The FTSE Finish Line: January 13 - 2025

FTSE A Shaky Start To The Week As Yields Continue To Weigh On Risk Sentiment

British stocks fell on Monday, affected by a worldwide selloff as investors avoided risky assets after a U.S. jobs report from last week strengthened expectations that the Federal Reserve would be careful about reducing interest rates this year. The blue-chip FTSE 100 dropped by 0.4%. Most subsectors experienced declines, with aerospace and defense being the most affected, dropping by 1.8%. Global stock markets fell, while bond yields stayed high after Friday's data revealed that U.S. job growth unexpectedly picked up in December, and the unemployment rate decreased to 4.1%. The yield on the 30-year gilt surged to a new 27-year peak, and the yield on the 10-year note reached its highest level since 2008, continuing the selloff for a second consecutive week. British midcaps faced a nearly 3% decline last week, impacted by a significant increase in British borrowing costs that raised concerns about public finances following the government's announcement of substantial spending plans. Energy stocks were an exception, rising by 1.2% as crude oil prices increased due to broader U.S. sanctions on Russian oil and anticipated impacts on exports to major buyers like India and China. The high crude oil prices negatively affected airline stocks, with the travel and leisure sector down by 1.3%. This week, inflation data will be closely monitored in the UK, as well as in much of Europe and the United States. UK quarterly GDP estimates are also set to be released on Thursday.

Single Stock Stories:

British gambling firm Entain Plc saw its shares jump 8.8% to 679p, making it the top percentage gainer in the FTSE 100 index. The rise came as the company announced that it expects its core profit for 2024 to reach the upper end of its forecast range of £1.04 billion ($1.26 billion) to £1.09 billion ($1.32 billion). At the same time, Entain reiterated its projection of a $250 million core loss for BetMGM, its joint venture with MGM Resorts in the United States. JP Morgan noted that while there is potential for a future turnaround, particularly as Entain continues to refine its offerings in key markets such as the UK, US, and Brazil, the company will require more time and investments to regain momentum in its overall trading and profitability. Despite the day’s rally, Entain’s shares have fallen roughly 30% in 2024, reflecting ongoing challenges.

Shares of British biotech firm Oxford Nanopore Technologies soared 21.6% to 158.75p after the company announced it expects to report full-year revenue of approximately £183 million ($222.27 million), up from £169.7 million in FY23. The revenue growth is attributed to its successful expansion into new sectors beyond research, including applied industrial, biopharma, and clinical markets. The company also reaffirmed its medium-term guidance, signaling confidence in its long-term strategy. Despite the strong performance on the day, Oxford Nanopore's stock has declined about 36% in 2024, reflecting broader challenges in its market.

The shares of British recruiter PageGroup experienced a 5% decline to 295.8p, marking their lowest point since May 2020 and positioning them as the largest loser on the FTSE mid-cap index, which saw a 1.4% decline. The decline followed the company's issuance of its second profit warning in six months, with PageGroup now expecting full-year operating profit to be at the lower end of market consensus, projected between £49 million and £58.5 million ($59.51–$71.05 million). The company reported a 13% decline in Q4 gross profit to £196.7 million, reflecting challenging market conditions. CEO Nicholas Kirk highlighted continued macroeconomic and geopolitical uncertainties in key markets, especially France and Germany. As of the prior close, the stock was down 9.4% year-to-date, underscoring the ongoing headwinds the company is facing.

Technical & Trade View

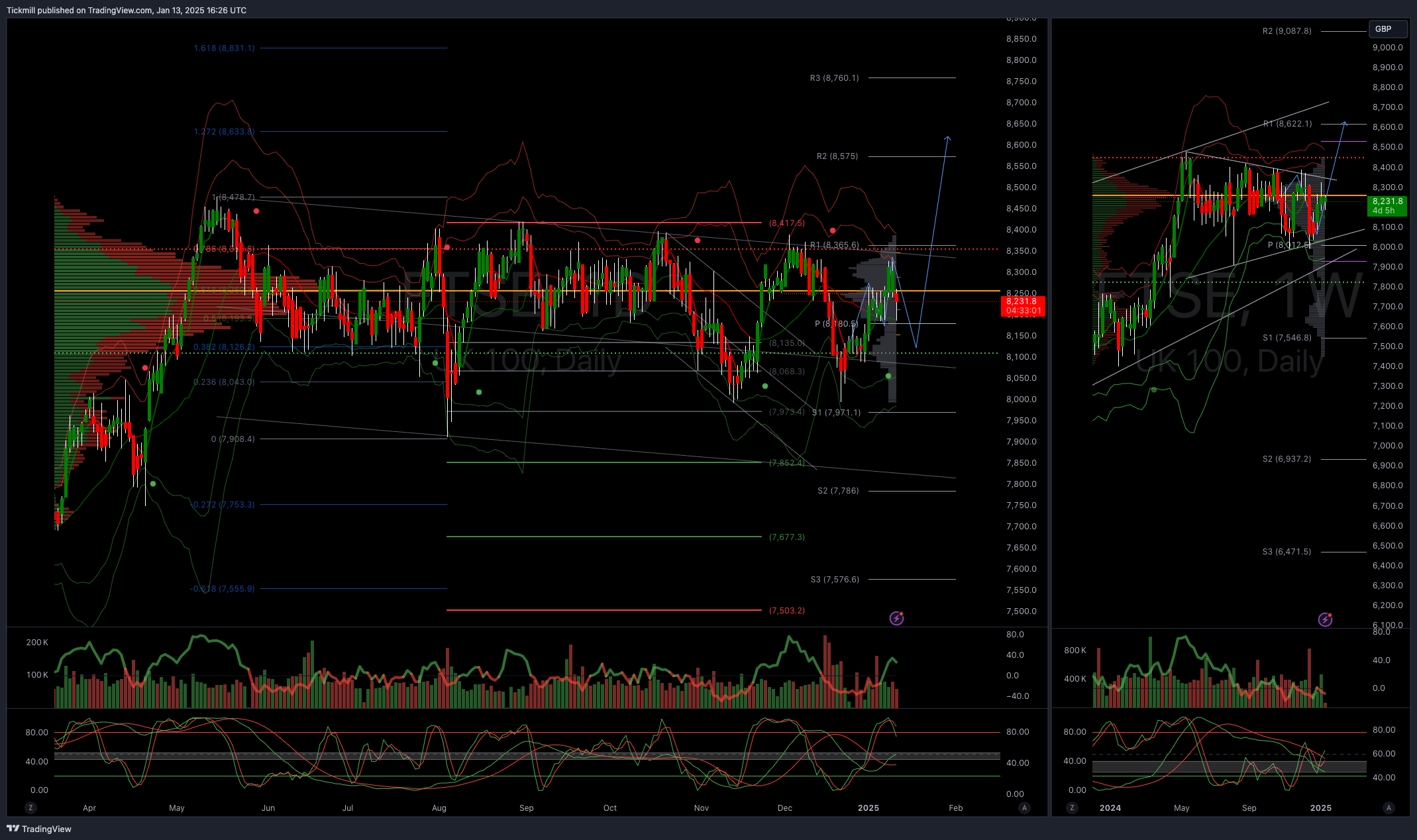

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!