Yen Collapses

USDJPY is attracting a lot of attention today following the gap higher at the open today, with price now up around 2% from Friday’s close. The move comes in response to news that pro-stimulus Takaichi looks set to become the new prime minister in Japan, making history as the first female PM there. Following her appointment as head of the LDP party, Japanese yields sank, and JPY plunged as traders scaled back BOJ rate-hike expectations through the remainder of the year. With the Nikkei soaring on the news, USDJPY has blown through recent resistance levels as trades eye a less hawkish BOJ stance under the potential new PM.

Fiscal Expansion Incoming

Takaichi is known for her support for fiscal expansion and her economic agenda has been dubbed a return to Abenomics. Under her leadership, the market is expecting Japan to see increased government spending, wider industrial support and the help of the BOJ to ensure easier liquidity conditions. This marks a stark shift in the hawkish BOJ outlook which has dominated markets for the year up to now. Traders had been looking for the BOJ to hike rates at least once further time this year. However, this view has now shifted aggressively, and JPY looks prone to furtehr weakness near-term. While the LDP is unlikely to gain a majority in the mid-October vote, Takaichi will still become PM given that the LDP will be the biggest party in the new coalition.

Technical Views

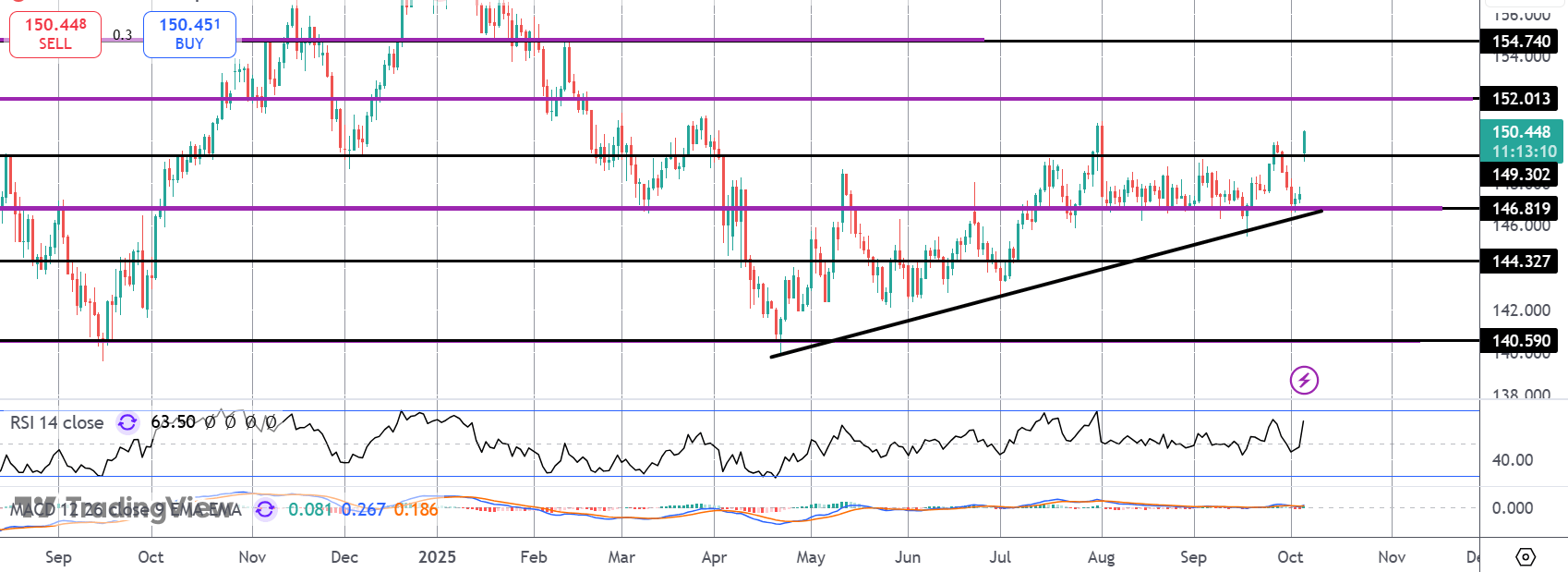

USDJPY

The rally off the 146.81 level has seen the market breaking above the 149.30 level. With momentum studies bullish, focus is on a continuation higher and a test of the 152.01 level next. Bullish outlook holds while price remains above the bull trend line off YTD lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.