SP500 LDN TRADING UPDATE 9/9/25

SP500 LDN TRADING UPDATE 9/9/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~10 POINTS***

WEEKLY BULL BEAR ZONE 6440/50

WEEKLY RANGE RES 6556 SUP 6407

SEP MOPEX STRADDLE - 6260/6639

SEP EOM STRADDLE - 6282/6638

DAILY BULL BEAR ZONE 6502/6492

DAILY RANGE RES 6565 SUP 6448

2 SIGMA RES 6627 SUP 6387

VIX DAILY BULL BEAR ZONE 16.5

DAILY MARKET CONDITION - BALANCE 6541/6452

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

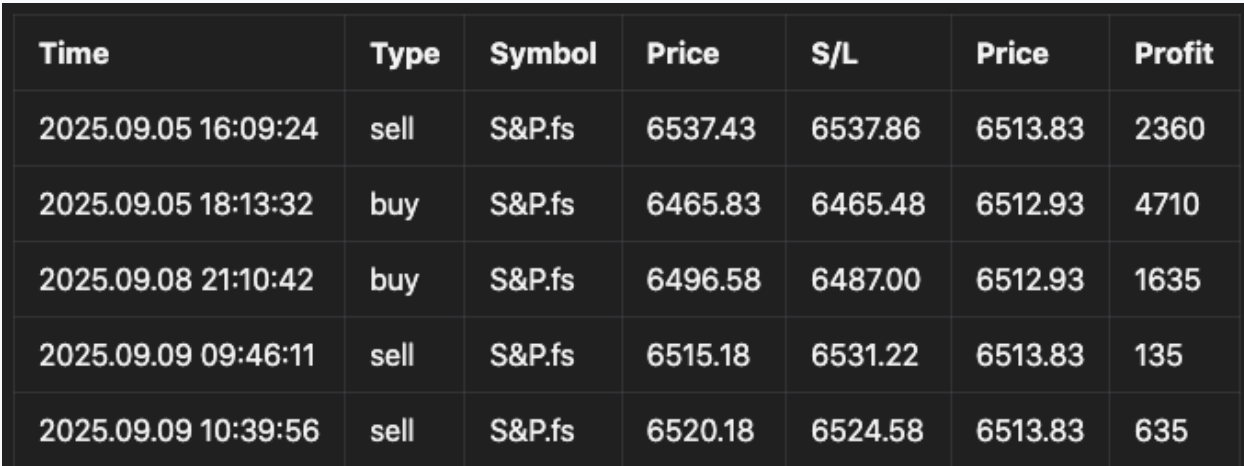

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY/WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: ACTIVE WEEK AHEAD

FICC and Equities | 8 September 2025 |

Market Performance:

- S&P 500: +21bps, closing at 6,495 with MOC flows of $2.3bn to SELL.

- NASDAQ 100 (NDX): +46bps, closing at 23,762.

- Russell 2000 (R2K): +20bps, closing at 2,398.

- Dow Jones: +25bps, closing at 45,514.

- VIX: -46bps, ending at 15.11.

Volume & Key Assets:

- Total U.S. equity exchange volume: 16.5bn shares traded vs YTD daily average of 16.8bn shares.

- Crude Oil: +108bps, closing at $66.21.

- U.S. 10-Year Yield: -3bps, settling at 4.04%.

- Gold: +66bps, closing at $3,677.

- DXY (Dollar Index): -32bps, ending at 97.45.

- Bitcoin: Unchanged at $112k.

Session Overview:

The market started the week rangebound, setting the stage for what’s expected to be an active week driven by macro and micro catalysts:

- Macro: Key data releases include annual payroll revision (Tuesday), PPI (Wednesday), CPI and ECB decisions (Thursday), and University of Michigan sentiment (Friday). The Fed remains in blackout ahead of next week’s FOMC meeting.

- Micro: Day 1 of the flagship Communacopia + Technology conference kicked off today, alongside GS-led activity on 5 IPOs that will allocate and trade. Additional launches, including STUB this morning, are expected. Elevated block activity is anticipated.

Sector Insights:

Price action was muted overall, but consumer sectors (retail, restaurants, staples) showed notable weakness. This contrasts with last week’s strength during the retail conference, where the group (as defined by XRT) reached a new 52-week high.

- Consumer Discretionary: The long/short ratio stands at 2.23, near one-year highs (96th percentile) and strong relative to the past five years (72nd percentile).

Trading Desk Activity:

- Floor Activity: Scored a 6 out of 10 for overall activity levels. Finished +3% net buyers vs a 30-day average of -70bps.

- Long-Only (LO) Funds: Net buyers of $1bn, driven by demand in software and macro tech plays.

- Hedge Funds (HFs): Slight net sellers, with supply in tech and financials offset by demand in energy.

Key Tactical Developments:

1. S&P Top-of-Book Liquidity: Declined by $12.21m as of Friday’s close, marking the largest single-day drop since 2021.

2. Systematic Positioning: Currently at ~8/10, indicating elevated length without immediate reduction pressure.

3. Buyback Activity: GS estimates this will be the final week of the open window period. By 9/15, ~40% of the S&P 500 is expected to enter blackout.

Derivatives Update:

Monday was quiet, with markets grinding higher on limited weekend news. Intraday ranges were tight, and volatility drifted lower throughout the morning.

- Key Story: NDX outperformed RUT, with NDX volatility outperforming SPX and RUT.

- Positioning: Favor long volatility on the topside for continued breakout potential. SPX or NDX are reasonable implementation options..

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!