The FTSE Finish Line: May 21 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

Britain's FTSE 100 index edged higher on Wednesday, recovering from early losses driven by mixed corporate earnings and hotter-than-expected inflation data. The unexpected inflation surge in April, particularly in areas closely monitored by the Bank of England, prompted investors to scale back expectations for imminent interest rate cuts. The data is likely to rule out any UK interest rate reductions for the next few months and suggests the Bank of England will maintain its aggressive policy stance for an extended period. Investors now estimate a 40% chance of a rate cut in August, down from 60% before the inflation report. Following the data release, the British pound hit a three-year high against the U.S. dollar. Meanwhile, the domestically focused midcap index slipped in response to the inflation figures. On a separate note, official data revealed that British house prices recorded their fastest annual growth since late 2022 in the year leading up to March.

Single Stock Stories & Broker Updates:

Shares of Marks and Spencer fell 3.7% to 354p, among the top FTSE 100 losers, down 0.2%. The company expects a £300 million ($402.9 million) operating profit impact for 2025/26 due to a cyber attack, with online disruptions continuing into July. CEO Stuart Machin announced online operations will restart soon. MKS reported a FY pretax profit of £875.5 million, up 22.2% YoY, and is down about 5% YTD.

Shares of JD Sports fell 9.4% to 84.2p, making it the top loser on the FTSE 100 index. The stock is set for its worst day since November 2024 due to concerns over higher prices from U.S. tariffs impacting customer demand. The company reported a 2% decline in first-quarter underlying sales and is diversifying its sourcing countries despite limited visibility on tariff impacts. As of the last close, the stock is down 3% year-to-date.

UK housebuilders index fell 1.6% after inflation exceeded expectations in April, leading investors to reduce the likelihood of a Bank of England rate cut in August to 40% from 60%. Homebuilder stocks, sensitive to high borrowing costs, saw declines: FTSE 100 firms Barratt, Redrow, Persimmon, and Taylor Wimpey down 1.2% to 2.1%, while mid-caps Vistry and Crest Nicholson dropped 2.1% to 2.3%.

Avon Technologies' shares rose 3.5% to 1626p. The company anticipates double-digit revenue growth in FY25 and has improved margins due to effective scrap reduction in its core brand, Avon Protection. H1 adjusted profit before tax increased to $14.8 million from $8.8 million a year ago. It expects to meet medium-term financial targets a year early in FY2026 and does not foresee US tariffs or DOGE impacting margins. The stock is up approximately 14.15% year-to-date.

Technical & Trade View

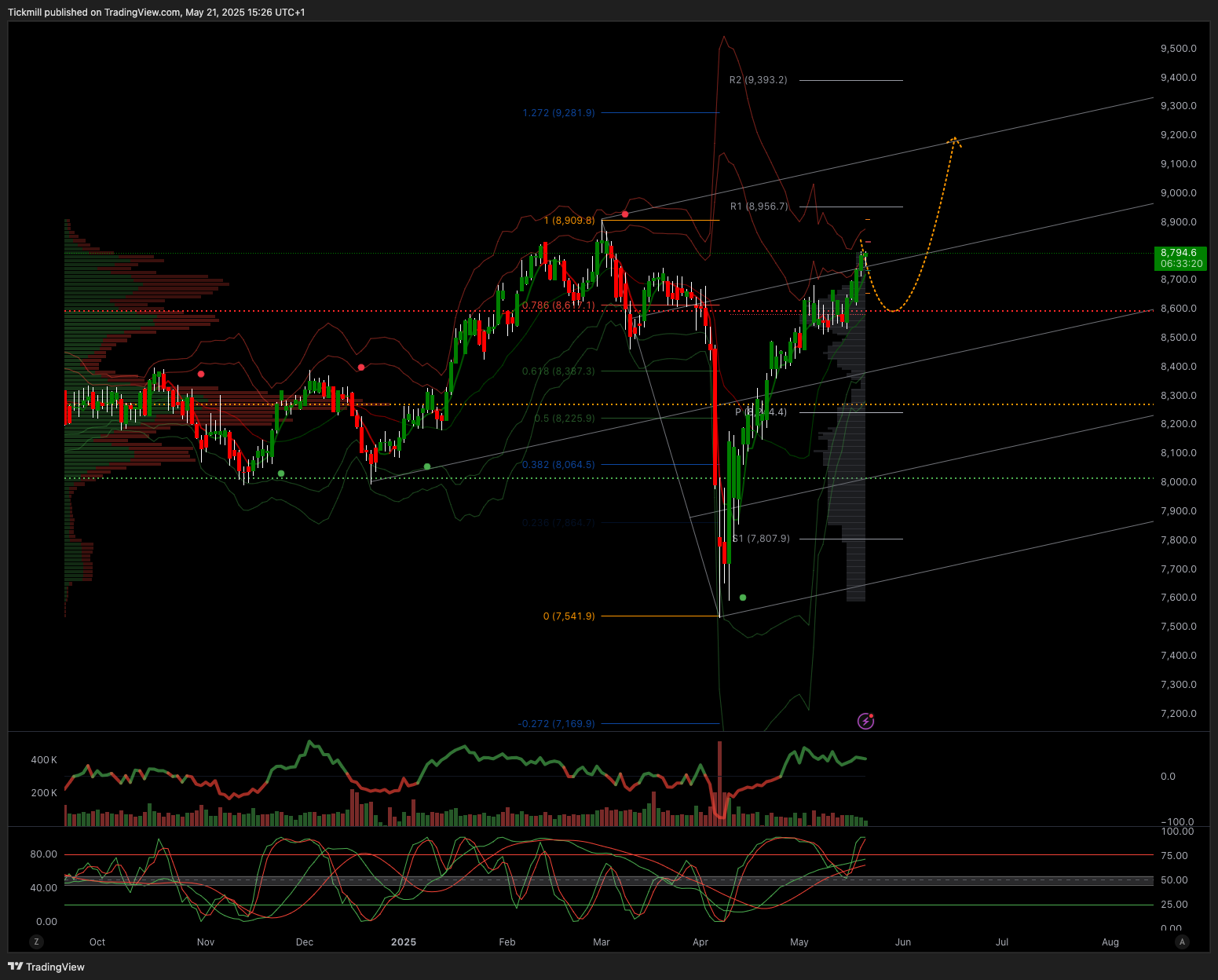

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8500

Below 8500 opens 8250

Primary objective 8900

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!