FTSE 100 FINISH LINE 9/2/26

FTSE 100 FINISH LINE 9/2/26

The FTSE 100 began the week on a downward trajectory as investors closely monitored the intensifying political unrest in the UK. Banking stocks faced notable pressure, with NatWest experiencing a significant drop following its announcement to acquire wealth management firm Evelyn Partners. The blue-chip index reflected cautious market sentiment amid growing uncertainty. British Prime Minister Keir Starmer suffered another setback on Sunday with the resignation of his chief of staff, Morgan McSweeney. McSweeney took responsibility for advising Starmer to nominate Peter Mandelson as the U.S. ambassador, despite Mandelson’s controversial connections to convicted sex offender Jeffrey Epstein. Starmer's popularity has taken a sharp hit, with recent polls indicating widespread voter dissatisfaction. A series of high-profile policy U-turns has further eroded his credibility, prompting some within his own party to openly question his leadership and political future. Meanwhile, rising long-term borrowing costs signal that financial markets are preparing for potential political instability. Speculation is growing that Starmer may be forced to step down, with analysts predicting a leadership change could result in a shift toward a more left-leaning successor. Such a transition could weigh on the currency and drive long-term bond yields higher, adding further complexity to the UK’s already uncertain political and economic outlook.

The FTSE 100 faced pressure as shares of NatWest Group plunged 5.5%. The decline followed the bank’s announcement of its £2.7 billion ($3.68 billion) acquisition, including debt, of Evelyn Partners, one of the UK’s largest wealth management firms. UK banking stocks collectively dropped 1.2%, reflecting investor concerns over potential interest rate cuts by the Bank of England. Last week, the central bank opted to hold rates steady after a narrow 5-4 vote, while signaling possible rate reductions if inflation continues to ease. Key economic data this week, including January’s retail sales figures and December’s GDP numbers, is expected to shed more light on the future trajectory of monetary policy. Elsewhere in the market, shares of Greggs slid 5% after Jefferies issued a cautionary note. The investment bank warned that the growing popularity of weight-loss medications could curb demand and impact the bakery chain’s sales growth. In contrast, Plus500 saw its shares soar 5.4% to an all-time high, as the online trading platform boosted investor optimism by forecasting stronger-than-expected results for 2026.

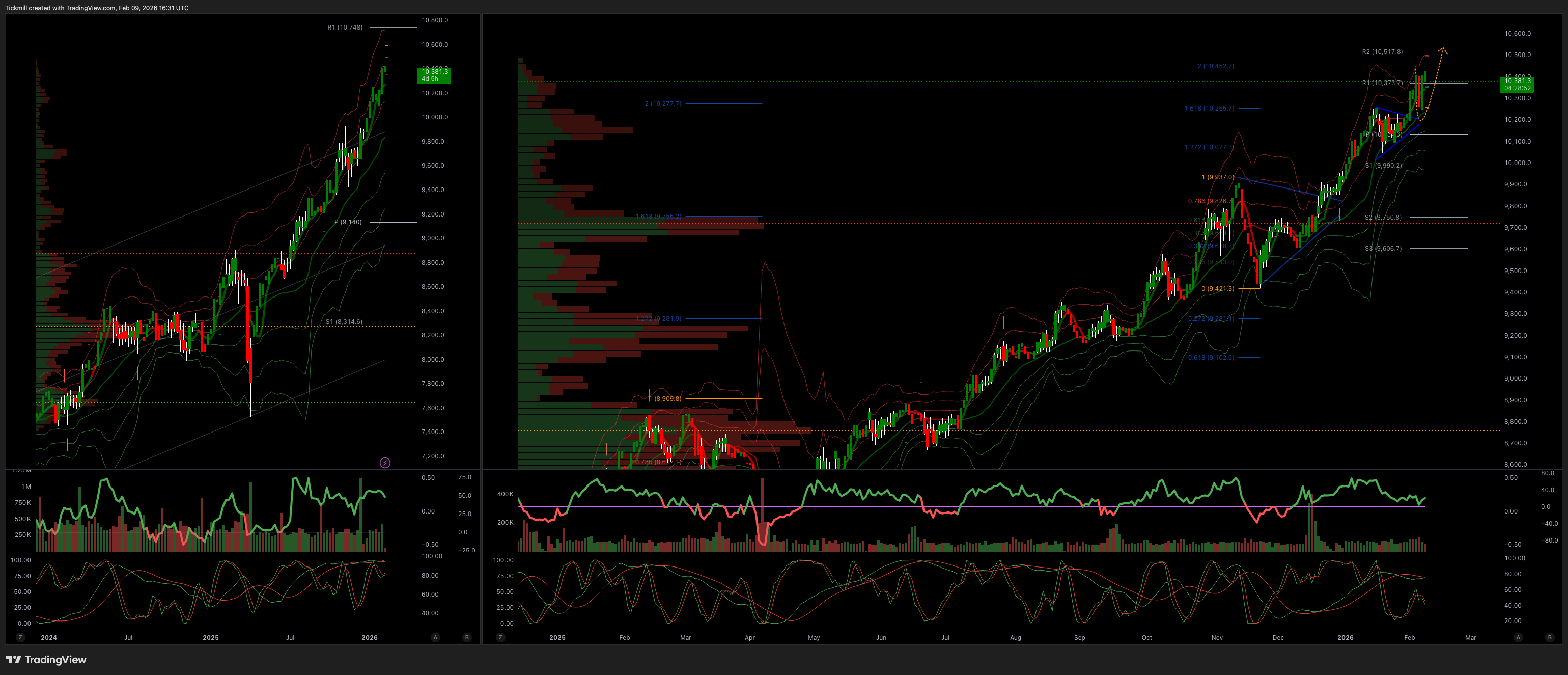

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 10350 Target 10510

Below 10325 Target 10250

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!