USD Gains Strength as PCE Inflation Surges

Greenback flexes its muscles, propelling EUR/USD to cling to the lower 1.070s range in the wake of robust US inflation figures unveiled by the Personal Consumption Expenditures (PCE) report. The data, showcasing a steeper-than-anticipated climb in the Fed's preferred inflation metric, rings alarm bells as it breaches market forecasts.

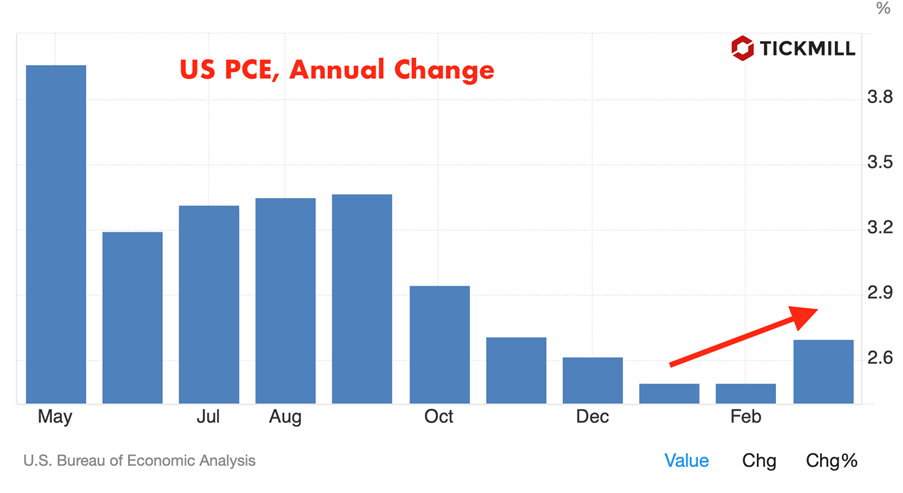

March's annual PCE inflation notches a resilient 2.7%, surpassing February's 2.5%, and notably eclipsing market expectations by 0.1%. This uptick signals an escalating inflationary environment in the US since the year's inception, aligning closely with revised market sentiments regarding the anticipated timing of the Federal Reserve's easing cycle:

The core PCE Price Index, excluding volatile components like food and energy, maintains its robust stance, holding firm at 2.8% year-on-year, defying analysts' projections by 0.2%. A monthly analysis reveals a consistent 0.3% uptick in both the PCE Price Index and its core counterpart, underscoring the enduring inflationary pressures.

Further dissecting the report, Personal Income marks a monthly ascent of 0.5% in March, paralleled by a hearty 0.8% surge in Personal Spending. Such buoyancy in consumer behavior underscores a resilient domestic economic landscape.

The Federal Reserve's recalibrated Summary of Economic Projections (SEP), elucidated through the dot plot post-March meeting, projects a year-end core PCE inflation of 2.6% for 2024, a notable uptick from December's forecast of 2.4%. This upward revision underscores the central bank's acknowledgment of inflationary momentum.

Nevertheless, Thursday's narrative saw the Greenback stumble amid the US Bureau of Economic Analysis's revelation of a modest 1.6% annualized expansion in first-quarter real Gross Domestic Product (GDP), markedly divergent from market expectations of 2.5%. However, a silver lining emerges as the GDP Price Index surges to 3.1% from 1.7%, buttressing the USD against steeper declines.

As US stock index futures soar after the upbeat economic report, the prevailing risk-on sentiment could temper the USD's bullish trajectory in the American trading session.

Market indicators, particularly Federal funds futures, signal a substantial 90% probability of the Fed maintaining the policy rate unchanged in June. With investors having digested the quarterly PCE Price Index adjustment, the monthly inflation data is poised to exert a fleeting influence on rate expectations.

There was a kind of ambiguity in the short-term technical picture of EURUSD since the market managed to stage a recovery and, after a failed test of the 1.07 level, made a second attempt at a breakthrough. Fresh inflation insights, however, usher in a newfound consensus, anticipating prolonged resistance at the 1.07 level and a potential swing lower towards the lower bound of the bearish channel before a transition to a bullish trend is possible:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.