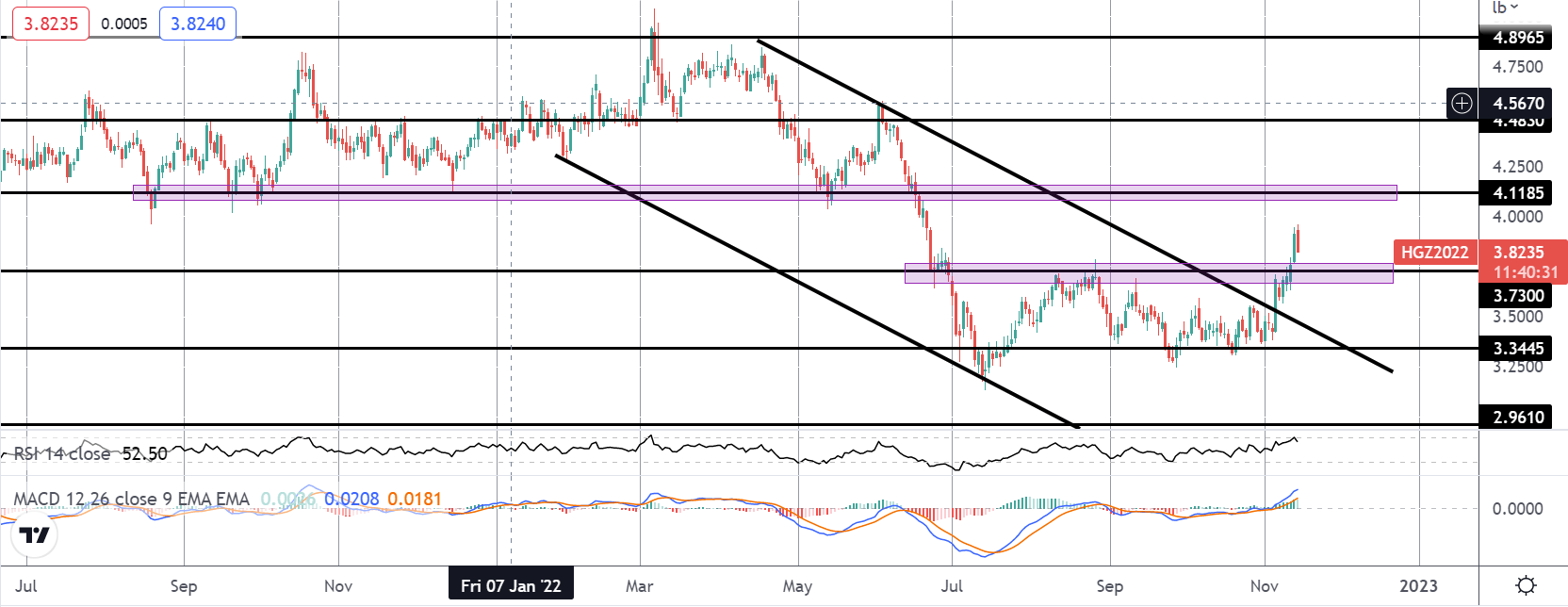

Copper Climbs Above Bear Channel

The sharp drop in USD last week has fuelled noteworthy moves across markets. Commodities markets have benefitted strongly from a weakness in USD, as evidenced by the rally we’ve seen in copper. Following heavy sideways action since early July, copper futures broke out to their highest level since June last week. While a stronger start for USD this week has seen the market conceding some of these gains, the near-term view remains bullish with USD vulnerable to further losses this week.

Additionally, any positive news around China reopening should also feed into higher copper prices. Recent chatter around a potential March reopening of the Chinese economy (while denied so far) has raised the prospect in traders minds and as such, copper prices look to have some near-term upside risks should this story gain fresh traction at any point. Traders will therefore be keeping an eye on today’s meeting between Biden and Xi as well as the ongoing G20 meetings this week for any encouraging signs regarding potential reopening of the Chinese economy.

Technical Views

Copper (HG)

The breakout above the 3.7300 level and the bearish channel top ha seen copper futures hitting their highest levels since June. With both MACD and RSI bullish, while above here the focus is on a further push higher and a test of the 4.1185 level next, a break of which opens the way for a higher push towards the 4.4830 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.