#SP500 LDN TRADING UPDATE 15/01/25

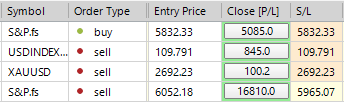

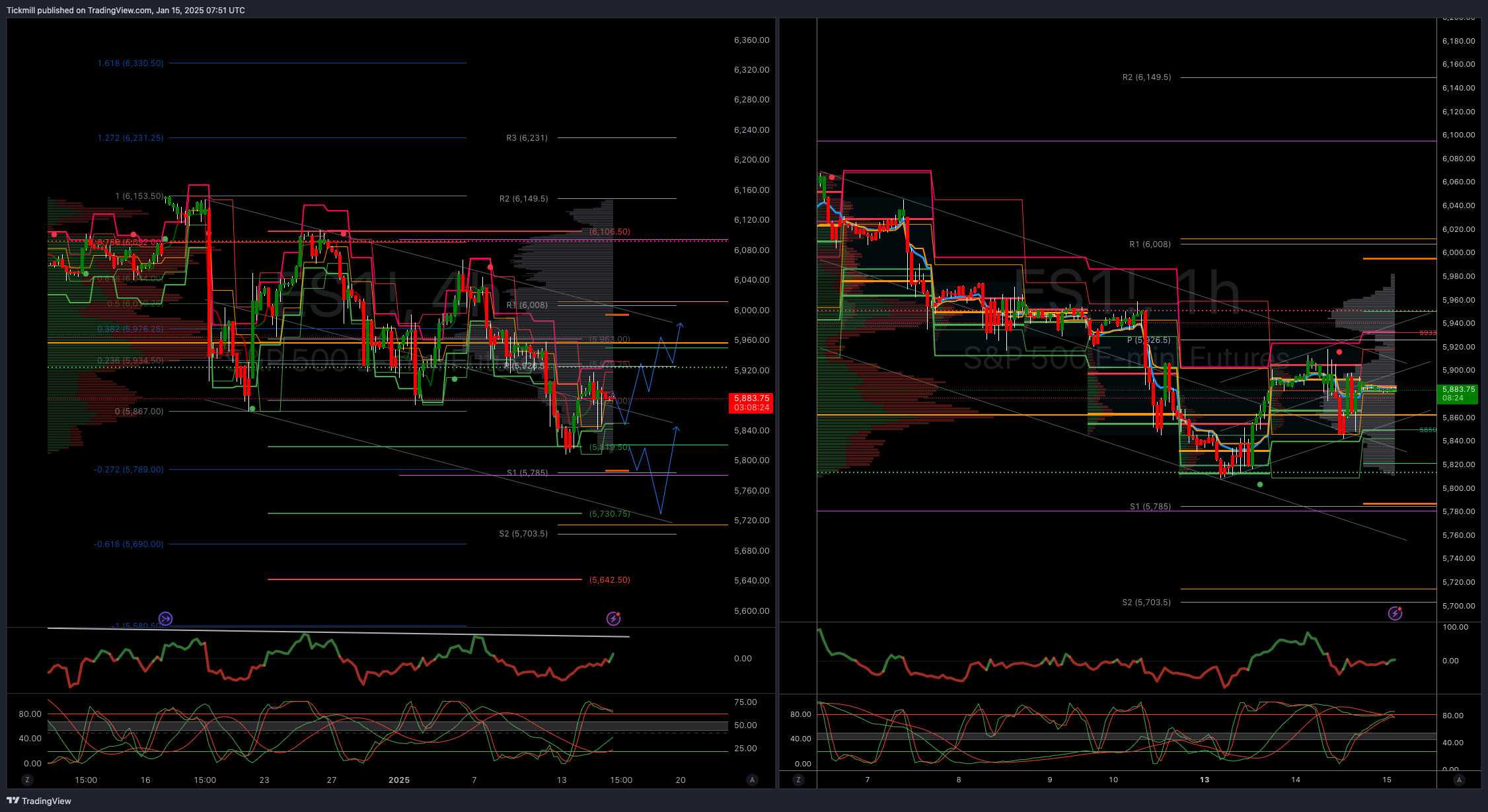

WEEKLY BULL BEAR ZONE 5905/15

WEEKLY RANGE RES 5983 SUP 5745

DAILY BULL BEAR ZONE 5860/50

DAILY RANGE RES 5933 RANGE SUP 5850

TODAY'S TRADE LEVELS & TARGETS

LONG ON ACCEPTANCE ABOVE 5920 TARGET DAILY RANGE RES > 5965 > WEEKLY RANGE RES

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE/DAILY RANGE SUP TARGET WEEKLY BULL BEAR ZONE

SHORT ON ACCEPTANCE BELOW 5810 TARGET WEEKLY RANGE SUP

TO REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO CLCIK HERE

GOLDMAN SACHS TRADING DESK VIEWS

What’s happening with stocks? Following a carryover from late December, the price movements in the new year have been quite erratic. At the very least, we are in a transitional phase for the market, primarily due to a new set of federal policies. Simultaneously—possibly related to the previous point, or perhaps not—the significant development in recent months has been a notable increase in US interest rates. While we can discuss the reasons behind this shift, the reality is that the previously tidy expectations for adjustment cuts have been significantly reduced, and stock traders have modified their outlook for easier monetary conditions.

As a result, the nature of the trading environment has evolved, and the range of possible outcomes has seemingly expanded. What I mean by this is that market participants are actively considering the sequence and impact of Trump 2.0 policies, along with the corresponding trajectory of monetary policy, which introduces some friction that is reflected in reduced portfolio risk.

The next question is: how should our trading strategy adapt? Although I maintain my belief that we are in a bull market with an upward primary trend, I anticipate a prolonged period of moderately higher volatility. In other words, after two years of impressive Sharpe ratios and excellent beta, this year will likely be more suited for traders, with fewer obvious opportunities. Therefore, if last year rewarded aggressive strategies, I anticipate that the early part of this year will demand more subtlety and adaptability.

Beyond equities, I still want to focus on the opportunities available to us, and I wouldn’t oppose the main trends, particularly a stronger dollar and a steeper yield curve.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!