Bitcoin Rallies Midweek

Bitcoin prices action continues to be very interesting here with the market seeing a strong rally yesterday. BTC futures spiked around 3% higher yesterday amidst an uptick in risk appetite as chatter of diluted tariff actions did the rounds. The market is bracing for Trump’s tariff announcement today which looks likely to be a make-or-break catalyst for Bitcoin near-term. If risk appetite collapses in response to aggressive action, BTC looks poised to drop near-term. However, if Trump is seen taking a more dilute approach today, this could ushed in a fresh rally in BTC amidst a broader recovery in risk appetite.

Bullish Forecasts

Notably, there is plenty of bullish analysis going around for BTC this week that points to the potential for a forthcoming rally. Analytics group CryptoQuant have highlighted a decrease in short-term holder selling pressure, which has typically aligned with a market bottom and set the stage for a recovery rally. Furthermore, on-chain analytics group Glassnode reports that longer-term holders saw far less selling pressure into the recent highs than during previous market tops over the last 10 years, suggesting that longer-term players are choosing to hold for an expected further rally, rather than cashing in positions into recent highs.

Near-Term Focus

While neither set of analysis is set in stone, its certainly interesting to see these factors aligning and worth noting that both point to bullishness in the medium term (next three months). Looking ahead, BTC could be poised to breakout to the topside if bulls can keep price above the $80k level.

Technical Views

BTC

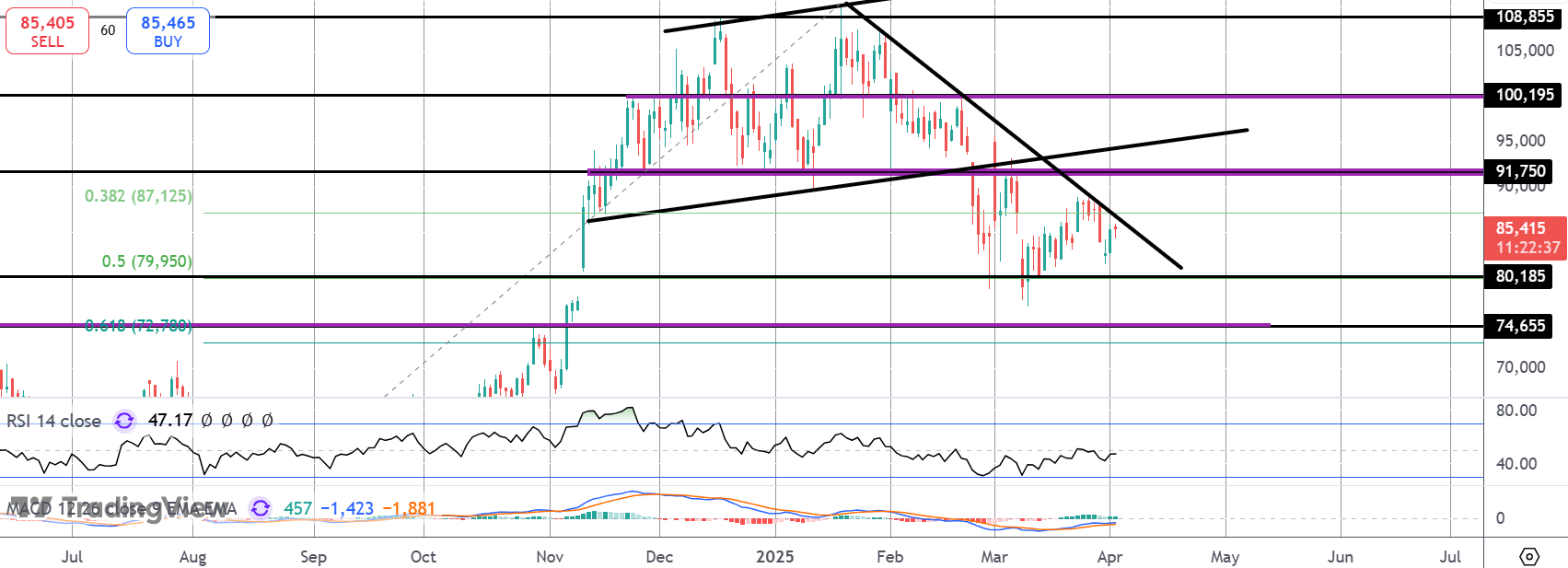

For now, BTC remains caught between support at the $80k, 50% Fib level and the bearish trend line from YTD highs. Bullish divergence into recent lows suggests room for a push higher though bulls will have to make a clean break above the $91,750 level and broken bull channel lows to put focus back on YTD highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.