Spotify Earnings Up Next

On the back of two consecutive quarters of earnings declines, Spotify is in focus today. The company is due to report Q4 results with Wall Street looking for an adjusted loss per share of -$1.35 on revenues of $3.391 billion. Spotify suffered sharply over 2022, losing more than 60% of its share value. While we’ve seen a recovery so far this year, in line with the broader tech recovery linked to US rate-path expectations, today will show whether fundamentals at the company are worth getting behind this year.

Gross Margins in Focus

The big focus for traders will be the company’s gross margins which have been declining recently. It was the drop in Q3 gross margins which caused shares to tank more than 10% in reaction to the results. Market forecasts are for gross margins in the 24.5% region. Anything below this might well fuel a similar reaction today. Recent layoffs at the company should help underpin margins, however.

Price Increases & Subscriber Number

Looking ahead, traders will be keen to hear about any potential plans to hike the price of premium services. Spotify recently said that it was considering such a move, in line with Apple and Youtube. Subscriber growth will also come under the microscope with consensus calls for 7 million in new premium accounts and overall active users of 478 million. Any undershooting of these figures might again see Spotify shares firmly lower.

Technical Views

Spotify

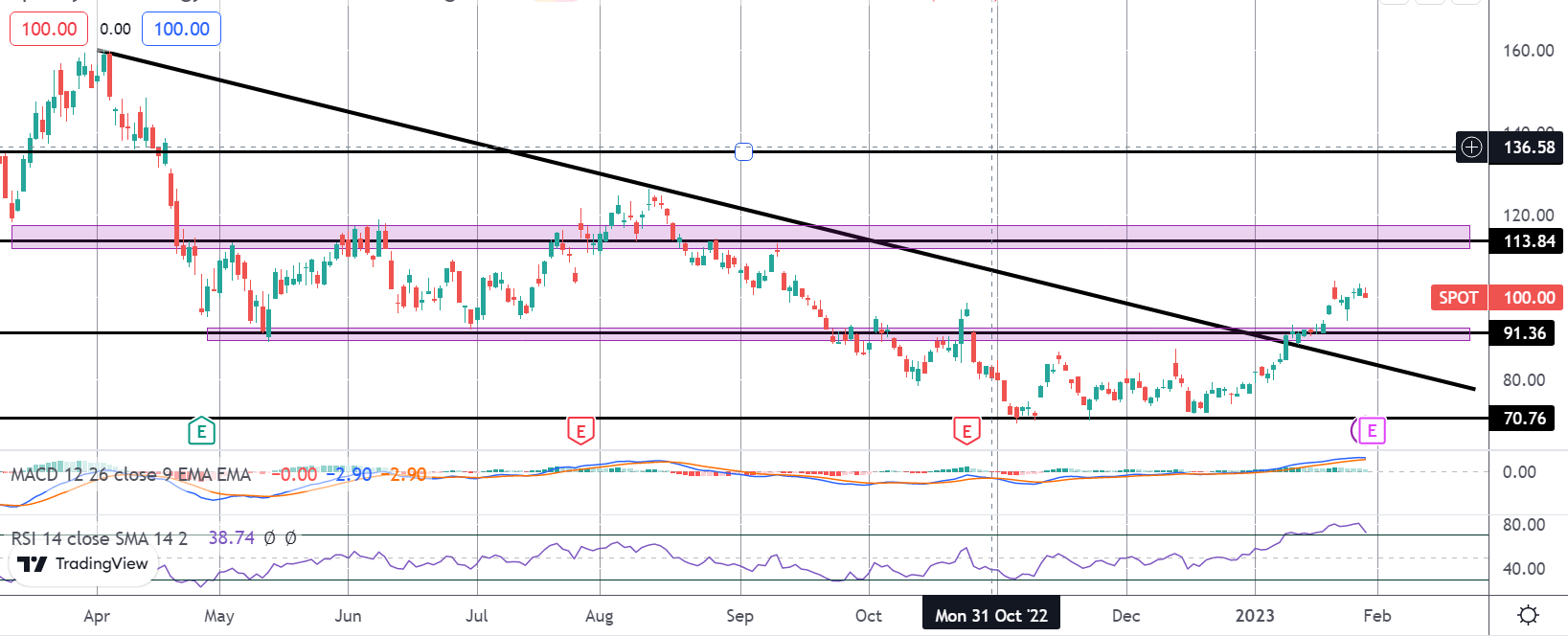

The rally in Spotify shares off the 2022 lows has seen the market breaking out above the bear trend line and above the 91.36 level. This is a key technical development and while above here the focus is on a further push higher towards the next big hurdle at 113.84. Bulls will need to see a break of this level to establish momentum for a fuller reversal higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.