The FTSE Finish Line - December 3 - 2024

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE Mints Another Positive Day Aided By Miners Outperformance.

U.K. stocks rose on Tuesday, buoyed by increased commodity prices that benefited mining and energy shares. The FTSE 100 index climbed 0.5% after a 0.3% gain on Monday. Mining companies such as Anglo American, Antofagasta, and Glencore saw their shares increase by 1-2% as commodity prices continued to trend upward in light of the U.S. President-elect Donald Trump's tariff remarks.

Single Stock Stories:

Greencore shares up 9.5% after a 36.1% rise in annual pretax profit to £61.5 million. The company announced a £10 million share buyback and reported like-for-like volume growth exceeding the wider market. FY25 adjusted operating profit expected to be in the top half of market estimates (£107.1 million to £98.1 million). GNC has risen ~124% YTD.

SSP Group shares rise 13.2% to 183.53p, leading FTSE 250 gainers. The company reports a 23% increase in FY core profit, meeting analyst estimates. Year-end net debt is 593 million pounds, below the previous guidance of 610-630 million pounds. The company also raises its FY operating profit margin target to 3% for its Continental European unit. Currently, the stock is up 11.8%, reducing YTD losses to approximately 23%.

Shares of UK travel retailer On The Beach rose 13.4%, reaching their highest since June 2022 and becoming the top gainer on the FTSE smallcaps index. The company is confident that Summer '25 will outperform Summer '24 and expects FY25 adjusted PBT to align with a consensus estimate of £37.9 million. FY24 adjusted PBT was £31 million, up from £24.8 million last year, with FY revenue increasing 14% to £128.2 million. The stock is up approximately 9.07% year-to-date.

Shares of discoverIE rose 14.1%. The company reported H1 underlying operating margin of 13.8%, up from 12.9% last year, exceeding full-year targets according to Peel Hunt analysts. They are on track to achieve a 15% adjusted operating margin target for FY2027/28. H1 group revenue was 211.1 million pounds ($267.8 million), down from 222 million pounds ($281.7 million) last year. H1 profit before tax was 15.8 million pounds, slightly lower than last year's 16 million pounds. DSCV expects to meet FY underlying earnings expectations. The stock is down ~11.39% YTD.

Broker Updates:

British electrical retailer Currys falls 4.1% to 77.7p, becoming the top loser on the FTSE midcaps index. Deutsche Bank downgrades its rating to "hold" from "buy" and lowers the target price to 85p from 95p, citing cost controls and price elasticity as key factors. Some UK retailers are better positioned to handle rising wage pressures and weak consumer demand. The stock has risen ~54% this year.

Technical & Trade View

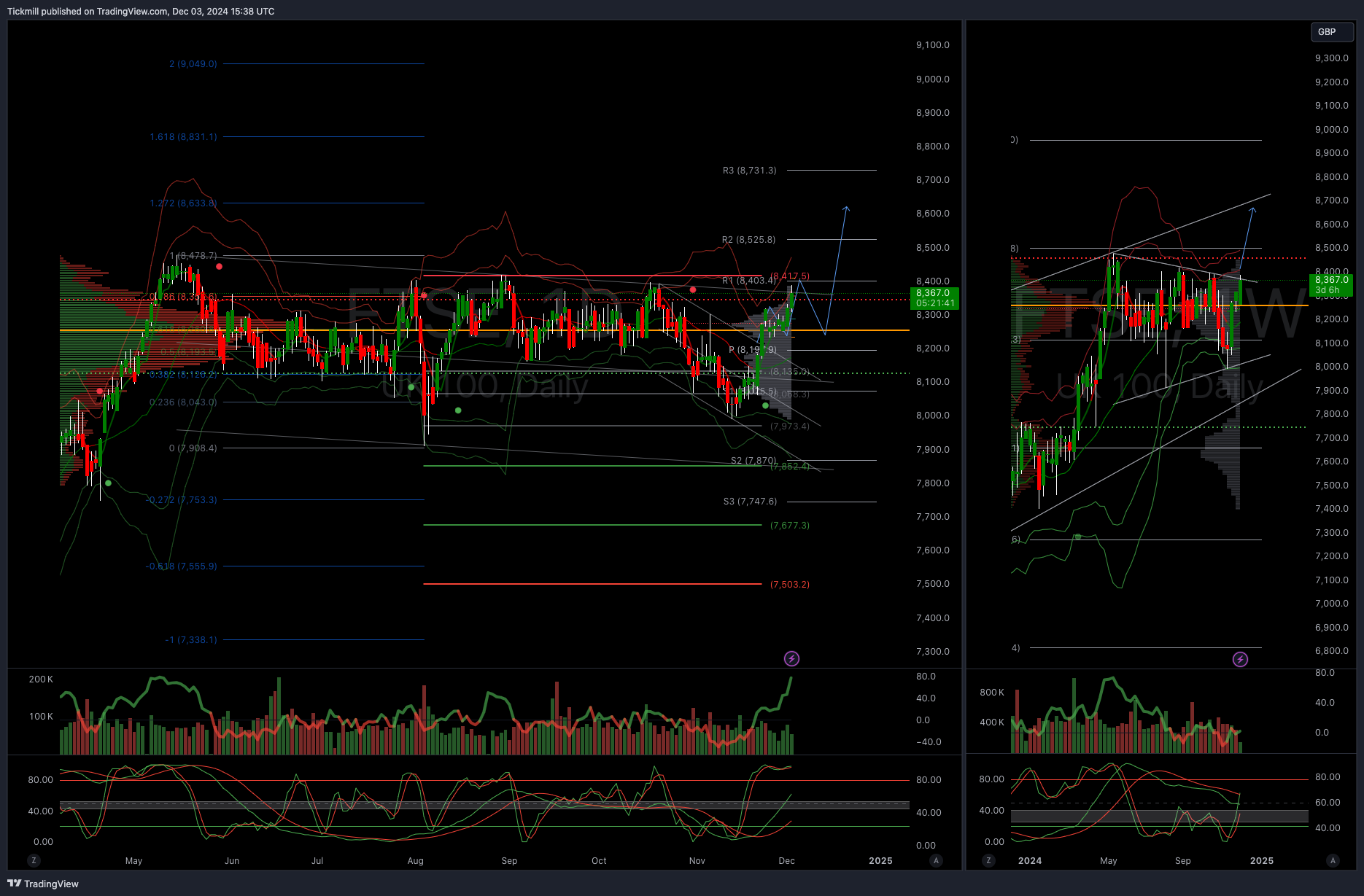

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!