Weak US Dollar & Fed Expectations

Gold prices traded to fresh record highs today before stalling and softening a little as traders brace for the March FOMC meeting later today. The yellow metal has been a firm favourite this year, benefiting from USD weakness and strong safe-haven inflows amidst a volatile geopolitical environment. Trump’s trade war has fuelled a significant uptick in demand for gold. With US economic risks (including risk of recession) seen rising as a result of tariffs, and expectations of a more dovish easing path from the Fed, USD has been heavily sold in recent weeks/months, which has helped drive gold prices higher. With traders bracing for fresh tariffs to take effect from April 2nd gold prices look poised to continue higher with safe-haven inflows expected to rise accordingly. Traders are expecting a dovish message from the Fed today which should keep USD anchored lower and offer further support for gold.

Middle East Fears

Developments in the Middle East this week are also feeding into bullish sentiment in gold. US airstrikes on Houthi targets in Yemen at the weekend is a concerning development. Trump has warned that strikes will continue unless the Houthis stop their attacks on Red Sea shipping lanes. Trump has also warned that Iran will be held responsible and suffer ‘dire consequences’ of any further Red Sea attacks. This news comes at a time when Israel has resumed its attacks on Gaza, killing several hundred in missile strikes on Monday, leading to greater instability and fear in the region. Against this backdrop and with the risk of further violence, gold prices look likely to continue to draw safe-haven demand near-term.

Technical Views

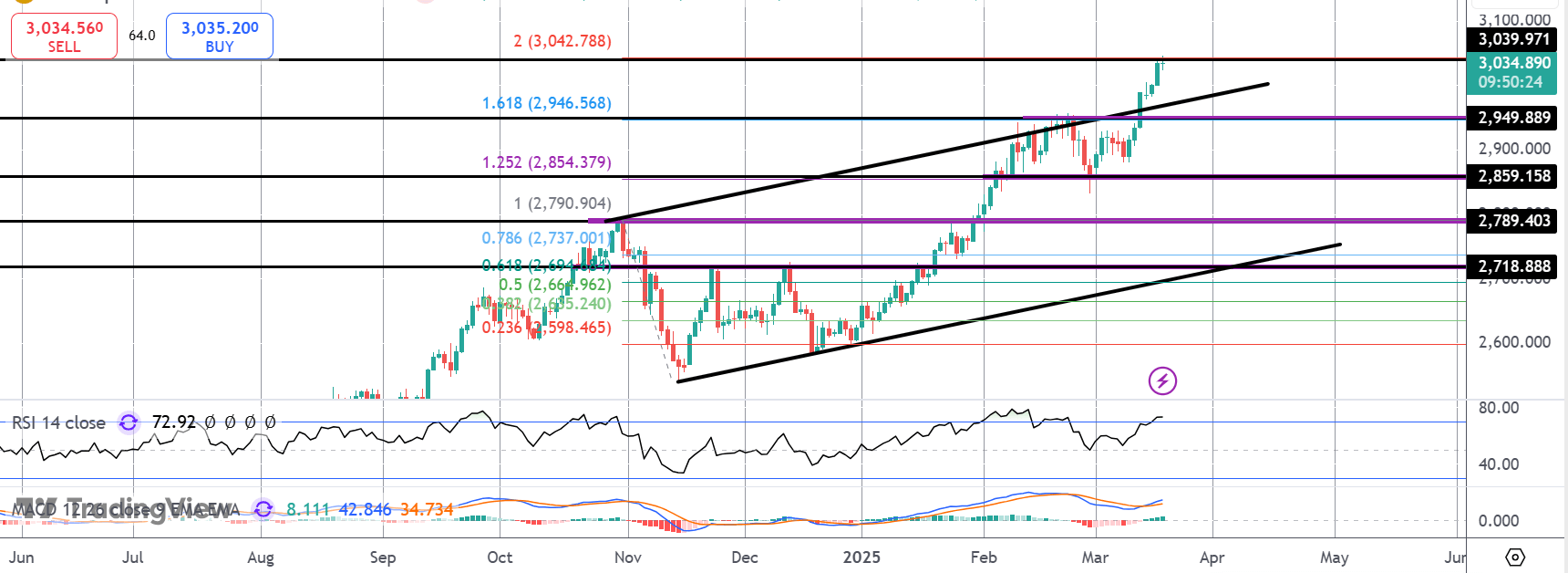

Gold

The rally in gold has seen price trading up the 2% Fib extension level where the market is currently stalled. While above the 2,949.88 level and broken bull channel highs, focus is on a continuation higher. Should we break below that level, 2,859.15 will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.