Institutional Insights: Goldman Sachs Crypto - Bitcoin Resilience

.jpeg)

GS Crypto: Bitcoin Resilience

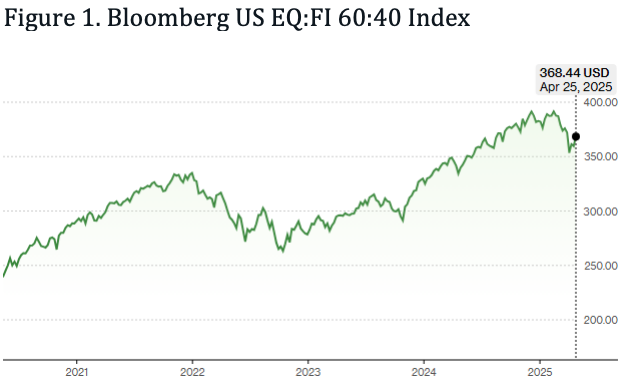

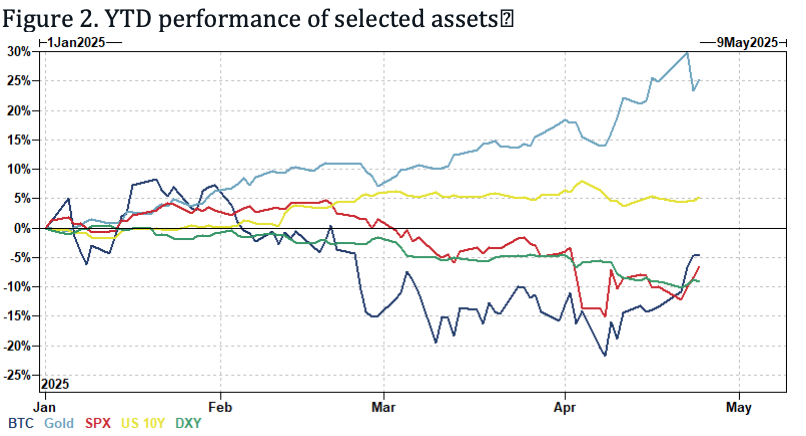

Investors are grappling with ongoing tariff-induced policy uncertainty, tightening financial conditions, and increasing US recession risks. Over the past three weeks, fluctuating news headlines have impacted equity and bond markets, pulling them in both directions. The performance of the traditional 60:40 portfolio—60% stocks for higher returns and 40% bonds for stability—has been significantly affected (Figure 1). Recently, as equity markets declined, traditional safe-haven assets like bonds (with higher yields) and the USD also weakened (Figure 2). In the past month, gold has emerged as a standout appreciating store of value, while Bitcoin has demonstrated resilience since the beginning of the month.

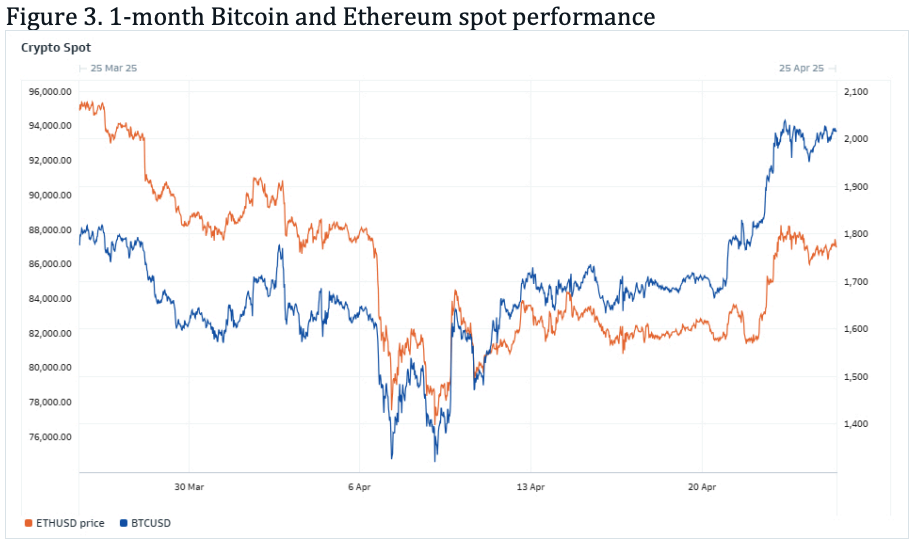

Since the "Liberation Day" tariffs announcement on April 2nd, Bitcoin has risen by 8%, whereas NDX and SPX are both down by 5% (Coinmetrics, Bloomberg). Although Bitcoin initially dipped to $76,700 following the announcement, it has impressively recovered to $94,000 today (Figure 3). Bitcoin rallied on April 21st due to President Trump's perceived dissatisfaction with Federal Reserve Chair Powell. The rally continued the next day as Cantor Fitzgerald, Tether Holdings, Softbank Group, and Bitfinex announced plans to create a $3 billion investment vehicle, emulating Michael Saylor’s Bitcoin investment strategy (The Block). Equity markets have further recovered as the US President seemed to ease trade tensions with China and retracted earlier comments about the Fed Chair.

