Looking beyond the shutdown: the bullish case for the USD in the long term

The ongoing U.S. government shutdown has introduced significant uncertainty into the economic outlook and reduced visibility in the foreign exchange (FX) market. This shutdown disrupts the flow of U.S. data, which will impact key economic indicators, including ISM and consumer confidence. Additionally, the Supreme Court's decision to pause President Donald Trump’s attempt to fire Fed Governor Lisa Cook has alleviated some market fears regarding fiscal dominance.

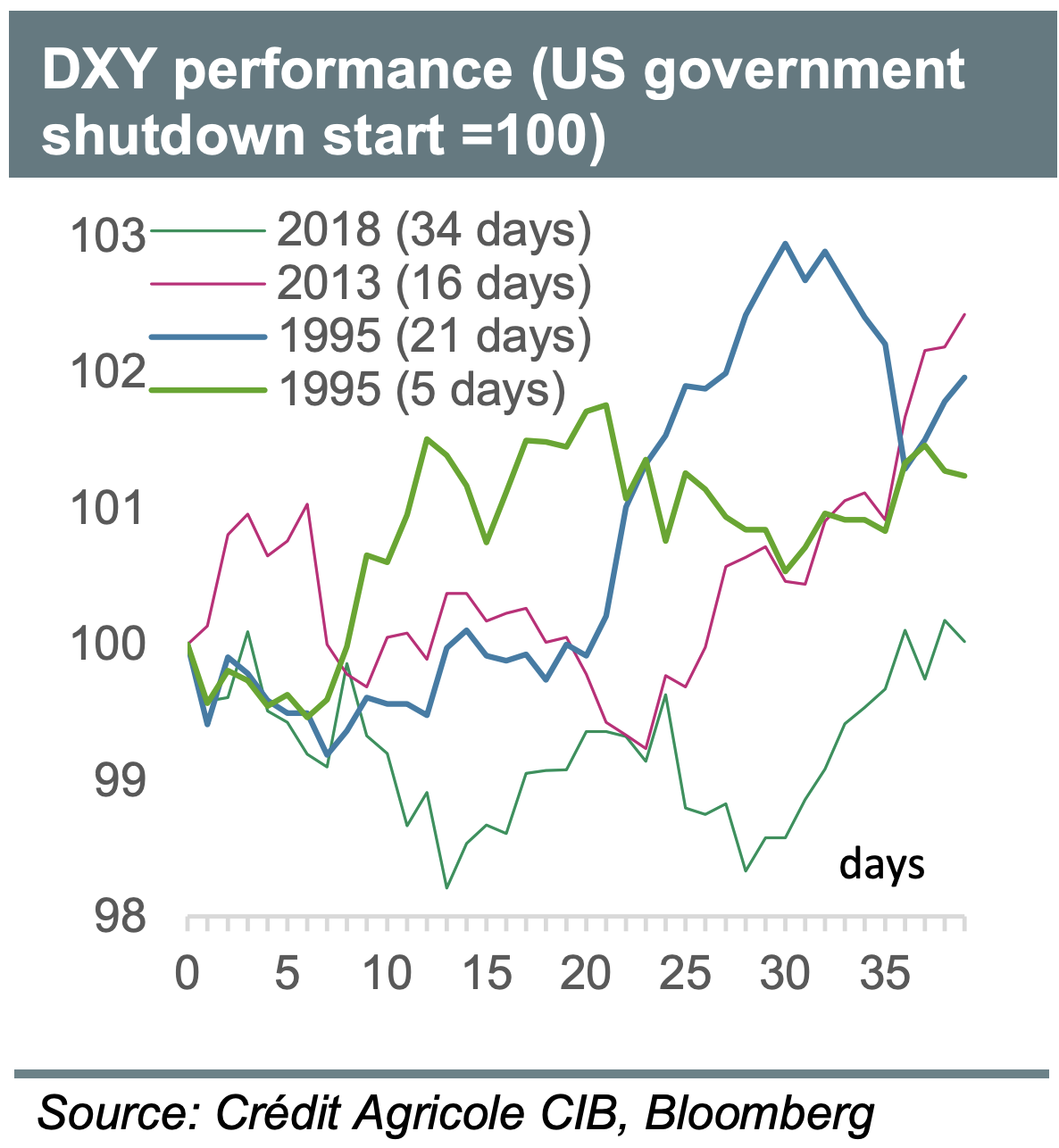

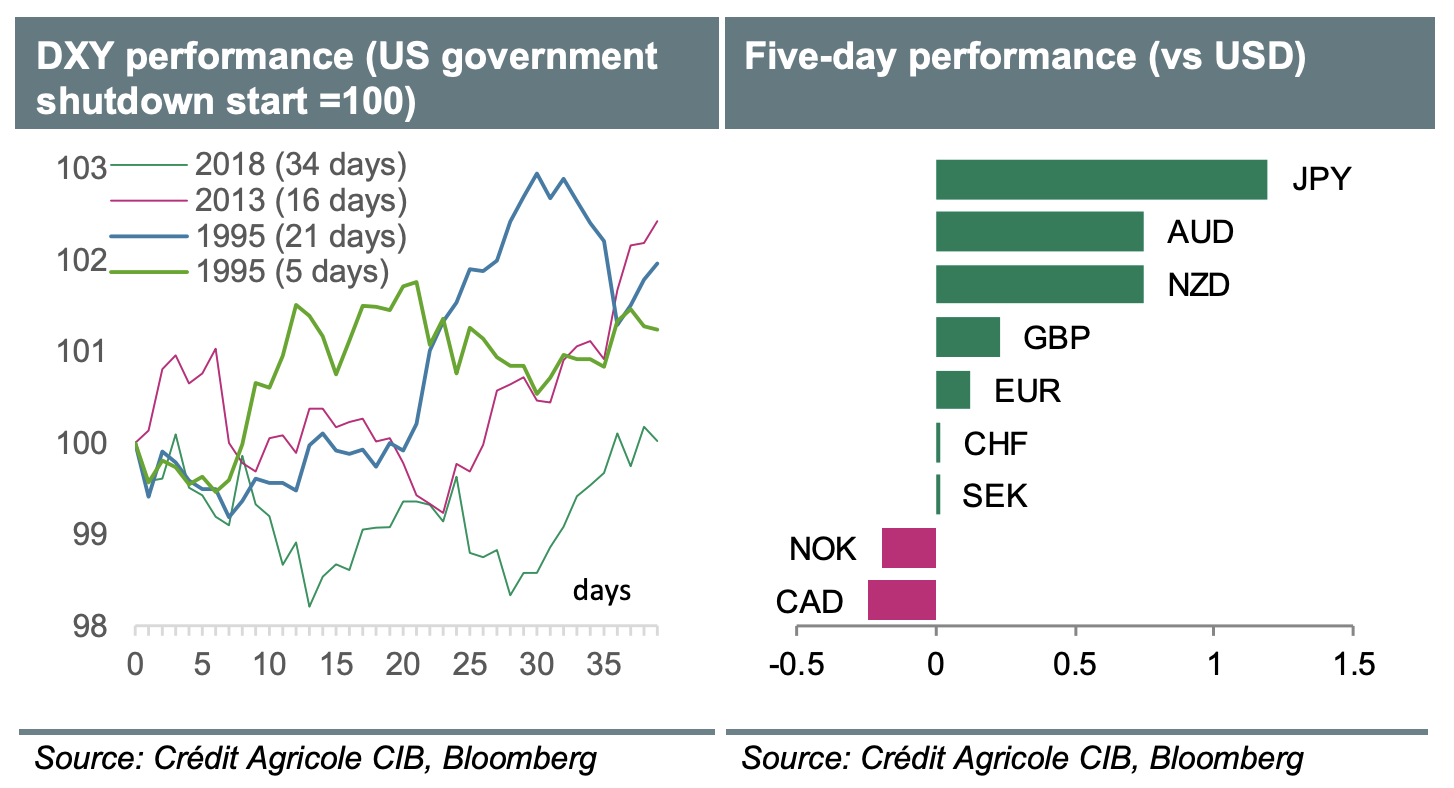

Despite the shutdown, market expectations regarding the Federal Reserve (Fed) and the U.S. dollar (USD) have remained relatively stable. Many negative factors related to the Fed are believed to already be priced into the USD. However, the shutdown is expected to keep the USD vulnerable in the short term, although a rebound is anticipated once it concludes.

Recent discussions with clients indicate that FX investors are beginning to look past the current USD weakness. There is a growing sentiment towards a potential period of consolidation and even outperformance of the USD in the coming months. This evolving perspective is contributing to an above-consensus outlook for the USD, which is becoming a common topic of discussion among investors.

Looking at the long-term potential for the USD over the next 6 to 12 months, several factors support a potential rebound. These include improving U.S. economic conditions, persistently high inflation rates, and a still-independent Fed that could challenge the current dovish market expectations. Such elements could enhance the appeal of USD-denominated assets and reduce the demand for short-USD hedges. The USD continues to attract significant portfolio inflows, underscoring its status as the world's primary reserve currency. Furthermore, the outlook for fresh foreign direct investment (FDI) inflows in 2026 supports the USD's position.

On a global scale, New Zealand is facing challenges as a significant contraction in GDP in Q2, which was three times the forecast by the Reserve Bank of New Zealand (RBNZ), suggests a likely 50 basis point cut to the official cash rate (OCR), bringing it down to 2.50% next week. In Japan, the recent results of the LDP presidential election could influence the Japanese yen (JPY). A victory for conservative faction candidate Sanae Takaichi may put downward pressure on the JPY, while a win for centrist candidate Shinjiro Koizumi could lead to a relief rally in the currency.

