Crude at Highs

Oil prices are back in the spotlight this week with crude futures having broken out to fresh YTD highs yesterday. Heightened geo-political risks linked to escalating conflict in the Middle East, OPEC supply cuts and better data out of China are helping to drive bullish sentiment currently. Crude prices are currently sitting around 24% up off the YTD lows and looked poised for further gains given the current backdrop.

Middle East Impact

Fears of retaliation from Hezbollah and Iran-backed militants against Israel, following the killing of a top commander during an airstrike on the Iranian embassy in Syria, are a major concern this week. The killing of foreign aid workers by Israel in Gaza has prompted growing criticism from Western governments, highlighting concerns that the conflict is showing no sign of stopping. As such, risks of escalated disruption to shipping routes are also feeding into higher oil prices.

OPEC On Watch

OPEC+ meets today for an online review of its output policy. According to Reuters, OPEC sources are expecting no shift in policy today following the recent agreement to extend current output cuts. However, markets will be keenly scrutinising details of the meeting for a view on whether policy is likely to change again in coming months.

Better China Data

Finally, stronger-than-forecast China factory data at the start of the week is prompting optimism that activity is on the turn higher there. With the outlook demand for oil seen creeping higher as a result, any further data upside should help keep oil prices well-supported.

Technical Views

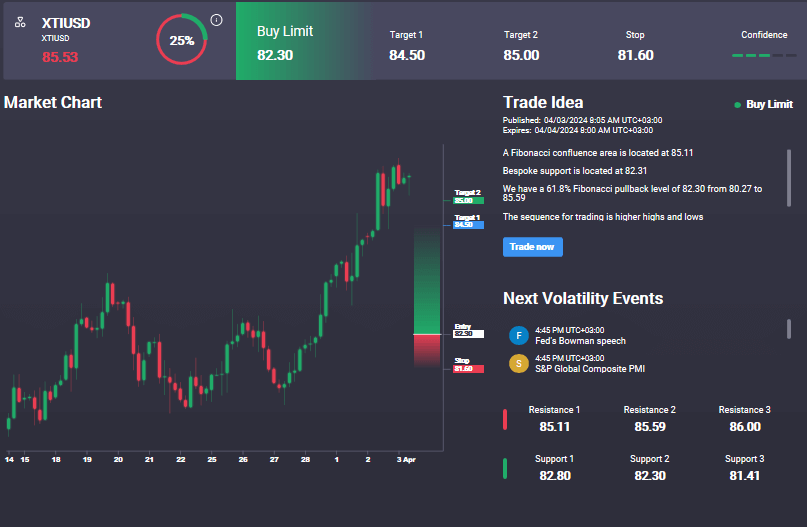

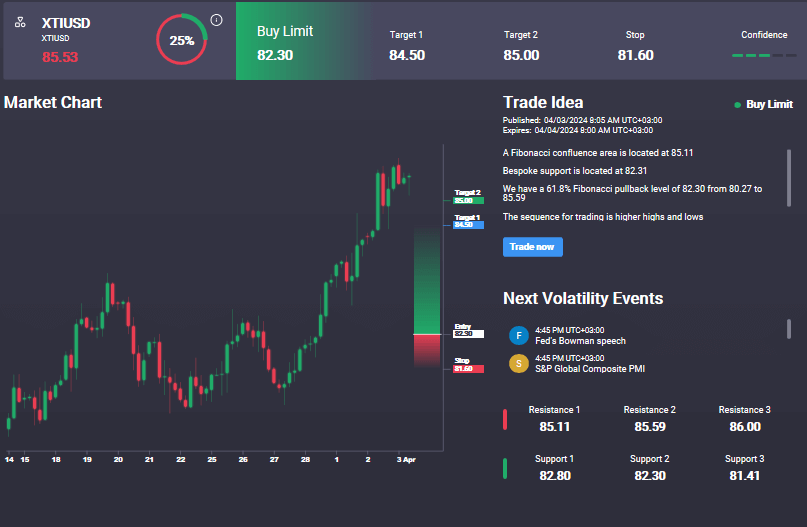

Crude

The rally in crude prices has seen the market breaking out above the bull channel highs and the 82.59 level. While above here, focus is on a continuation higher towards the 89.22 level next. To the downside, below 82.59, 77.64 and the bull channel lows will be next support to watch. Notably, in the Signal Centre today we have a buy signal at 82.30 suggesting a preference to buy into any pull back from current levels and position for fresh upside.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.