USDJPY About to Breakout?

NFP Up Next

USDJPY is pushing firmly higher today with the pair once again testing the 2025 highs just ahead of the 158.12 level. A combination of a stronger USD and some chatter regarding the BOJ holding rates steady this month is helping drive the rally here. USD has been on a steady push higher this week as traders brace for the latest US jobs report due later today as well as the SCOTUS ruling on Trump tariffs. On the data front, traders are expecting a broadly positive set of labour market reports which should keep Q1 easing expectations muted, allowing USD to run higher near-term. Any upside surprises in today’s data will be firmly bullish for USDJPY and should see the pair breaking out to fresh highs.

BOJ Expectations

On the JPY side, there has been some chatter this week that the BOJ wont go for a follow up hike this month following the December rate hike. Given the built-up level of hawkish expectations on the back of that December move, JPY is at risk of a heavier move lower, particularly if today’s US data comes in hot. Additionally, Bloomberg reported this week that the BOJ is expected to revise its growth forecasts higher. As such, the prospect of a higher growth without higher yields means capital is likely to move away from Japan, further weakening JPY near-term.

Technical Views

USDJPY

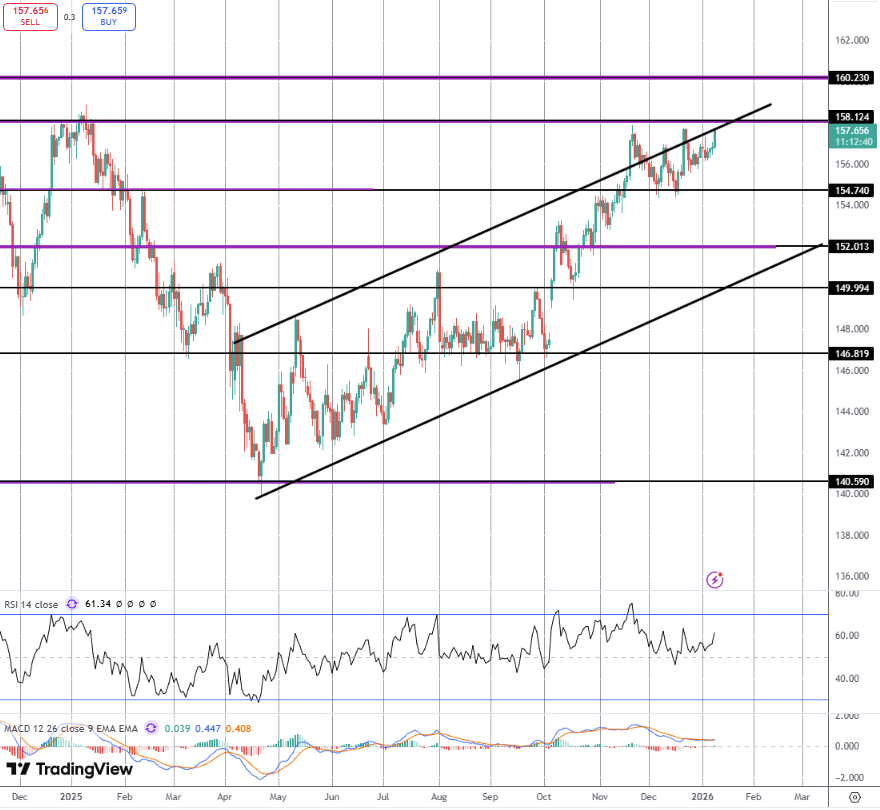

USDPY is currently pushing up against the bull channel highs and the 158.12 level. This is a big resistance zone which has capped the market several times. As such, a break higher here will be an important development, turning focus to 160.23 as the next upside marker to watch. To the downside, 154.74 is the key support to note with the outlook remaining bullish while price holds above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.