## FX and Gold Outlook

In the fourth quarter of 2025, we anticipate that the EUR/USD pair will remain supported; however, we doubt there is significant potential for further substantial gains of the euro against the dollar from current levels. This outlook reflects the belief that many positive factors for the euro, particularly regarding European fiscal stimulus, and negative factors for the dollar, related to the U.S. economic and Federal Reserve outlook, are already priced in. Notably, the anticipated ‘sell America’ trade has not materialized, with record foreign inflows into U.S. capital markets in recent months alleviating market concerns about U.S. external imbalances. Additionally, ongoing political uncertainty in France is expected to create headwinds for the euro, making it challenging for the euro to outperform the dollar on a sustained basis. We also foresee renewed weakness in EUR/USD in 2026. A possible near-term upside risk to our EUR/USD outlook arises from former President Trump’s continued attacks on Fed independence, particularly following his firing of Governor Lisa Cook, which has heightened fears about increasing fiscal dominance over the Fed.

Recently, the USD has stabilized due to diminishing worries about aggressive portfolio outflows from U.S. stock and bond markets, as well as fading concerns regarding the USD’s status as the world’s reserve currency. We maintain the view that the USD could rebound in the next 6 to 12 months, driven by an improving U.S. economic outlook, persistent inflation, and a still-independent Fed. These factors could challenge the current dovish market expectations, enhancing the appeal of USD-denominated assets and reducing demand for short-USD hedges. Moreover, U.S. exceptionalism remains evident, as indicated by record portfolio inflows into USD assets, which may be bolstered by fresh foreign direct investment (FDI) inflows in 2026. The USD continues to be the dominant reserve fiat currency, lacking credible alternatives.

Tariff uncertainties have increased demand for safe havens like the Swiss franc (CHF), which has strengthened even against the recovering euro. We expect EUR/CHF to edge higher throughout the year, as the return of zero interest rate policy (ZIRP) in Switzerland should make the CHF an attractive funding currency. However, lower inflation differentials may temper CHF real valuations, while stable growth should help avoid significant nominal losses.

The Japanese yen (JPY) serves as a good hedge against potential stagflation in the U.S. due to Trump’s tariff and immigration policies. Asset managers are likely to diversify away from U.S. and Japanese assets, benefiting the JPY. Nonetheless, the exchange rate may face downward pressure from potential Fed rate cuts and the Bank of Japan's anticipated rate hikes, which are not expected until 2026. Japanese political risks also pose a near-term downside risk for the JPY.

Our outlook for the British pound (GBP) remains cautious, as recent developments have heightened downside risks to the UK economic outlook. These include the prospects of aggressive fiscal austerity measures in November that could negatively impact the economy and lingering stagflation risks that limit the Bank of England's (BoE) ability to support the struggling economy. However, we believe that many negatives are already factored into the GBP price, particularly as we doubt that current market concerns about the UK fiscal outlook will escalate into fears about the UK’s sovereign creditworthiness. We also expect the BoE to begin supporting the UK economy with rate cuts once UK inflation peaks. Consequently, we maintain our view that the GBP should recover some ground against both the euro and the dollar in the latter half of 2025 and further outperform the euro in 2026.

The Canadian dollar (CAD) was weighed down in the second half of the summer by a cooler U.S.-Canada relationship and stronger expectations for additional easing from the Bank of Canada (BoC) following disappointing jobs data. In this context, USD/CAD is likely to hover closer to 1.40 than to 1.35, without threatening either boundary.

Investor concerns regarding U.S. tariffs and a global trade war appear to have peaked. A narrowing of the trade conflict to focus primarily on the U.S. and China would be less detrimental for the Australian dollar (AUD) than a broader trade war. The Chinese government is expected to continue stimulating its economy to counteract the growth drag from U.S. tariffs, which should benefit the AUD as investors diversify away from U.S. assets. The AUD remains strongly correlated with the Chinese yuan (CNY). Additionally, Australia’s rates market is overly aggressive in pricing rate cuts, and a tight labor market is likely to provide a solid positive impulse to underlying inflation, further supported by increased government spending after the election.

New Zealand's economy faces challenges due to the impact of President Trump’s tariffs, creating a deeper economic hole to climb out of. However, we remain optimistic as business survey data indicates that sectors most affected by the tariffs have been buoyed by New Zealand signing a trade agreement with a 15% tariff rate. The construction sector is also showing signs of recovery due to RBNZ rate cuts. Dairy farmers are experiencing near-record payout levels, which may encourage them to spend rather than save following the trade deal with the U.S.

The Norwegian krone (NOK) has had to recover from several setbacks in the past six months. Nonetheless, Norway's robust fundamentals and the NOK's rate appeal, despite the Norges Bank's more front-loaded easing stance, suggest potential for further appreciation in the long run, assuming no significant global disruptions.

The Swedish krona (SEK) has been a surprising outperformer in the G10 FX space this year, benefiting from its high-beta nature as an EUR proxy, although this advantage has diminished somewhat in recent quarters. A softer economic environment and a return to easing may have held the SEK back, as more convincing evidence of Sweden's macro outperformance over the Eurozone is needed for the SEK to secure further gains in the long run.

Gold is expected to remain supported by ongoing market concerns that the combination of increasing government borrowing and persistent inflation in G10 countries will make it challenging to find buyers for rising public debt. Fears about fiscal dominance over the Fed may also exert downward pressure on U.S. real yields, providing another boost to gold (XAU). It would take a significant rebound in the U.S. economic outlook and higher real U.S. rates and Treasury yields to diminish gold's strength in 2026.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!