SP500 LDN TRADING UPDATE 17/9/25

SP500 LDN TRADING UPDATE 17/9/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~61 POINTS***

WEEKLY BULL BEAR ZONE 6625/15

WEEKLY RANGE RES 6710 SUP 6570

SEP MOPEX STRADDLE - 6260/6639

SEP EOM STRADDLE - 6282/6638

DAILY BULL BEAR ZONE 6640/50

DAILY RANGE RES 6728 SUP 6612

2 SIGMA RES 6785 SUP 6555

VIX DAILY BULL BEAR ZONE 18

DAILY MARKET CONDITION - BALANCE

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

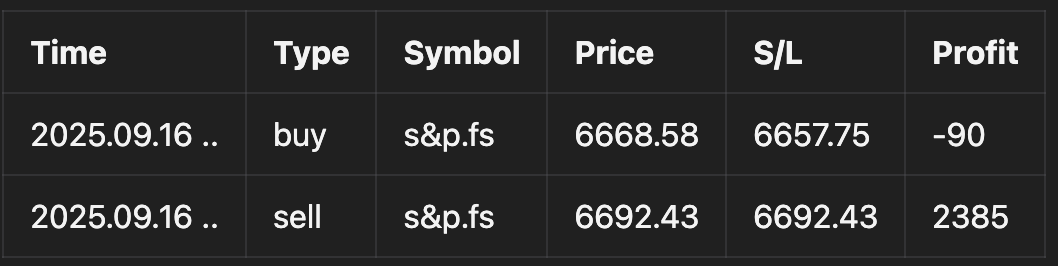

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON TEST/REJECT WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. Equities Overview: Muted Session

FICC and Equities | 16 September 2025 | 8:17 PM UTC

Indices Performance:

- S&P 500: Down 13bps, closing at 6,606 with a MOC inflow of +$3.3B to BUY.

- NASDAQ 100 (NDX): Down 8bps, settling at 24,274.

- Russell 2000 (R2K): Down 3bps, finishing at 2,424.

- Dow Jones: Down 27bps, ending at 45,757.

Market Activity:

- Total volume: 17.2 billion shares traded across U.S. equity exchanges, above the YTD daily average of 16.8 billion shares.

- Volatility Index (VIX): Rose 427bps to 16.36.

Commodities and Macro:

- WTI Crude: Up 207bps, closing at $64.61.

- U.S. 10-Year Yield: Down 1bp at 4.02%.

- Gold: Up 23bps, ending at $3,727.

- DXY (Dollar Index): Down 63bps to 96.69.

- Bitcoin: Up 131bps, reaching $116.9K.

Session Recap:

Stocks finished largely unchanged in a listless session. Key focus remained on AI and momentum trades, with institutional buying slowing in beta/AI/momentum longs over the past two sessions. Market sentiment appears to be posturing ahead of the FOMC meeting tomorrow. Momentum dynamics have been the dominant technical factor, with momentum up 20% YTD and nearing all-time highs again.

Floor Activity:

- Activity levels rated at 4/10 overall.

- Floor finished +170bps to BUY vs. a 30-day average of -1bp.

- Long-only (LO) investors were flat, with demand concentrated in supercap tech, while supply was notable in industrials and macro products.

- Hedge funds (HFs) were slight net sellers, driven by supply in semiconductors.

Sector Highlights:

Bartlett flagged several upcoming events in software to monitor this week: WDAY, WBD, CRWD, ZM, and INTU. Investor sentiment remains cautious, particularly for WDAY and INTU, where concerns over AI cannibalization dominate the narrative.

Macro Update:

August retail sales exceeded expectations, and industrial production posted a modest gain versus forecasts for a decline.

Straddle Expectations for Tomorrow:

- S&P 500: 0.68%.

- QQQ: 0.88%.

- IWM: 1.92%.

Nick T’s Commentary:

"With the rate decision largely anticipated, investor focus will shift to Powell’s stance during the quarterly economic projections on Wednesday. The key question: Will Powell and the Fed pencil in three rate cuts for the year or stick to the two cuts projected back in June when the labor market appeared more robust? Either decision risks potential division among policymakers."

Derivatives Insight:

- Preferred hedge implementation: Outright puts in October or short-dated SPX positions due to low gamma tenor pricing and steep rolldown.

- Recent volatility bid supports the case for put spread collars in December tenors, though selling sub-12 volatility on the call leg remains challenging for most reasonable strikes.

- QQQ volatility bid has been equally dramatic, with spreads to SPX appearing rich across all tenors except September and October. .

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!