USDJPY Under Pressure

USDJPY has broken down to fresh lows for the year ahead of the upcoming US inflation reading later today. The greenback has come under pressure on the back of last night’s presidential elections debate which post-debate polls have generally awarded to Harris. A well-cited CNBC poll gave Harris the win at 63%. Given that a Trump win is generally seen as being more Dollar-positive, the better odds of a Harris win are keeping USD muted currently.

Strong Yen Impact

Weakness in the US Dollar comes at a time when the Japanese Yen remains firm through continued BOJ tightening. After the joint action taken at the end of July, the BOJ has reaffirmed its commitment to continued tightening. Speaking today, BOJ’s Nakagawa reiterated the view that the bank stands willing to adjust policy levels as needed in light of the risks from wage-growth and import-inflation.

BOJ vs Fed

The BOJ’s hawkish stance is strongly juxtaposed with current Fed easing expectations. As such, today’s US CPI data could easily spark a fresh leg lower in the pair if we see CPI fall again, as expected. The market is looking for annualised inflation last month to print 2.6% from 2.9% prior. Indeed, if data undershoots forecasts, this would increase expectations of a deeper cut from the Fed this month, leading USD firmly lower near-term.

Technical Views

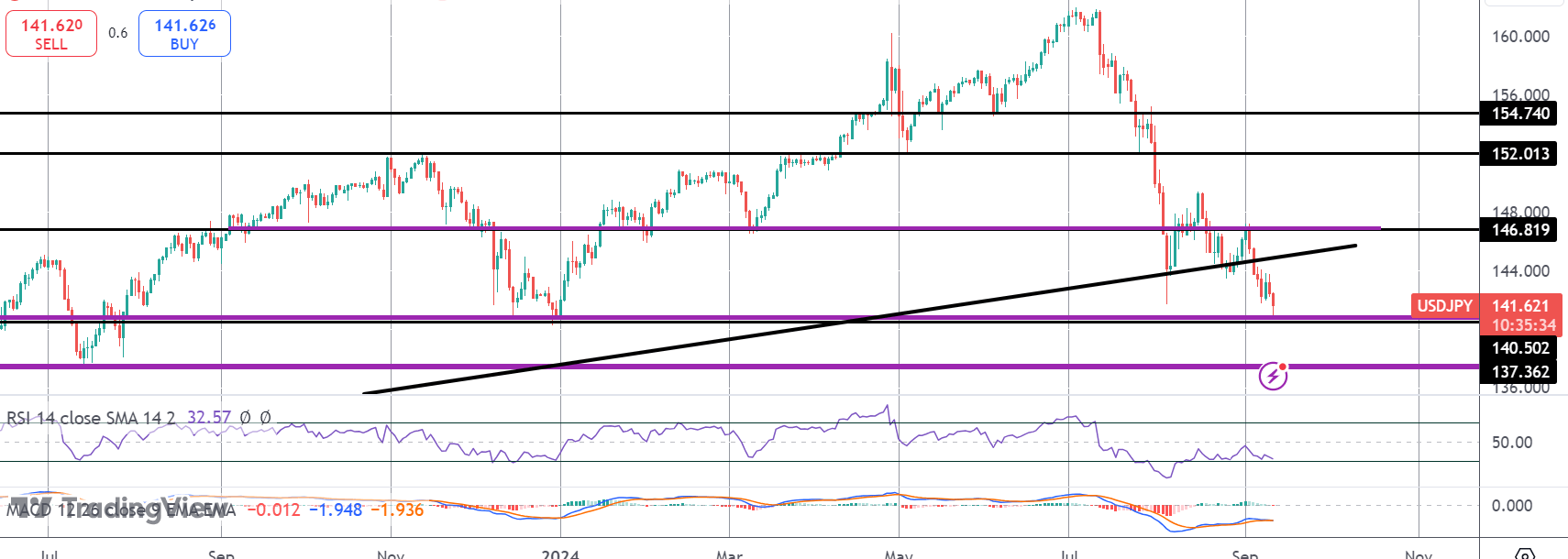

USDJPY

The sell off in USDJPY this week has seen the pair break below the prior 2024 lows with price now testing support at the 140.50 level. If price breaks below here, focus shifts to 137.36 next, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.