The FTSE Finish Line: April 04 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

UK stocks dropped significantly on Friday and are set to finish the week with considerable losses, as fears of a recession grew following China's response to U.S. President Donald Trump's declaration of extensive tariffs. The FTSE 100 reached its lowest point since last December, and is on track for its largest weekly decline since February 2022. The midcap index, which focuses on domestic companies, decreased by 4% and is set for its most significant weekly drop since March 2020. China, now subjected to a total of 54% tariffs on exports to the U.S., plans to introduce an additional 34% tariffs on all U.S. imports starting April 10, according to its finance ministry announced on Friday. In contrast, Britain received the lowest import duty rate of 10% in Trump's tariff announcement on Wednesday, although officials recognized the nation's susceptibility to global economic challenges. Bank stocks declined for the second day in a row as tariff anxieties heightened concerns regarding growth in the world's largest economy. Barclays led the losses in this sector on the blue-chip index, with a 10% drop, followed by HSBC Holdings, Lloyds Banking Group, and Standard Chartered. The UK's banking sector index decreased by 8%, reaching a three-month low. The mining companies' index also fell by 6.3% as London copper experienced its most significant weekly decline in nearly five months amid tariff worries.

Single Stock Stories & Broker Updates:

Shares in UK banks fell for the second session after Trump's new tariffs raised economic growth concerns. Standard Chartered leads declines, down over 4%; Natwest down 3.8%, Barclays 3.2%, Lloyds 2.4%, and HSBC 3%. Investec, Metro, and Close Brothers each drop 2.3%.

Oil firms Serica Energy and Enquest extend losses as the UK Takeover Panel pushes the merger deadline to May 2. Serica (SQZ) falls 8% to 123.4p, while Enquest (ENQ) drops 3.2% to 14.06p. Serica shares are down ~1% YTD, while Enquest is up ~16%. Global economic concerns deepen as U.S. tariffs prompt Chinese retaliation.

BP's stock was down 1.3% at 395.2 Helge Lund, the board's chairman, plans to retire, probably in 2026. Analysts at Jefferies note, "It also probably demonstrates the first significant effect of Elliott's involvement." BP announced that it has begun a succession process for the position. * "(Elliott) will now turn attention to CEO Murray Auchinloss – his attempts to pivot BP away from green energy look half hearted and we suppose that Elliott will want a new CEO that can undertake a proper reset on strategy," said Ashley Kelty, a Panmure Liberum analyst. This year, BP's stock has increased by almost 2%.

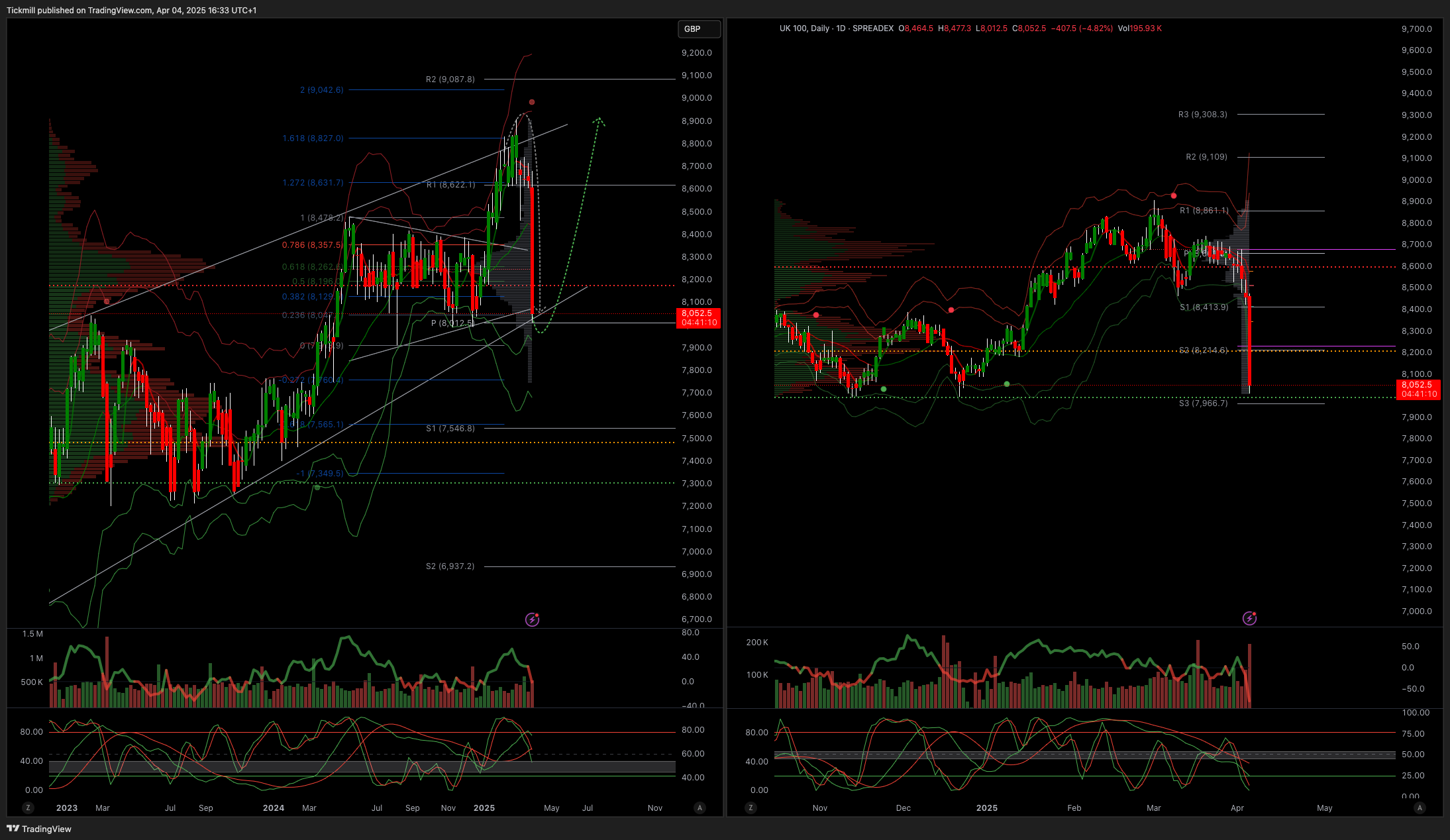

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8950

Primary support 8700

Below 8700 opens 8600

Primary objective 9050

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!