Safe-Haven Demand Remains

Gold prices have broken out to fresh highs today as safe-haven demand for the yellow-metal remains firm in the face of ongoing global adjustments. While there have been positive developments in the geopolitical sphere recently, such as the Israel-Hamas ceasefire holding out and now the prospect of an end to the Russia-Ukraine conflict, investors remain unsettled over lingering trade war risks.

Trump Trade War Risks

Comments this week from Trump, threatening new tariffs on all autos and pharmaceuticals have spooked investors. These comments show that Trump’s trade war is far from over and with unpredictable announcements like these now a signature of his administration, gold prices remain vulnerable to further upside near-term. Trade war risks had somewhat weakened prior to these comments with Trump announcing a shift in strategy on reciprocal tariffs which will now be applied on a country-to-country basis instead of as a blanket tariff. Additionally, with these tariffs not due to come into effect until April, there is room for negotiation. Still, with Trump maintaining aggressive rhetoric elsewhere on trade, investors look likely to continue to store capital in gold for now.

IB’s Upgrade Gold Forecasts

Indeed, we saw Goldman Sachs this week revising its year end gold forecast higher to $3100, citing projections of sustained central bank buying. This was echoed by UBS which also revised its forecasts higher, reflecting an ongoing shift in outlook for the gold market while global trade risks remain a key threat.

Technical Views

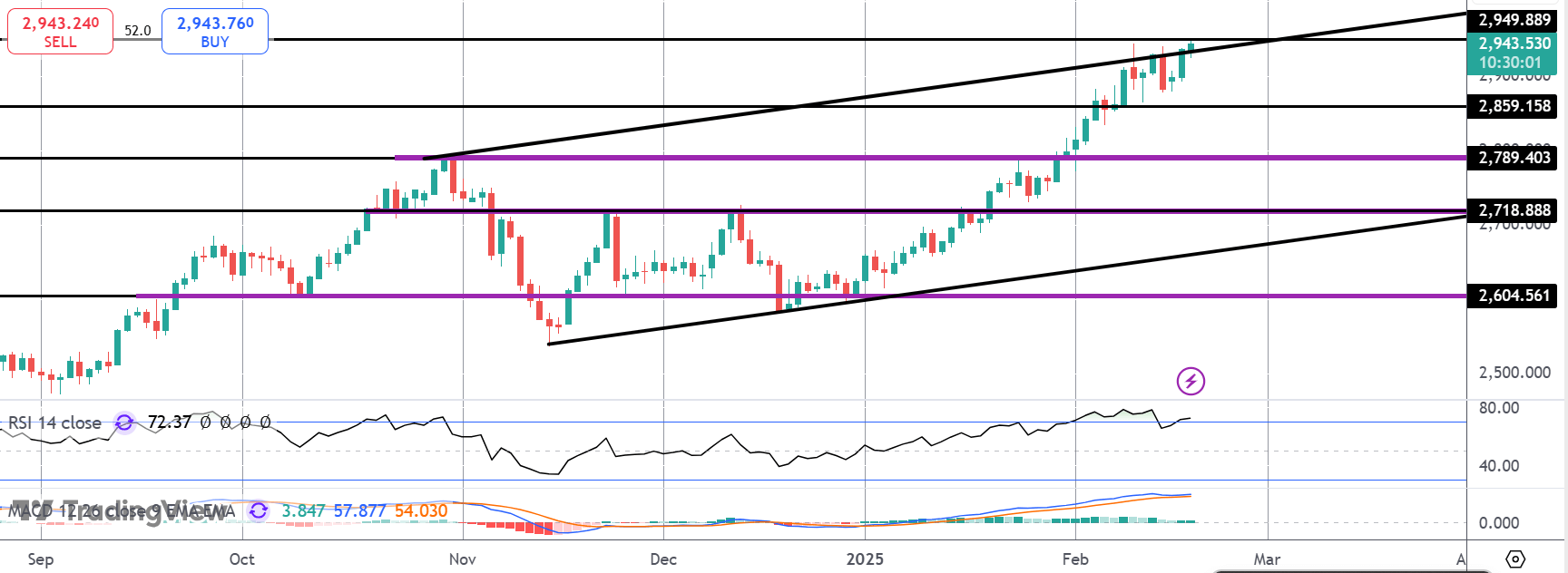

XAUUSD

Gold prices are now once again testing the 2,949.88 level and the bull channel highs. With momentum studies bullish, focus is on a fresh break higher here. 2,859.15 remains the key near-term support to watch with 2,789.40 the pivot for bulls to maintain.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.