Institutional Insights: Goldman Sachs Global FX Trader

.jpeg)

USD: Pulling at the Strings of an Accord

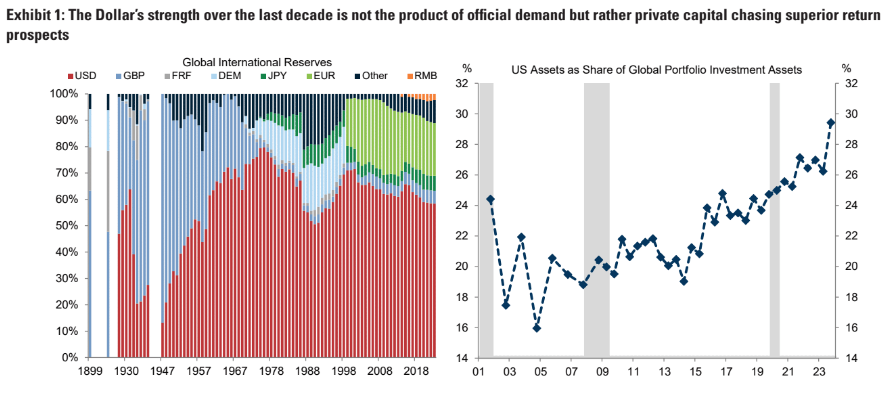

We remain skeptical of a centrally-planned currency accord but acknowledge shifting global policies could create conditions to weaken the Dollar. Historical blueprints like the Plaza Accord or Smithsonian Agreement don’t align with today’s macro setup. Successful FX intervention requires market forces to align with policy, which isn’t the case now. Unlike the 70s and 80s, today’s FX market is driven by private capital, not official demand. The strong Dollar of the last decade stems from private capital seeking higher returns, not reserve managers.

A plausible path to a currency “deal” involves reversing this trend through fiscal shifts: US fiscal consolidation and increased spending by key trading partners like the EU and China to boost domestic demand and curb US protectionist policies. This aligns with the "Mar-a-Lago Accord" concept, though some arguments fall short. Japan, for instance, plays a marginal role due to the dominance of private capital and the shifting US trade balance.

Efforts to weaken the Dollar may be overstated, as achieving this requires coordinated policies that conflict with US goals like raising tariffs and cutting taxes. The US is unlikely to abandon its policy agenda, which remains Dollar-positive. However, Europe’s expected increase in defense spending, including US equipment purchases, signals halting progress. This process will be slow, and the US effective tariff rate is projected to rise significantly this year.

Ultimately, the Dollar’s outlook hinges on the balance between US policy changes and foreign responses, which currently reflect discord rather than accord. This evolving balance slightly tempers our expectations of Dollar strength over the next year.

EUR: Revising EUR/USD forecast upward.

While we still expect tariffs and uncertainty to weigh on Eurozone growth, widening the US-Euro divergence and pushing EUR/USD below parity, recent developments suggest a more moderate Dollar appreciation.

1. Trade uncertainty's impact on the Eurozone has been contained, while US policy uncertainty is affecting sentiment and tightening financial conditions.

2. Tariffs may be less impactful than anticipated, with stable USD/CNY mitigating broader FX volatility.

3. Faster-than-expected peace talks and increased EU fiscal spending, including on defense, could boost growth.

However, risks remain. Disagreements on the Russia-Ukraine peace process and potential heavier tariff impacts on Europe highlight ongoing instability. The market appears overly optimistic, underpricing risks. We revise EUR/USD forecasts to 1.02 (3 months), 1.01 (6 months), and 0.99 (12 months), up from prior estimates of 1.00, 0.97, and 0.97, as the Dollar’s strength remains underappreciated.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!