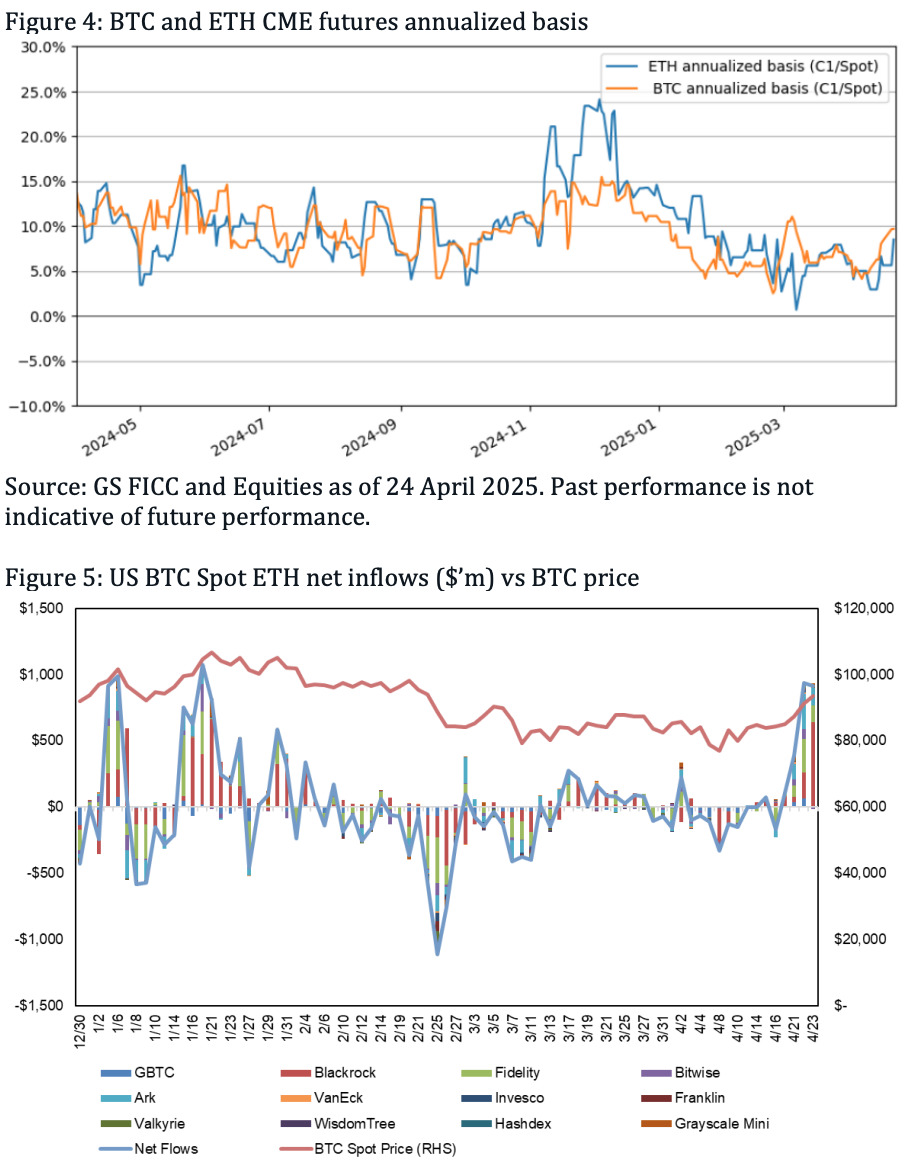

Bitcoin futures basis is rising again, approaching 10%. As Bitcoin's spot price climbs above the $90k level, the futures premium basis has increased to annualized levels of 9-10%. The market appears to be re-engaging in the basis trade—long spot/ETF versus short futures/NDF—driven by significant $900 million inflows into US spot Bitcoin ETFs over the past few days, which have coincided with the basis increase. Aside from this, ETF flows have been relatively low throughout the month.

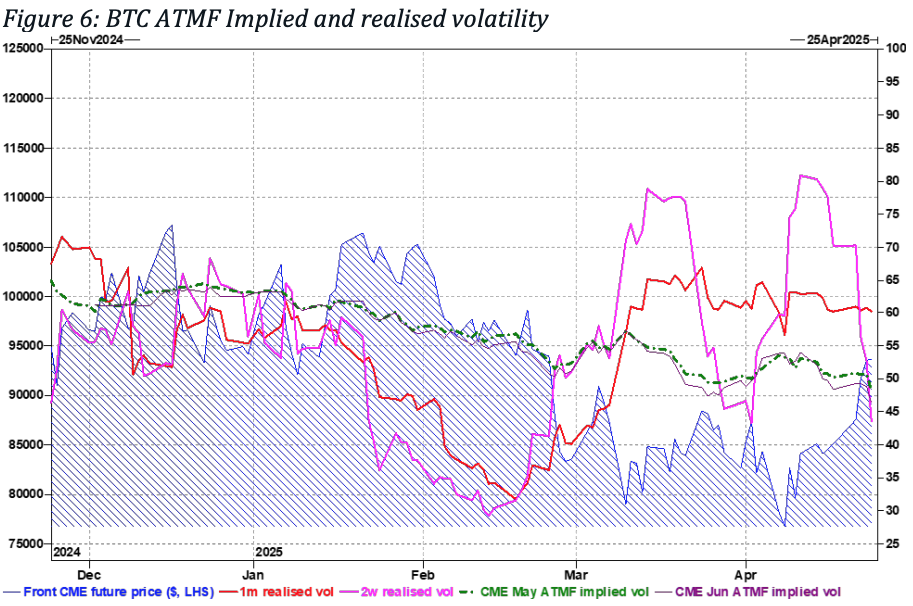

The 1-month implied volatility in Bitcoin is currently at the lower end of the 1-year range, slightly under 50 vol, while the 1-month realized volatility has been around 60. Structurally, the 25 delta risk reversals for the front 3-month tenors have shifted, with calls moving higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!