Institutional Insights: Goldman Sachs Global FX Trader Update

.jpeg)

Institutional Insights: Goldman Sachs Global FX Trader Update

The following are the thoughts of Goldman Sachs on USD, JPY & GBP

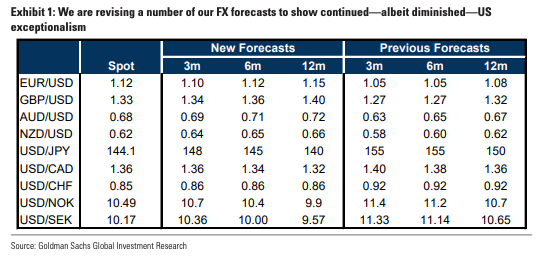

USD: Fed brings better balance; adjusting our forecasts. With a 50bp rate cut, the FOMC most likely chose the option that leads to lower economic and financial volatility. The greater sense of urgency should help alleviate recession risks that have been evident in FX markets over the last few months. This is clear in the divergence between the broad Dollar, which has slipped only around 2% since the end of June and is flat over the last year, whereas the DXY, with its heavy weights in safer havens such as JPY and EUR, has fallen nearly 5%. That divergence also demonstrates that we may be reaching the limits of how much Dollar depreciation can be achieved from pricing the Fed’s policy reaction function alone. If those recession risks now abate, without a pronounced and unexpected deterioration in the labor market, further Dollar downside is likely to have a slightly different composition, driven instead by more cyclical currencies rather than EUR and JPY. Taking a step back, we have been arguing that Dollar depreciation over the last few months was a natural outcropping of approaching Fed cuts, but ultimately should be unwound if the Fed under-delivers and the US economy over-delivers. However, given slowing momentum in the labor market and the Fed’s demonstrated willingness to respond more aggressively to that risk relative to peers, the case for a full Dollar reset is weaker. However, as we look ahead, we continue to expect: (i) the US economy to outperform, (ii) China and the Euro area to underperform, and (iii) US real returns to remain attractive relative to peers and the previous cycle. In light of these considerations, we are revising a number of our FX forecasts to show continued—albeit diminished— US exceptionalism (Exhibit 1). We think this balance should entail a weaker Dollar over time, but we still expect that to be a gradual and uneven process. We also still believe the Dollar’s high valuation will not be eroded quickly or easily, but the bar has been lowered a bit.

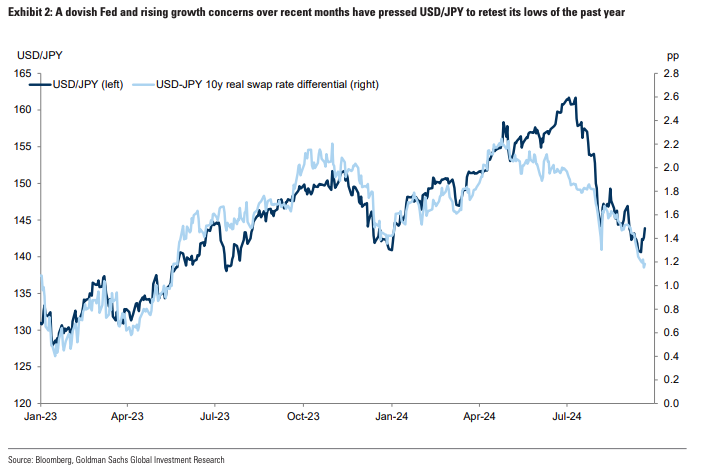

JPY: Slow down, you move too fast. The initiation of the Fed’s cutting cycle was always going to be an important milestone, and coupled with the BoJ’s journey in the opposite direction (and Yen-supportive interventions earlier in the year), this development points in the direction of Yen strength. And markets have increasingly taken that view as a dovish Fed and rising growth concerns over recent months have pressed USD/JPY to retest its lows of the past year (Exhibit 2). But while we think gradual Yen strength is the right directional view, we think it will be a much slower process than consensus expectations or forward-market pricing—both because we think continued expansion in the US is more likely than imminent recession and because a very rapid Yen appreciation would prove self-defeating for the BoJ’s objective of restoring sustained positive inflation rates. Accordingly, we now see USD/JPY at 148 in 3 months, 145 in 6 months, and 140 in 12 months (vs. 155, 150, 150 previously). We also see more gradual appreciation over the longer-run to 135 in 2026 and 130 in 2027 (vs 125 and 120 previously). Despite slow appreciation over time, our forecasts imply nearer-term upside. More broadly, we think we may be approaching the limits of Dollar weakness on a dovish Fed alone (see USD bullet). But other factors also press against Yen strength. First, even if the Fed decides to continue cutting at a faster pace than currently priced, that should further reduce recession risk, pushing up equities and supporting long-end yields, mitigating any boost to JPY. Second, we expect CNY to face renewed weakness, an important anchor for most of Asia FX, including JPY. Finally, as long as US recession odds remain low, Japanese investors have a limited incentive to hedge US assets, even with a narrowing rate differential. So despite our economists now looking for sequential Fed cuts through mid-2025 and our relative rates forecasts implying USD/JPY a bit below current spot over the coming months, we see some limited near-term upside in USD/JPY

GBP: Riding risk. The BoE kept rates on hold and sent a slightly hawkish message this week, emphasizing a “gradual” approach to removing policy restraint. EUR/GBP took another leg lower on the news and is making new cycle lows as we close out the week. At the current juncture, support for Sterling is coming both from its risk beta as well as solid growth momentum and a patient Bank of England. The Fed began easing this week into relatively robust US growth. And as a result, markets have priced out US recession risk, benefiting risky assets and pro-cyclical currencies like Sterling. Assuming US growth continues to outperform and the Fed still eases quickly, this pattern should support further upside in GBP, particularly versus safe havens like CHF. Long GBP positioning looks stretched on some metrics, but we do not see that as enough of a headwind when the broader pro-cyclical backdrop is driving gains and is likely to remain supportive

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!