Trade Woes Hit USDJPY

Fresh US tariffs against China, and the threat of more to come unless China acquiesces, has seen USD falling midweek. Fears over US economic prospects as a result of the trade war have seen investors turning away from USD towards other safe havens such as gold and, in FX, JPY and CHF. Against this backdrop, USDJPY is testing YTD lows and looks poised for a fresh leg lower unless we see a quick turnaround in sentiment for the greenback. Given the volatile trade environment and the aggressive rhetoric from Trump, such as shift in sentiment looks unlikely near-term unless China does in fact back down and reverse its countermeasure tariffs.

Inflation Up Next

Looking ahead, traders will be watching incoming US inflation data due tomorrow. If CPI is seen cooling further as expected, USD looks vulnerable to a fresh break lower as Fed easing expectations rise accordingly. Given the hawkish BOJ outlook, such a shift in Fed pricing would widen the divergence between the two central banks, putting extra downside pressures on the pair.

FOMC Minutes Due

Ahead of that data, traders will be watching today’s FOMC minutes, in particular looking for the Fed’s assessment of the risks from Trump’s tariffs (which had yet to be announced at the time). Given the severe reaction we’ve seen, the minutes might have lost some relevancy though if they show the Fed leaning towards a stronger easing bias this should help keep USD anchored lower into tomorrow’s data.

Technical Views

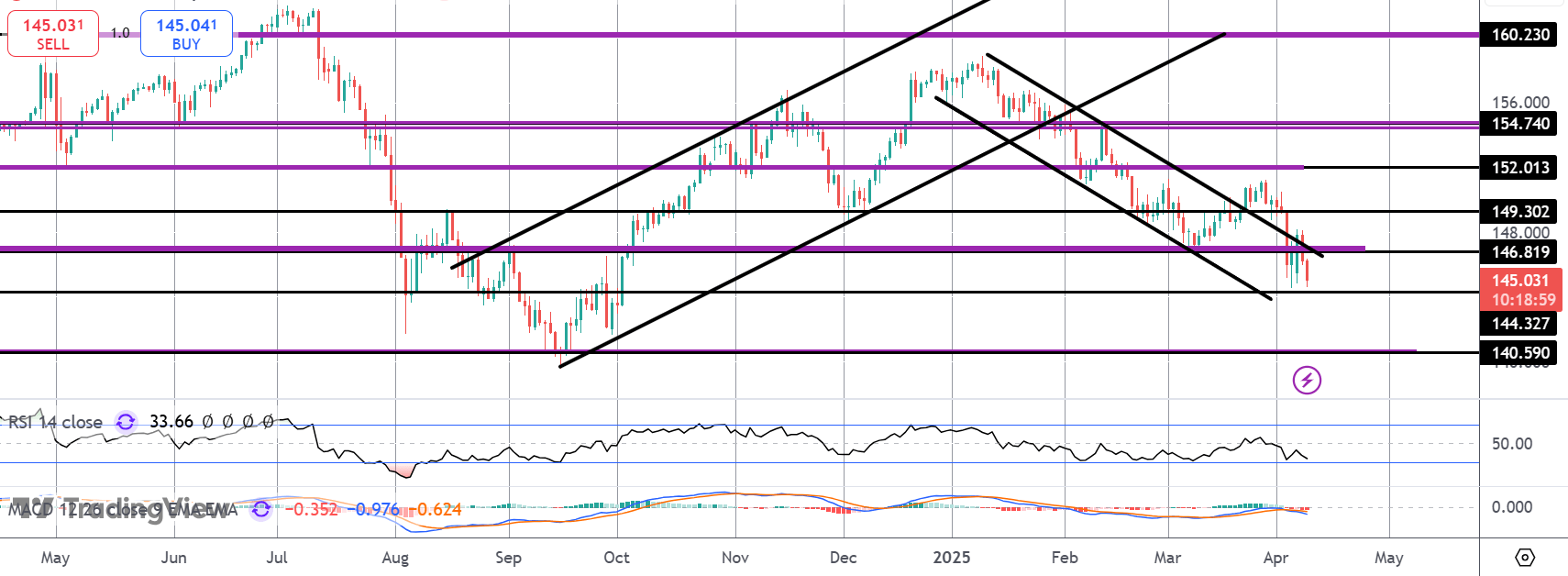

USDJPY

The recovery move from last week has failed with price now back below the 146.81 level. While below here and with momentum studies bearish, focus is on a break lower with 144.32 the next support to watch ahead of the 140.59 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.