Institutional Insights - Goldman Sachs Weekly Equities Colour

-1730113729.jpeg)

Institutional Insights - Goldman Sachs Weekly Equities Colour

From a flow perspective, flow skews were very benign, with feedback suggesting lower gross risk and trading activity as anticipation for the election continues to churn. Both LOs and HFs finished small net buyers. The largest buy skews were seen in Energy, Tech, and Industrials while Comm Svcs was net sold. Our ETF desk also noted lighter volumes. Looking back at previous elections, with the exception of 2008, we've seen a similar degree of volume erosion up until election day. Once the president-elect is determined, volume pops and can linger around ~30% of the tape. Best on the week: Memes + megacaps up ~80bps Worst on the week: Housing Exposure -6%, Tariff Risk -4%, Democrat Outperform -3.5%

Next week, year-end for 22% of MFs on Thurs (keep GSCBMF24 tax loss basket on the radar). On the economic calendar - we get JOLTS job openings on Tuesday, ADP private payroll, first look at Q3 GDP and pending home sales on Wednesday, initial claims, ECI, personal income/spending/PCE inflation and Chicago PMI on Thursday, and employment report, ISM manufacturing and construction spending on Friday. Street currently looking for a ~130K increase in October NFP following the outsized 254K increase in August. Additionally, 41% of S&P market cap set to report next week, the busiest week of 3Q eps season. Some of the highlights: Mon .. ON Tues .. AMD GOOGL RDDT Visa Weds ... BKNG CFLT DASH EBAY ETSY KLAC META MSFT PCOR Thurs (Halloween) .. AAPL AMZN CMCSA RBLX STM UBER INTC TEAM The most controversial / debated prints .. ON, FFIV, AMD, GOOGL, CMCSA, MSFT, AMZN, UBER, TEAM, EBAY, CFLT

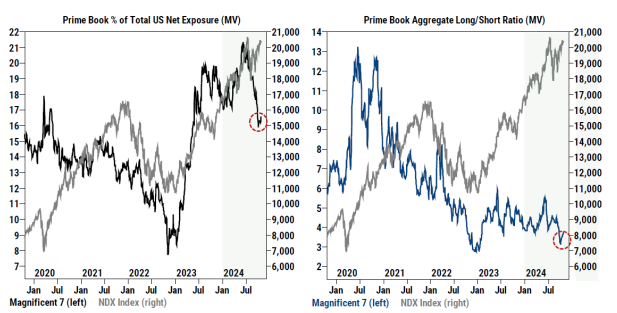

With the implied election move hovering around 2%, today was one of the first times we saw clients buying this move in the form of strangles or put / call spreads. Looking forward the desk expects skew to come in over the next few weeks as we head into November, and still like QQQ upside as the vol spread to SPX is below a 5 handle. This will also carry well given the slew of tech earnings - GOOGL/META/MSFT/AAPL/ AMZN all report before month end. The straddle for next week is out at 1.64% (h/t Braden Burke) Megacap Tech stocks collectively are net bought in Oct MTD, driven by short covers and to a lesser extent long buys. From a positioning standpoint, however, the group’s Net allocation and long/short ratio are both well below their respective levels going into Q1 and Q2 earnings..

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!