SP500 LDN TRADING UPDATE 23/04/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5250/60

WEEKLY RANGE RES 5476 SUP 5146

DAILY ONE TF DOWN 5262

WEEKLY ONE TF DOWN 5496

MONTHLY ONE TF DOWN 5997

DAILY BULL BEAR ZONE 5370/60

DAILY RANGE RES 5373.75 SUP 5255.25

2 SIGMA RES 5630 SUP 4998

5314 - 5610 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 30 POINTS)

WEEKLY ACTION AREA VIDEO https://www.youtube.com/watch?v=P4oaIdrVRmI&t=114s

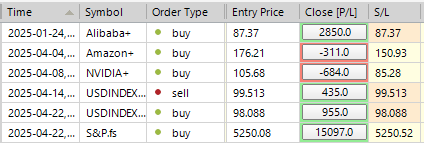

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET WEEKLY RANGE RES

SHORT ON TEST REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE 5470 TARGET 5610 GAP FILL

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: REBOUND

Date: 22 April 2025 |

Markets Overview:

- S&P 500 closed up +2.51% at 5,287, marking its third-best session in over two years, with a Market on Close (MOC) order of $1 billion to buy.

- NASDAQ (NDX) rose +2.63% to 18,276.

- Russell 2000 (R2K) increased +2.76% to 1,901.

- Dow Jones Industrial Average (Dow) climbed +2.66% to 39,186.

- Trading volume reached 15 billion shares, slightly below the year-to-date daily average of 16.4 billion shares.

- Volatility Index (VIX) decreased by 9.61% to 30.57.

- Crude oil increased by 1.95% to $64.31.

- U.S. 10-Year Treasury yield slightly down by 1 basis point to 4.39%.

- Gold dropped by 1.02% to $3,390.

- U.S. Dollar Index (DXY) rose by 0.70% to 98.974.

- Bitcoin surged by 4.42% to $91,215.

Market Sentiment:

Today's rebound was driven by favorable conditions with higher DXY and lower yields, aligning with what stocks needed. A slew of positive earnings reports from companies like PNR, GE, MMM, PHM, GPC, DGX, DHR, IVZ, EFX, SYF, and NTRS supported the market. ETF activity represented 33% of trading, moving back towards a more typical level of 28%.

Geopolitical Developments:

Early optimism was noted with reports suggesting a potential de-escalation with China, although it may take months to finalize trade deals, according to Politico.

Market Activity:

Overall activity levels were moderate, rated at 4 on a 1-10 scale. Our floor finished 2.83% better for sales compared to a 30-day average of -1.05%. Market volumes were 31% below the 20-day moving average. Long-only and hedge funds were slight net buyers, with large asset manager sell orders from last week not returning today. There is emerging demand for megacaps, but overall buying remains limited. Long-term investors are still cautious about taking positions in single stocks. Boeing (BA) is in focus tomorrow, with positive commentary on free cash flow at the March conference, though tariff concerns persist.

Post-Market Highlights:

- Tesla (TSLA): Unchanged after earnings miss; no guidance provided. EPS reported at $0.27 versus consensus of $0.43, with EBITDA at $2.81 billion against a consensus of $3.12 billion. Gross margins were in line, better than expected. Future guidance will be revisited in the 2Q update.

- Intuitive Surgical (ISRG): Down 8% due to weaker placements overshadowing strong volumes; updated guidance includes tariff impact.

- Bristol-Myers Squibb (BMY): Down 6% following a missed Phase 3 study for Cobenfy as an adjunctive treatment in schizophrenia.

Derivatives Market:

Another day of subdued activity despite the S&P experiencing over 2% intraday swings. Volatility decreased, with notable buying of VIX downside, including 25,000 May 21 puts. Gold options saw heightened activity with approximately 800,000 calls traded. Index gamma is now short by around $1 billion, with dealers short in all scenarios, though length flattens slightly on the downside.

Outlook:

With a busy calendar ahead, including Fed speakers and the start of mega-cap tech earnings, the market is pricing in a potential 2.4% move by Friday's close.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!