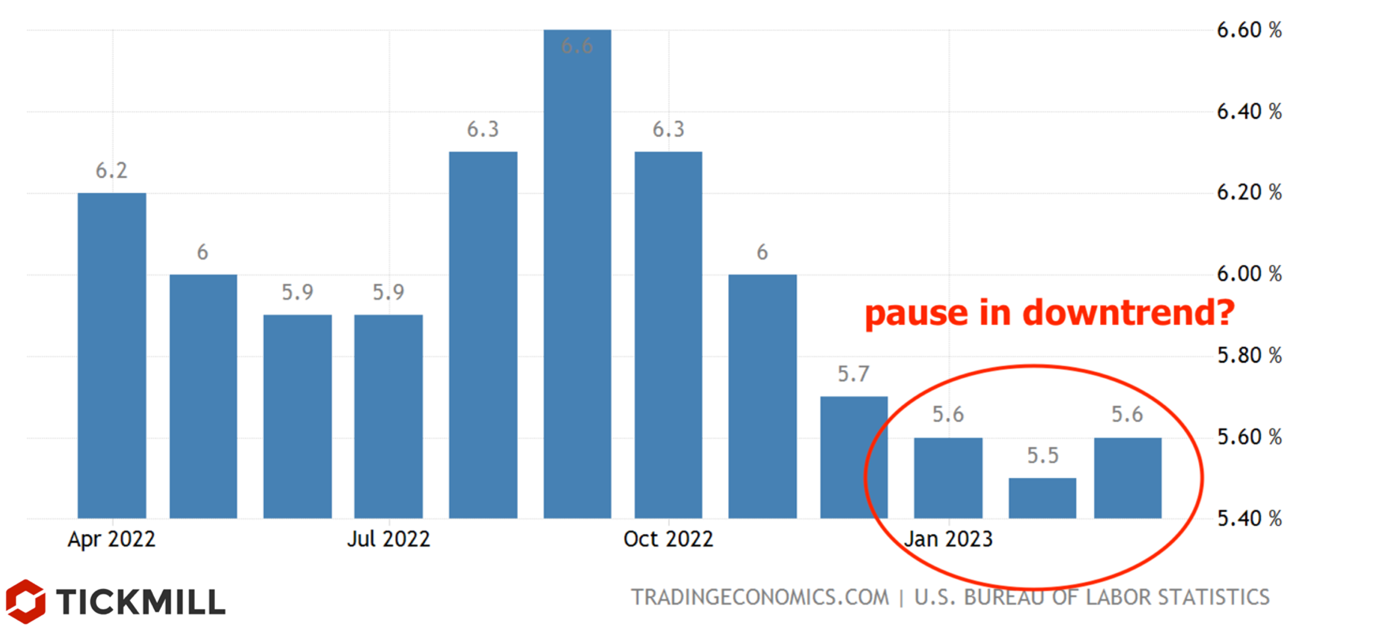

The NFP report released on Friday has transformed the perception of a rate hike by the Federal Reserve in June from unrealistic to tangible possibility. Strong inflation risks emerged from the data, with the unemployment rate reaching a multi-year low of 3.4% and monthly wage growth heating up to 0.5%. With prior confidence in the Fed's pause for June nearly unquestioned, there is now significant room for expectations to tilt towards more hawkish outcomes. Market participants are currently factoring in the risk that the upcoming CPI report for April, which holds greater significance in this narrative, will confirm sustained inflationary pressures and pose a perplexing challenge for the Fed. For such an outcome to materialize, core inflation in April would need to surpass the 5.5%-mark, further fuelling concerns that the downward trend may have lost momentum:

Investors are adjusting their strategies to account for the potential impact of a strong CPI, reducing their exposure to risk assets and favouring the dollar. This shift is evident in the downward movement of major EU stock indexes and US futures and the uptick in the dollar. The dollar index is on the brink of breaking through a medium-term sloping resistance line, and if successful, it could pave the way for an accelerated upward movement and a test of the global bearish channel line (102.20/30 on DXY):

Given the circumstances, EURUSD could easily decline to 1.09 or lower if the April CPI surpasses expectations, as it would heighten the likelihood of a Fed rate hike in June. However, alongside this development, market prices will also reflect the risks of potential upheavals in the US banking sector and the tightening of credit conditions in response to these risks. These factors are bound to have negative implications for risk appetite.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.