US Yields Surge on Sixth Straight Retail Sales Rise

Retail Sales Rise Again

The latest set of US economic data released today serves as further evidence of the resilience of the US economy. Retail sales were seen rising for a sixth straight month in September, despite consumers grappling with higher rates and higher inflation. Headline retail sales rose 0.7% on the month, well above the 0.3% the market was looking for. Similarly, core retail sales were seen rising 0.6%, again higher than the 0.2% the market was looking for. Along with these readings, both readings for the prior month were revised higher.

Rate Hike Pricing Rising

On the back of the data, market pricing for a December hike was seen increasing to over 40%. The Fed had signalled last time around that a further hike this year was likely this year with rates then forecast to stay higher for longer through 2024. Today’s data shows that any talk of a consumer slowdown is still premature and, as such, US yields and USD look likely to remain well supported near-term. Industrial production too, was seen coming in above forecasts at 0.3% vs 0% expected. With USD also deriving support from safe-haven inflow currently, the near-term outlook remains favourable ahead of Powell’s keenly awaited speech on Thursday.

Technical Views

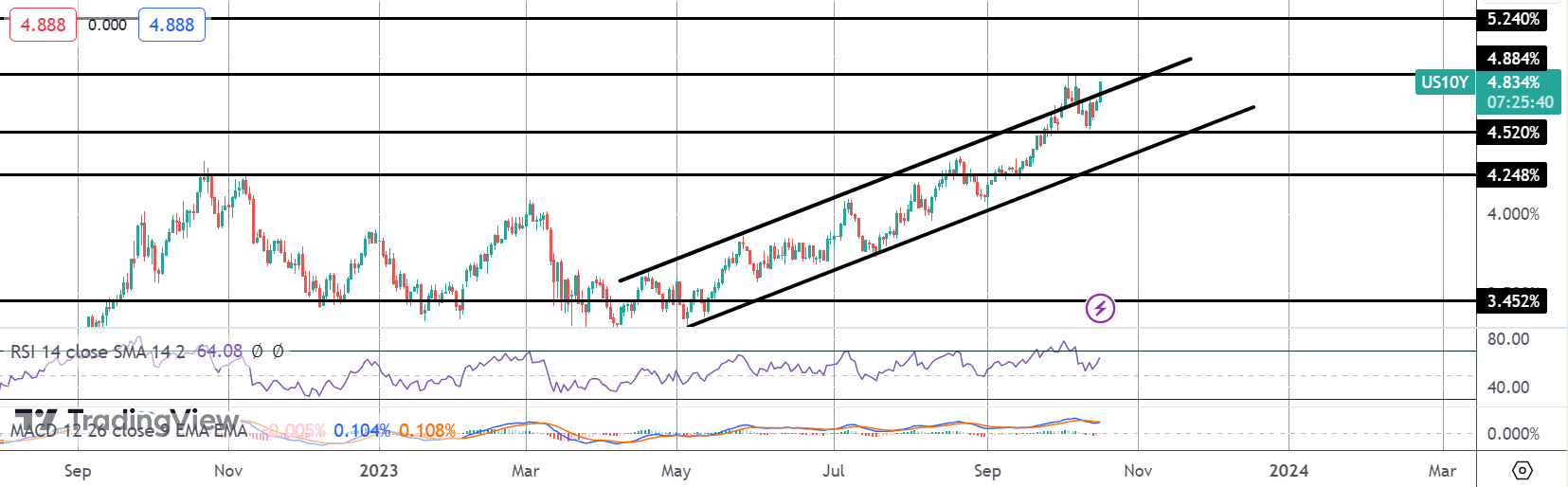

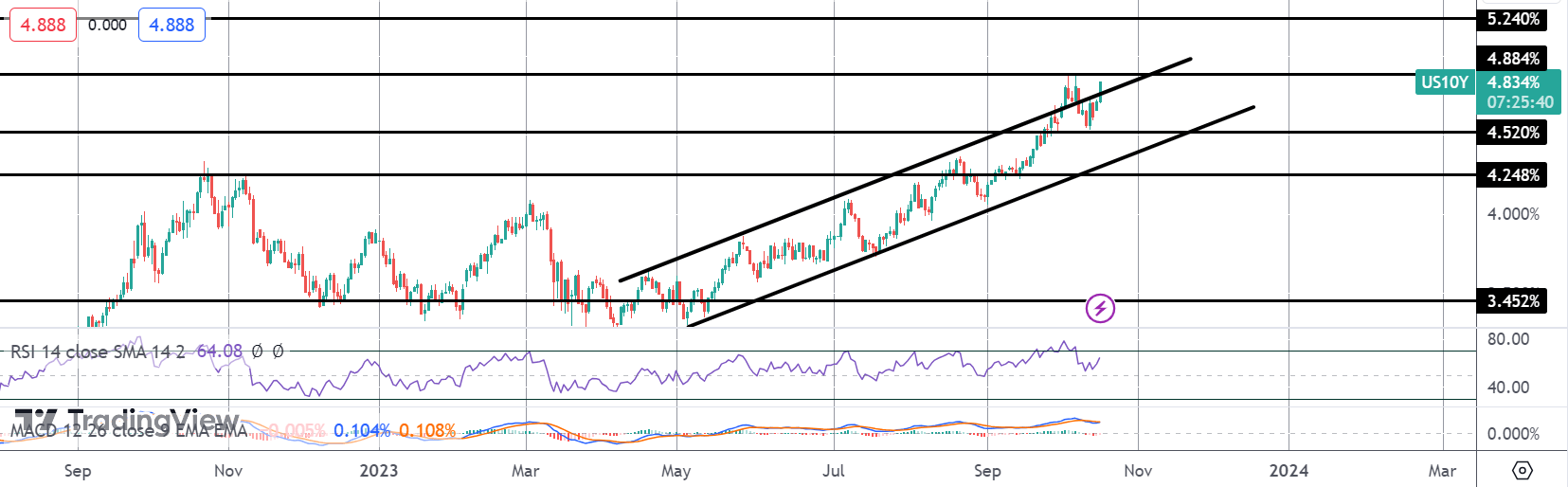

US10Y

Yields on 10Yr US paper are pushing firmly higher again this week. Geo-political uncertainty and better-than-forecast US data are seeing yields trading back up towards the YTD highs following a brief correction lower. With yields now pushing on further above the broken bull channel, the outlook remains firmly bullish near-term with 5.240% the next upside target on a break of current highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.