The FTSE Finish Line - July 25 - 2024

FTSE Reverses Early Losses After Printing Three Month Lows…Buy!

On Thursday, the FTSE 100 reversed early losses from its lowest level in nearly three months, mainly due to a decline in gold miners. However, Unilever saw a surge in its stock after surpassing profit expectations for the first half of the year. The blue-chip FTSE 100 index is up 0.23%

Most major sub-sectors saw early declines as investors analysed market movements and various corporate updates. Precious metal miners, particularly gold miners like Fresnillo and Endeavour Mining, experienced over a 3% decline as spot gold prices fell due to profit-booking. Energy and industrial miners also saw a decline in tandem with oil and copper prices. Industrial support services stocks trended 2.3% lower, with Rentokil being a significant contributor to this decline after reporting its interim half-yearly results.

On the other hand, the personal care, drug, and grocery sector stood out with a 3.8% gain driven by Unilever's strong performance, which saw a 6.7% climb after beating profit estimates for the first half of the year. Unilever is leads the FTSE 100 after exceeding profit expectations in the first half of the year. Unilever reported an underlying operating profit of 6.1 billion euros ($6.6 billion), surpassing the market's forecast of 5.44 billion euros. The company also maintained its full-year sales growth forecast of 3%-5% and its full-year underlying operating margin forecast of at least 18%, which is ahead of market expectations. However, Unilever fell short of market expectations for quarterly underlying sales growth, with a 3.9% rise compared to analysts' average expectation of 4.2%. The stock had previously risen by approximately 16% so far this year up to the last close.

Globally, investor sentiment was affected by disappointing performances from big tech companies like Alphabet and Tesla, impacting the tech-heavy Nasdaq and the S&P 500. Data-wise, investors are keeping an eye on the U.S. personal consumption expenditures (PCE) price index, scheduled for release on Friday, to gauge the Federal Reserve's stance on interest rate cuts. In other news, British American Tobacco reported a 1.3% rise in half-year profit, surpassing analyst expectations and leading to a 1.4% increase in its stock. Conversely, Centrica experienced a significant decline of 7.8% after reporting a fall in first-half adjusted operating profit, while BT shed 3.5% following the release of its trading statement for the first quarter.

Technical & Trade View

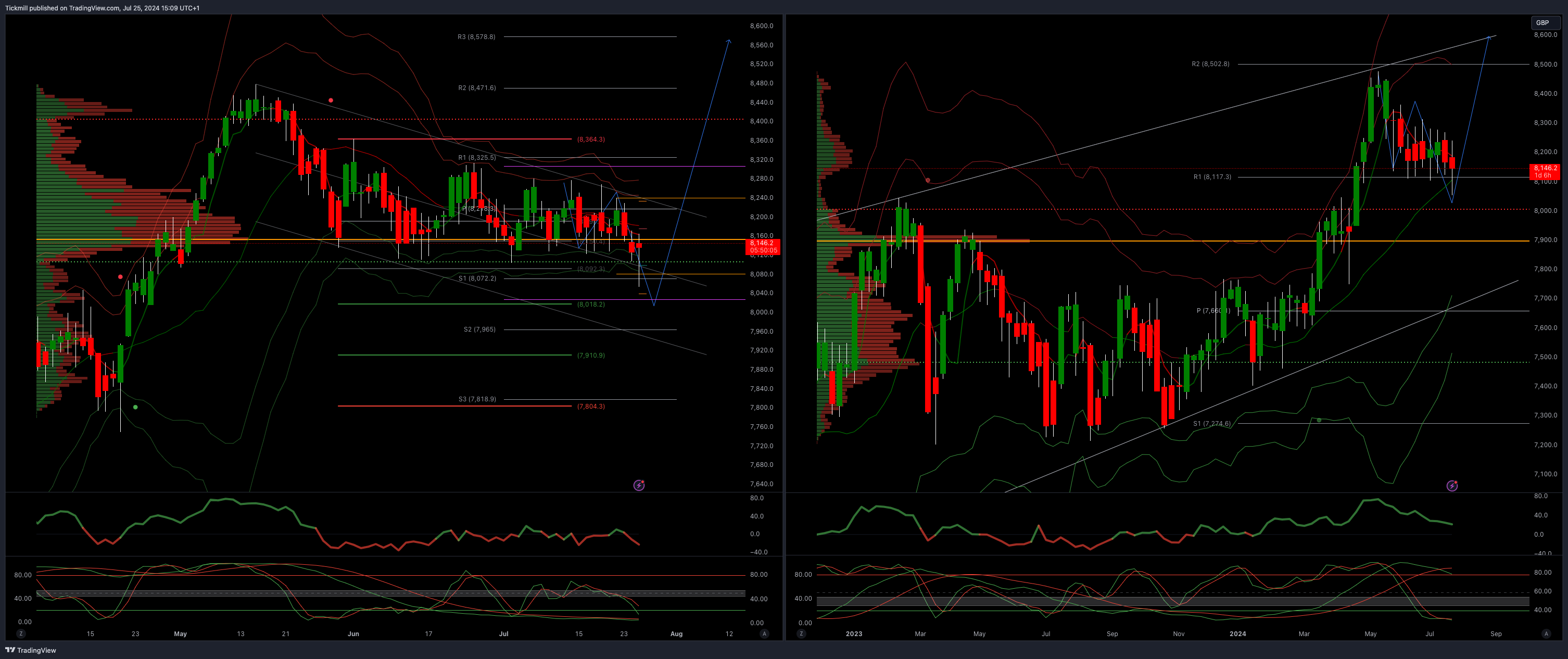

FTSE Bias: Bullish Above Bearish below 8225

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bearish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!